Has the Recent Subaru EV Partnership Driven the Stock Beyond Its True Value?

Reviewed by Bailey Pemberton

- Curious if Subaru is a bargain or overpriced? Let's break down what its numbers are telling us and dig into its market value together.

- Subaru's share price has been on a tear lately, climbing 7.3% over the past week, 15.3% in the last month, and nearly 50% over the past year.

- Industry buzz has picked up on Subaru's push into electric vehicles and a recent strategic partnership that is getting analysts excited. This renewed focus on innovation has contributed to shifting investor sentiment and could explain the strong upward momentum.

- When it comes to traditional valuation checks, Subaru scores a 3 out of 6 for being undervalued. As you'll see in the next sections, there is more than one way to assess a stock's true worth, so stick around for an even sharper way to look at value at the end.

Approach 1: Subaru Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model tries to estimate a company's true worth by forecasting its future cash flows and discounting those future values back to what they are worth today. This approach reflects not only what the business is earning now, but also what it is expected to generate in the coming years.

For Subaru, the latest reported free cash flow stands at approximately ¥263.4 billion. According to analyst estimates, the company's free cash flow is expected to fluctuate in the next several years, with projections still reaching ¥120.3 billion by 2030. While analyst forecasts guide the first five years, Simply Wall St extrapolates beyond that by using trends for the subsequent periods.

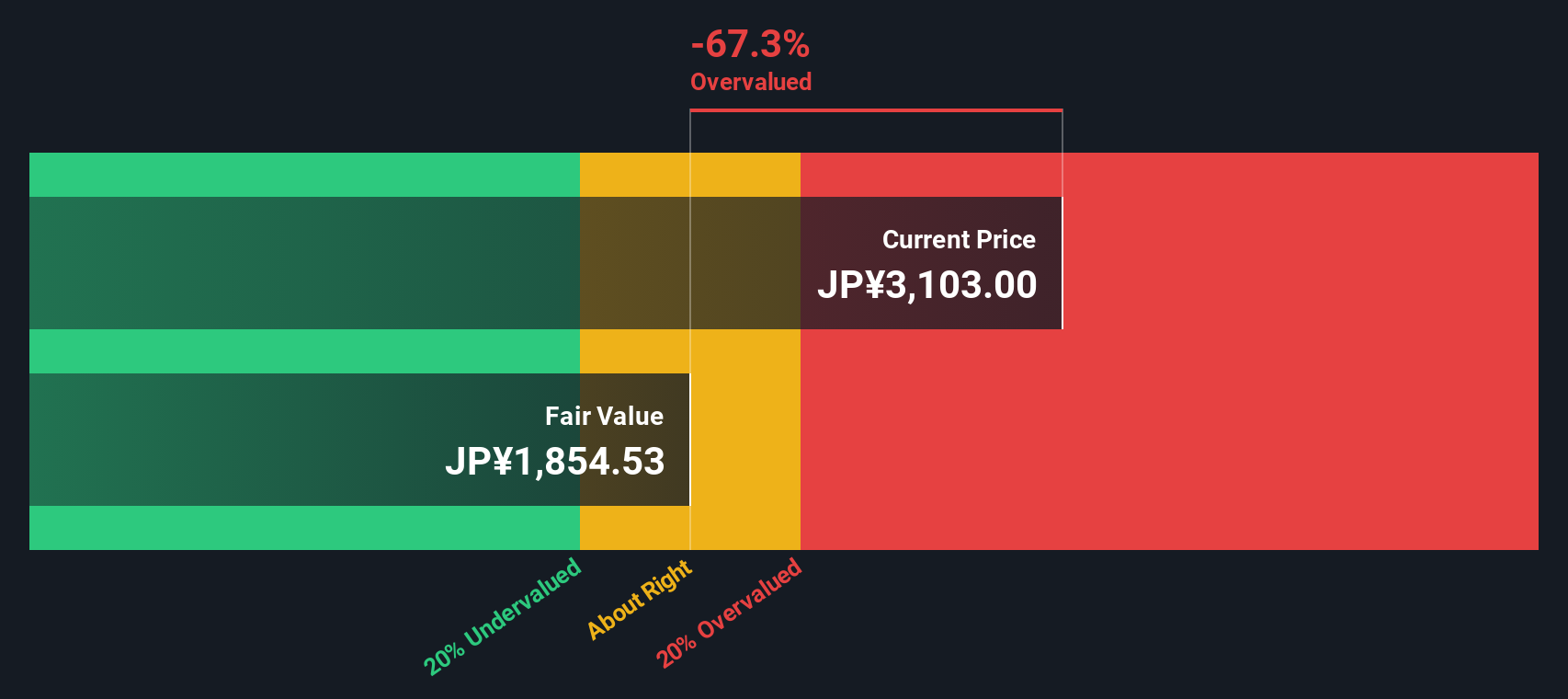

After summing up Subaru's future cash flows and discounting them to today's value, the DCF model estimates the intrinsic value of the stock at ¥2,350 per share. However, the calculation suggests the current share price is 51.2% higher than this fair value, pointing to significant overvaluation based on cash flow fundamentals.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Subaru may be overvalued by 51.2%. Discover 874 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Subaru Price vs Earnings

For profitable companies like Subaru, the Price-to-Earnings (PE) ratio is a popular and efficient tool to assess valuation. The PE ratio measures how much investors are willing to pay for each yen of earnings, which makes it especially useful when a company is consistently profitable and generating steady bottom-line results.

When evaluating a PE ratio, it is important to remember that growth prospects and business risk play a huge role in shaping what is considered a "fair" multiple. Faster-growing companies or those with more stable earnings generally deserve a higher PE, while lower growth or higher risk warrants a discount.

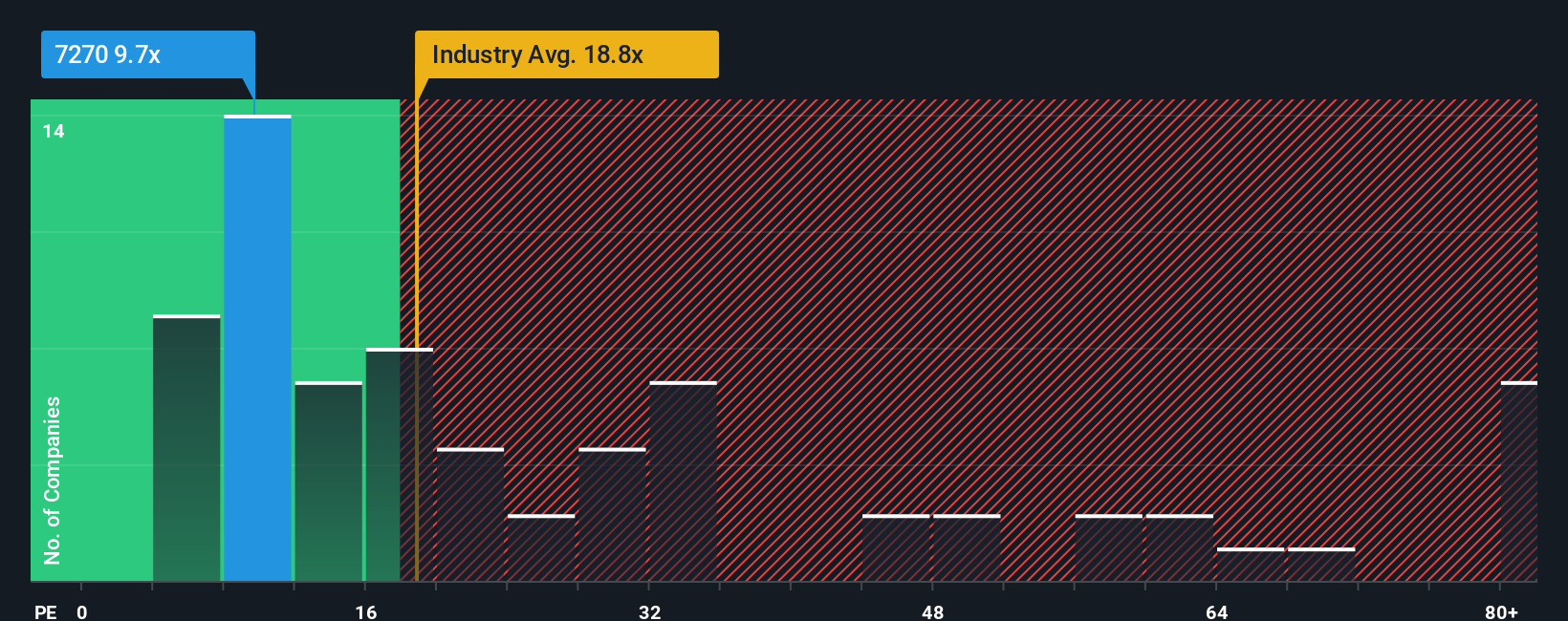

Subaru currently trades at a PE of 9.7x. This is lower than the peer group average of 13.7x as well as the wider auto industry average of 17.9x. At first glance, this suggests Subaru may be trading at a discount relative to its sector and direct competitors.

However, looking at actual trading multiples only tells part of the story. Simply Wall St's proprietary "Fair Ratio," which in this case is 14.1x, offers a more customized benchmark by considering Subaru's specific growth outlook, profit margins, risk profile, market capitalization and its position within the auto industry. This fair value multiple provides a more nuanced and robust comparison than generic industry or peer averages and highlights what investors should reasonably expect to pay for Subaru given its unique characteristics.

Comparing Subaru's actual PE of 9.7x with its "Fair Ratio" of 14.1x points to undervaluation, suggesting that the current share price understates its true earnings power.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1400 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Subaru Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story about a company, where you connect your perspective on Subaru’s future with your assumptions for fair value, growth, and profits, all backed by your own estimated numbers.

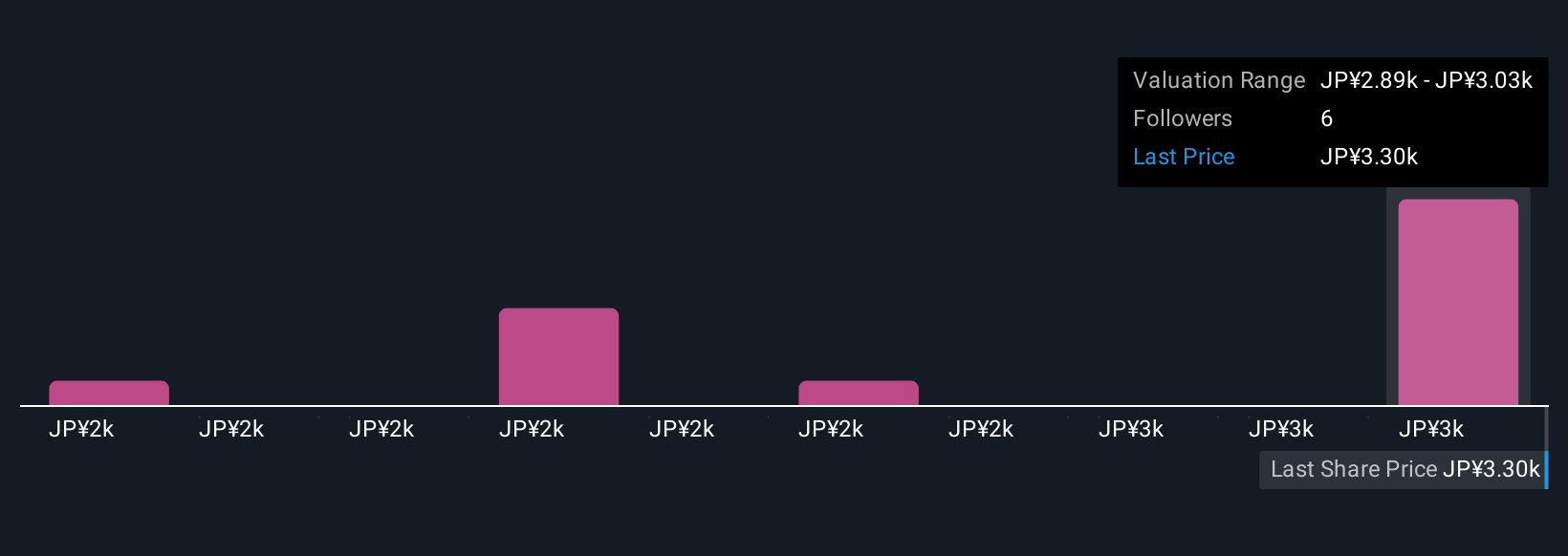

Narratives bridge the gap between the “story” behind Subaru and the numbers it might deliver, linking your expectations for the business to a financial forecast and ultimately to what you believe the stock is actually worth. Available to everyone in the Simply Wall St Community page, Narratives make it easy for any investor to create, update, and follow their own take on Subaru’s potential.

By comparing the Fair Value from your Narrative with the current stock price, you can quickly see whether Subaru looks like a smart buy or if it’s time to sell. Since Narratives update instantly with new company news or earnings, you always stay in control. For example, while one Subaru investor expects high electric vehicle sales and values the stock above the market, another may worry about global competition and see it as overvalued, and both viewpoints are easily tracked and compared using Narratives.

Do you think there's more to the story for Subaru? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7270

Subaru

Manufactures and sells automobiles and aerospace products in Japan, Rest of Asia, North America, Europe, and Internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives