Mazda’s Dividend Reinstatement Raises New Questions About Capital Priorities for TSE:7261

Reviewed by Sasha Jovanovic

- Mazda Motor Corporation released consolidated earnings guidance for the fiscal year ending March 31, 2026, projecting net sales of ¥4.9 trillion and raising its year-end dividend forecast to ¥30 per share.

- This reinstatement of dividend guidance, after previously leaving it undecided, signals Mazda's emphasis on stable shareholder returns in response to current business performance.

- With the year-end dividend now set, we'll look at how Mazda's focus on steady returns shapes its investment narrative.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Mazda Motor's Investment Narrative?

If I were considering Mazda Motor as a long-term holding, I’d need to believe in the company’s ability to carve out a path in a competitive global auto sector, while managing historically tight profit margins and operational volatility. The recent dividend reinstatement for the March 2026 year, after a period of uncertainty, underscores Mazda’s current financial stability and its intention to reward shareholders consistently, a development that may reduce short-term dividend risk and reassure those focused on income. Although analysts previously flagged upside catalysts around upcoming product launches and projected strong earnings growth, it’s just as important to consider risks like below-market revenue growth, ongoing margin challenges, and volatility stemming from global tariff policies. The latest dividend news suggests short-term uncertainty around shareholder returns may ease, but cost competitiveness and margin improvement remain top concerns for forward-looking investors.

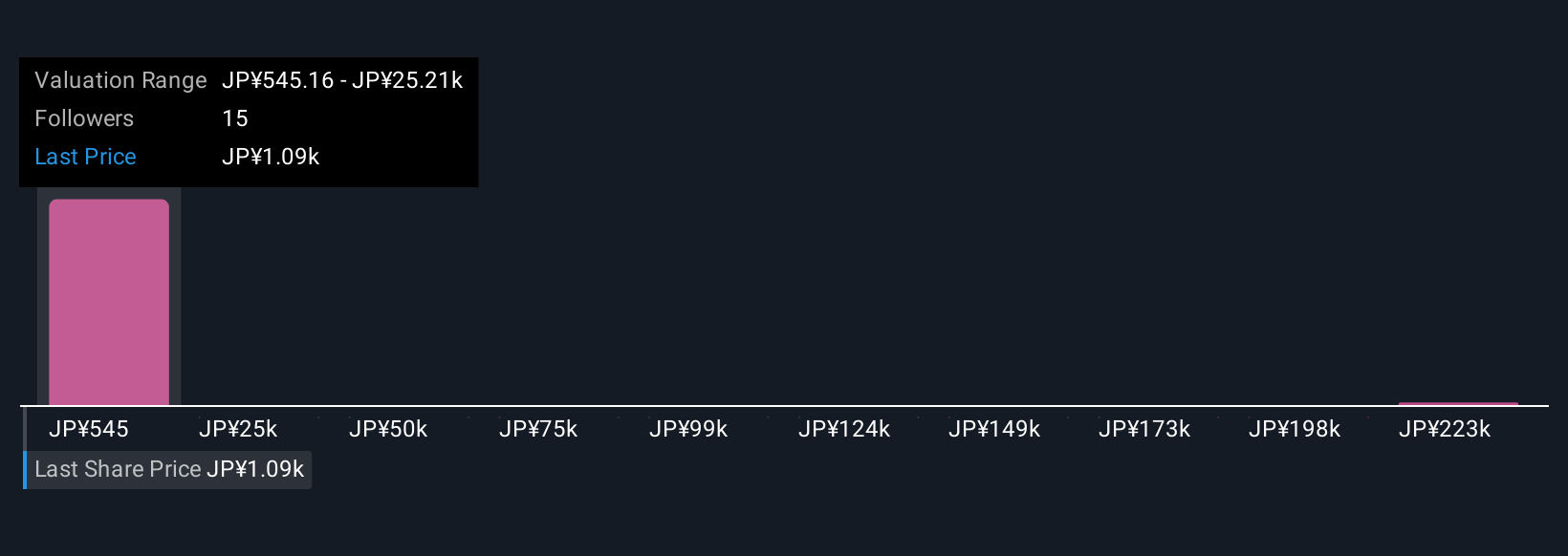

But keep in mind, persistent industry risks like thin profit margins could become more prominent. Despite retreating, Mazda Motor's shares might still be trading 5% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 8 other fair value estimates on Mazda Motor - why the stock might be worth less than half the current price!

Build Your Own Mazda Motor Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mazda Motor research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Mazda Motor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mazda Motor's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7261

Mazda Motor

Engages in the manufacture and sale of passenger cars and commercial vehicles in Japan, North America, Europe, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives