Did Mitsubishi Motors' (TSE:7211) Earnings Cut and Dividend Reduction Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

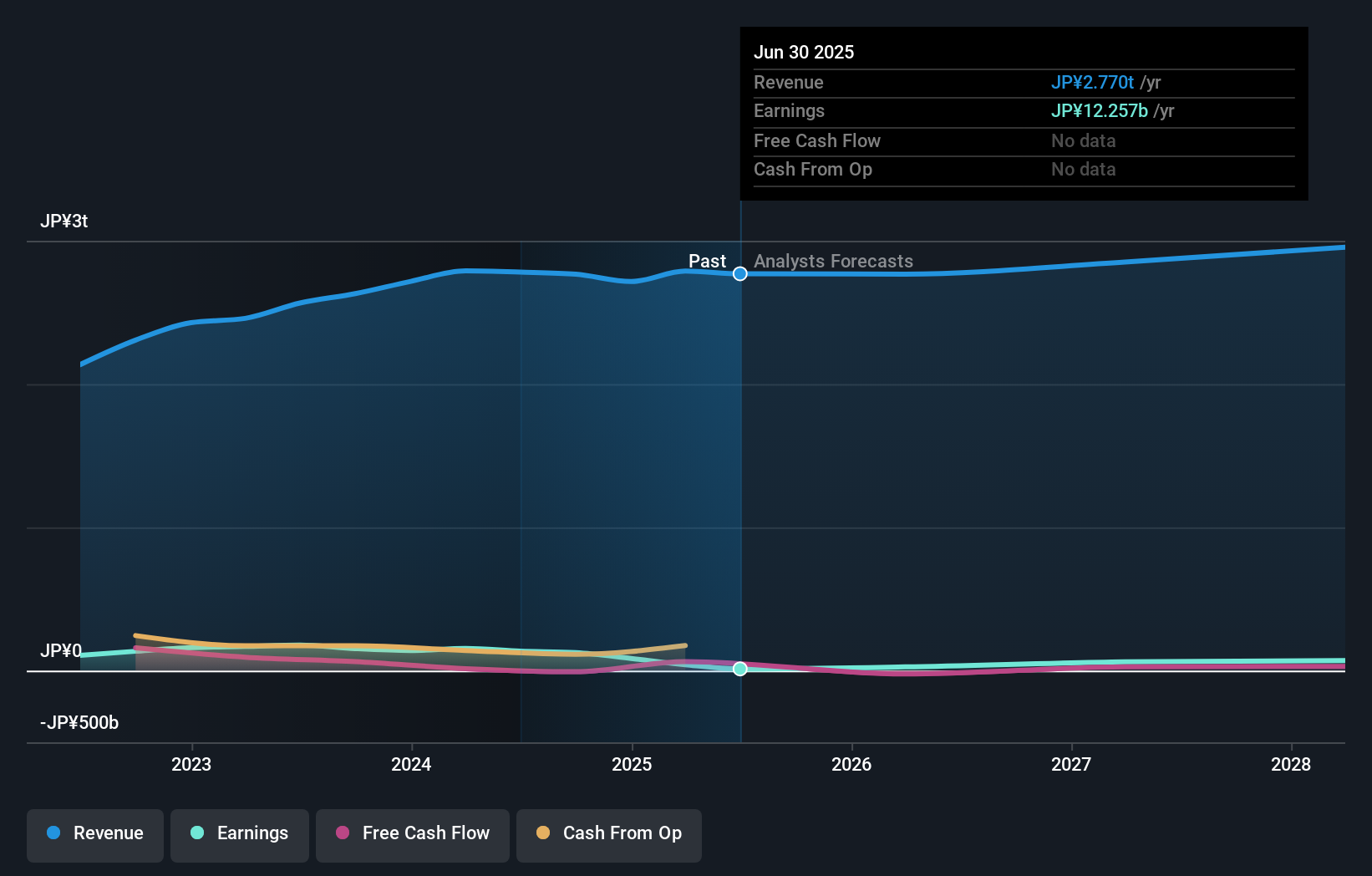

- Earlier in November 2025, Mitsubishi Motors Corporation revised its earnings guidance for the fiscal year ending March 31, 2026, projecting net sales of ¥2.82 trillion, operating profit of ¥70.0 billion, and profit attributable to owners of the parent at ¥10.0 billion, alongside a reduced second-quarter dividend of ¥5.00 per share scheduled for December 3, 2025.

- This combination of lowered earnings expectations and a dividend decrease provides important signals about the company's outlook and operational priorities for investors.

- We'll examine how the revised earnings forecast and dividend cut shape Mitsubishi Motors' broader investment story and risk profile.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Mitsubishi Motors Investment Narrative Recap

To be a shareholder in Mitsubishi Motors today, you need to have confidence in the company’s ability to manage ongoing market headwinds, chief among them, heightened competition from global automakers and unpredictable trade conditions. The latest cut to both profit guidance and the interim dividend signals pressure on near-term earnings, but does not appear to materially change the importance of successfully rolling out new models in growth markets, which remains the key short-term catalyst. The overriding risk still lies with margin pressure as Mitsubishi confronts pricing challenges globally.

Among recent developments, the sharply lowered profit expectations confirmed in November directly reflect ongoing struggles with vehicle demand in core regions and cost pressures tied to tariffs and inflation. This is closely related to the business’s main catalyst, new product launches and localization strategies aimed at safeguarding margins, even as macroeconomic and competitive risks remain prominent.

However, what investors should be aware of is that, despite recent efforts to control costs, the risk of further margin erosion from price competition and...

Read the full narrative on Mitsubishi Motors (it's free!)

Mitsubishi Motors is projected to generate ¥2,985.0 billion in revenue and ¥63.5 billion in earnings by 2028. This outlook assumes annual revenue growth of 2.5% and an earnings increase of ¥51.2 billion from the current ¥12.3 billion.

Uncover how Mitsubishi Motors' forecasts yield a ¥422 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered 1 fair value estimate for Mitsubishi Motors, clustering tightly at ¥63.13. While opinions can differ, margin risk remains front of mind for many investors seeking future performance drivers.

Explore another fair value estimate on Mitsubishi Motors - why the stock might be worth as much as ¥63!

Build Your Own Mitsubishi Motors Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mitsubishi Motors research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mitsubishi Motors research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mitsubishi Motors' overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7211

Mitsubishi Motors

Engages in the development, production, and sale of passenger vehicles, and related parts and components in Japan, Europe, North America, Oceania, the rest of Asia, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives