How Investors Are Reacting To Isuzu Motors (TSE:7202) Expanding Its Share Buyback Program

Reviewed by Sasha Jovanovic

- Isuzu Motors announced in the past that it had repurchased 18,117,300 shares as part of its ongoing buyback program, which extends through March 2026 and was initially authorized by the Board in May 2025.

- This move to reduce outstanding shares highlights the company’s ongoing efforts to optimize capital structure and return value to shareholders.

- Now, we'll explore how the progression of Isuzu Motors' share buyback initiative could influence its broader investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Isuzu Motors Investment Narrative Recap

To invest in Isuzu Motors, one usually has to expect the company to execute on long-term commercial vehicle expansion plans while managing ongoing challenges in profitability, competitiveness, and innovation. The latest buyback update underscores a commitment to boosting shareholder returns, but its completion to date is unlikely to significantly alter the biggest short-term catalyst, growth from new product initiatives, or address the most pressing risk of rising material costs squeezing margins.

The recent financial guidance announcement remains most relevant to this buyback progress, as it shows the company’s confidence in stable revenue and earnings performance despite headwinds. The buyback could enhance earnings per share, but its impact is interlinked with whether Isuzu effectively delivers on its projected operating profit and new product strategies amid external cost pressures.

However, in contrast to share buyback optimism, investors should be aware that margin pressure from rising materials costs could...

Read the full narrative on Isuzu Motors (it's free!)

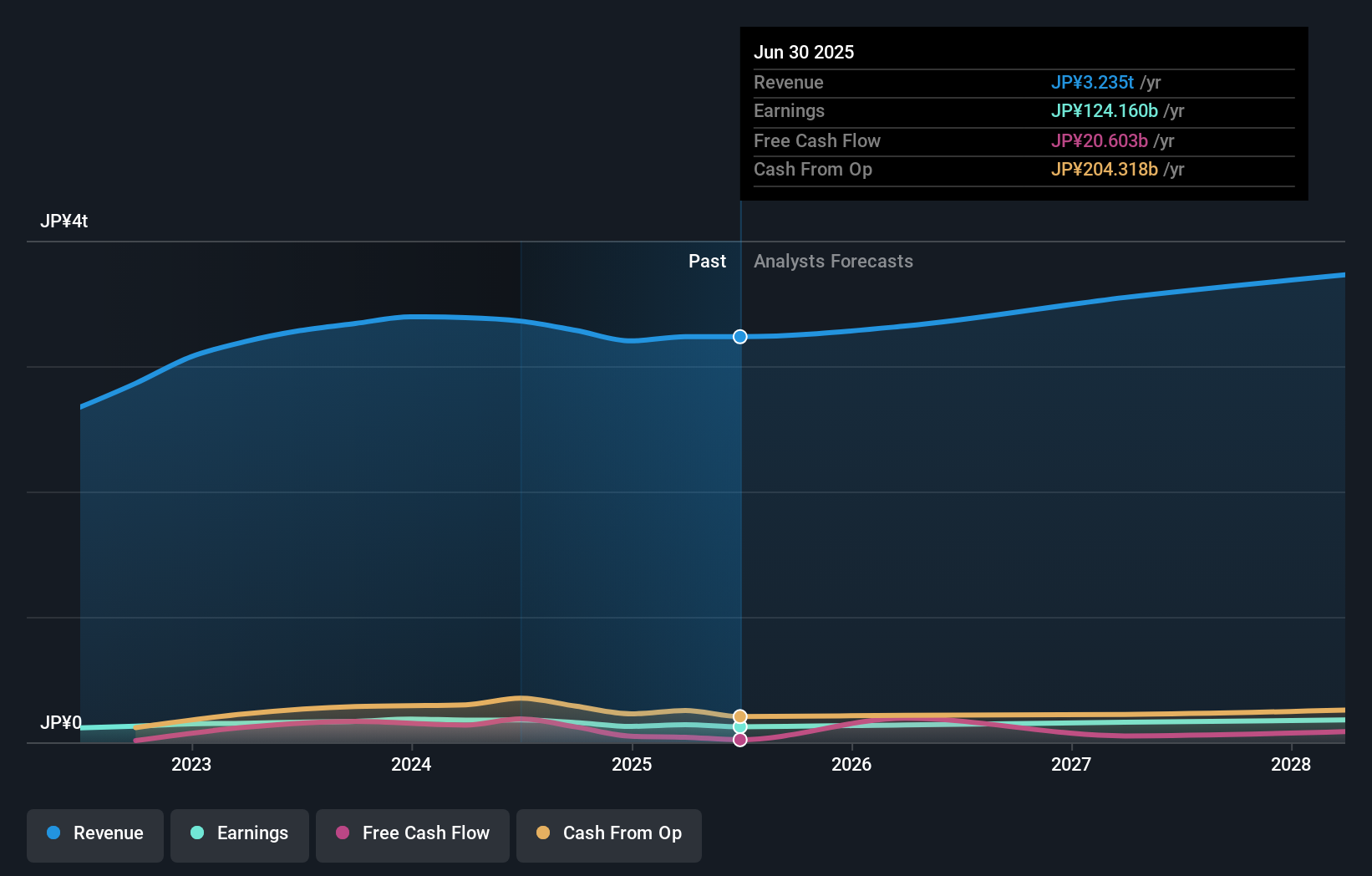

Isuzu Motors' narrative projects ¥3,792.9 billion in revenue and ¥180.7 billion in earnings by 2028. This requires a 5.4% yearly revenue growth and a ¥56.5 billion earnings increase from ¥124.2 billion today.

Uncover how Isuzu Motors' forecasts yield a ¥2164 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members shared two fair value forecasts for Isuzu Motors, ranging from ¥1,191 to ¥2,164 per share. With uncertainty around input costs challenging net margins, these varied estimates highlight the need to weigh multiple viewpoints when analysing the company’s outlook.

Explore 2 other fair value estimates on Isuzu Motors - why the stock might be worth as much as 13% more than the current price!

Build Your Own Isuzu Motors Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Isuzu Motors research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Isuzu Motors research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Isuzu Motors' overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7202

Isuzu Motors

Manufactures and sells commercial vehicles, light commercial vehicles, and diesel engines and components worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives