Subaru (TSE:7270): Assessing Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for Subaru.

Subaru’s strong run this year stands out, with a 29% year-to-date share price return and an impressive 49.9% total shareholder return over the past 12 months. Momentum has been building quickly as investors focus on brighter prospects, supported by recent operational improvements and increasing sector optimism.

If Subaru’s rally has you thinking about what else is out there, this could be the perfect time to explore See the full list for free.

But with Subaru’s recent outperformance and rising investor confidence, the big question remains: is the market underestimating its upside, or are shareholders now paying a premium for future growth?

Price-to-Earnings of 9.7x: Is it justified?

Subaru’s stock trades at a price-to-earnings (P/E) ratio of 9.7x, which puts it well below the peer group average. At the last close of ¥3,552, this suggests the market is not pricing in aggressive earnings growth going forward.

The P/E ratio reflects how much investors are willing to pay for each yen of current earnings. In the automotive sector, it is a commonly used benchmark to gauge whether a stock is cheap or expensive versus rivals, and it can reveal investor expectations around future profit growth, risk, and stability.

Trading at a P/E well below both the Japanese market average (14.1x) and the Asian Auto industry average (18.9x), Subaru appears attractively priced relative to its competitors. When compared to the estimated fair price-to-earnings ratio of 14.1x, it suggests room for the market to re-rate if confidence in future growth improves.

Explore the SWS fair ratio for Subaru

Result: Price-to-Earnings of 9.7x (UNDERVALUED)

However, investors should note that slower revenue growth or failure to meet earnings expectations may challenge the current optimism regarding Subaru’s valuation.

Find out about the key risks to this Subaru narrative.

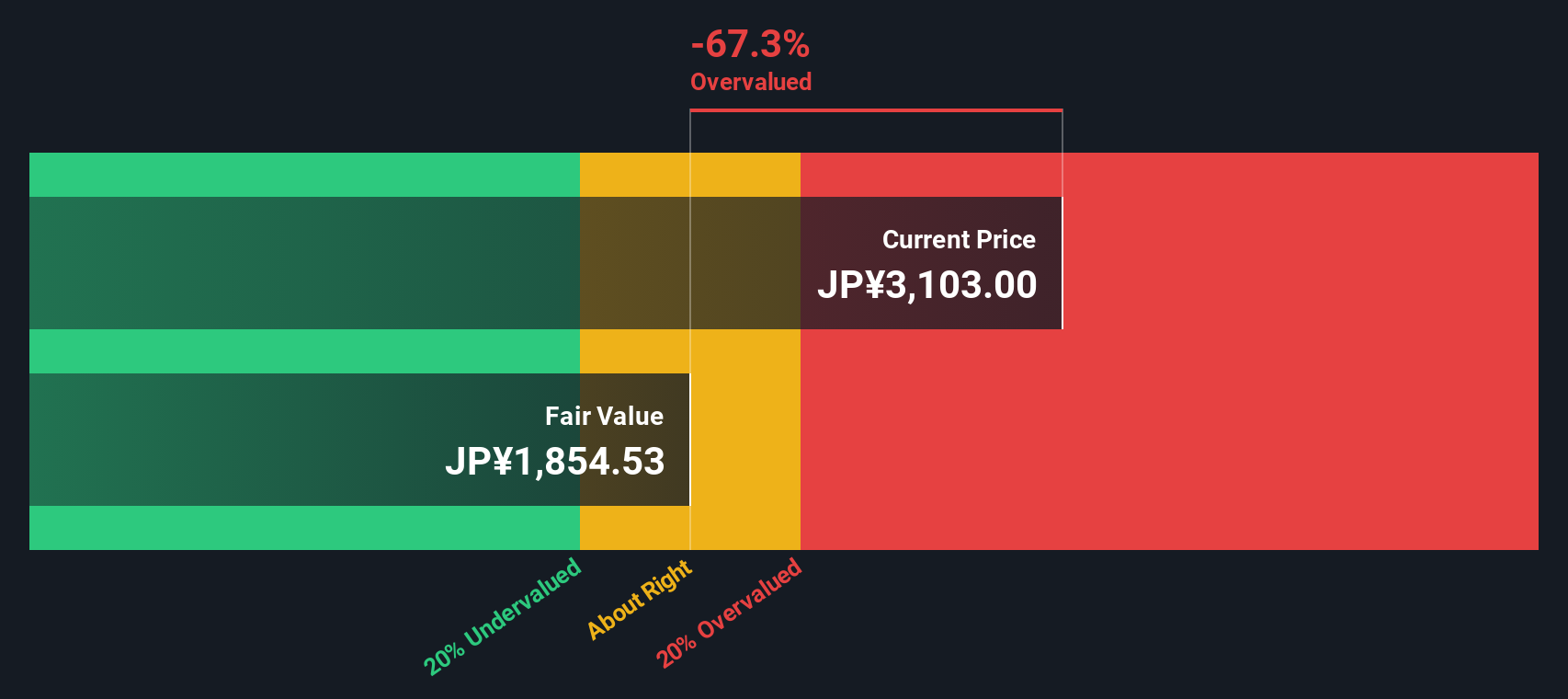

Another View: Discounted Cash Flow Tells a Different Story

While the stock may look cheap compared to peers on its price-to-earnings ratio, our DCF model draws a different conclusion. It suggests that Subaru is actually trading well above its estimated fair value, which could signal potential overvaluation. Does this mean optimism has overshot reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Subaru for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 897 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Subaru Narrative

If you have your own perspective on Subaru’s future or prefer digging into the details firsthand, you can craft your own findings in just a few minutes: Do it your way

A great starting point for your Subaru research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know the best opportunities rarely wait around. Let Simply Wall Street do the heavy lifting and see which stocks could give your portfolio an edge.

- Maximize your growth strategy by targeting early-stage companies using these 3578 penny stocks with strong financials with robust financials and big upside potential.

- Accelerate your returns through technology shifts by tracking these 25 AI penny stocks that are paving the way in artificial intelligence innovation.

- Boost your portfolio income by securing these 16 dividend stocks with yields > 3% that offer reliable yields and strong fundamentals beyond market hype.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7270

Subaru

Manufactures and sells automobiles and aerospace products in Japan, Rest of Asia, North America, Europe, and Internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives