Yamaha Motor (TSE:7272) Valuation in Focus as New Premium Electric Scooters Debut in India

Reviewed by Simply Wall St

Yamaha Motor (TSE:7272) just introduced two new electric scooters in India: the AEROX E, designed in-house, and the EC-06, co-developed with River Mobility. This reflects Yamaha's push for growth and its premium positioning in India's electric vehicle market.

See our latest analysis for Yamaha Motor.

Yamaha Motor’s unveiling of new electric scooters comes as the company pushes further into premium EVs and partnerships in Asia, following its recent move to acquire Robotics Plus in New Zealand. After a sluggish start to the year, the stock shows signs of regaining momentum, with the latest 90-day share price return of 2.7% helping to offset some of its earlier declines. Over the past year, however, the total shareholder return still sits at -15%. Yamaha’s five-year total return remains an impressive 109%.

If Yamaha’s EV strategy has you thinking about what else is shifting gears in the sector, take the next step and discover See the full list for free.

Given Yamaha Motor’s recent product launches and its climb back from earlier share price declines, the question for investors is clear: is there a bargain left on the table, or has the market already priced in further gains?

Most Popular Narrative: 2% Undervalued

Yamaha Motor’s fair value is estimated just above the last closing price, hinting at a tight gap between perceived upside and where shares currently trade.

The premiumization strategy in the core Motorcycle business, along with new product launches in emerging markets like India and the Philippines, is expected to enhance revenue growth and maintain profitability despite raw material cost increases. A recovery in Marine business demand, particularly for large outboard motors in the U.S. and improved inventory management, should normalize the production-to-sales flow and support higher revenue and profits.

Is Yamaha Motor’s future built on daring product bets or is it something else that lifts this valuation? The real catalyst, hidden in precise growth forecasts and margin upgrades, could surprise even seasoned investors. Find out why analysts are betting on a turnaround that goes far deeper than recent headlines suggest.

Result: Fair Value of ¥1,140 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges remain. Rising costs and unpredictable demand shifts could quickly test the assumptions behind Yamaha Motor's current valuation narrative.

Find out about the key risks to this Yamaha Motor narrative.

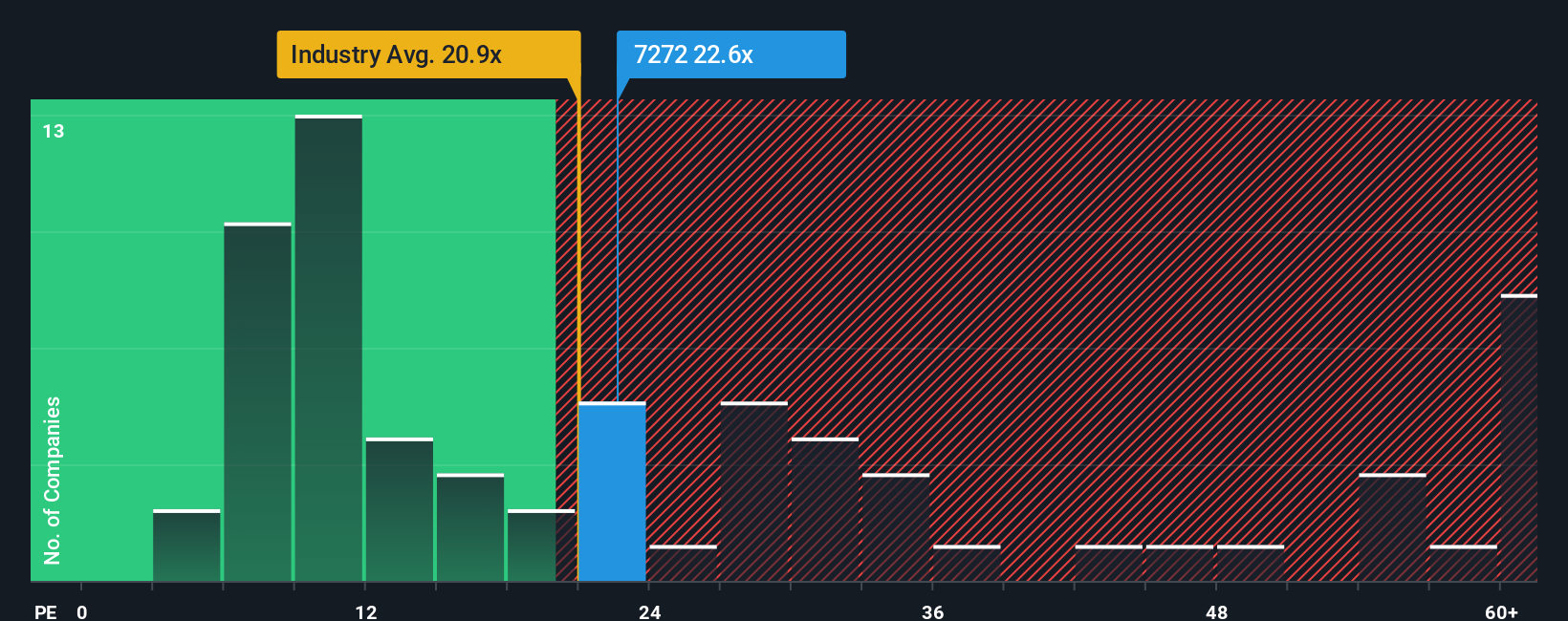

Another View: Market Multiples Tell a Cautionary Story

While our previous assessment shows Yamaha Motor is slightly undervalued, comparing its price-to-earnings ratio against the industry sends a cautionary signal. Yamaha Motor trades at 70.3x, which is far above both the Asian auto industry average of 18.8x and its fair ratio of 36.2x. This sharp premium suggests the market is pricing in a lot of optimism, increasing valuation risk if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Yamaha Motor Narrative

If you see things differently or want to draw your own conclusions, dive into the data and craft a narrative in just a few minutes. Do it your way

A great starting point for your Yamaha Motor research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Don’t let a bold new trend or hidden bargain pass you by when these market drivers are right at your fingertips:

- Unlock new growth potential and get ahead of breakthroughs by checking out these 25 AI penny stocks for their leadership in artificial intelligence.

- Boost your portfolio’s income stream as you scan these 16 dividend stocks with yields > 3% with attractive yields above 3%.

- Seize undervalued gems with strong fundamentals by reviewing these 879 undervalued stocks based on cash flows before the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7272

Yamaha Motor

Engages in the land mobility, marine products, robotics, financial services, and others businesses in Japan, North America, Europe, Asia, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives