- Japan

- /

- Auto Components

- /

- TSE:6473

JTEKT (TSE:6473): Evaluating Whether the Recent Share Momentum Signals Undervalued Opportunity

Reviewed by Simply Wall St

If you’re tracking JTEKT (TSE:6473), the recent movement in its stock may have caught your eye. There hasn’t been a big announcement to explain the uptick, but that just makes the situation more intriguing. With shares showing renewed momentum, investors are left wondering whether this is a signal of underlying opportunity or just another market blip.

Over the past year, JTEKT has delivered a total return of 50%, building on a strong three-year gain of 69% and even doubling over five years. In more recent periods, performance accelerated. Shares are up 8% over the past month and have surged by 38% in the past three months. This lift comes on the back of decent annual revenue growth and a notable surge in net income, though the stock had been relatively calm in the weeks prior.

With those returns in mind, the key question is whether JTEKT is still undervalued or if the market has already priced in all its growth potential.

Price-to-Earnings of 51.5x: Is it justified?

When evaluated on its price-to-earnings (P/E) ratio, JTEKT trades at 51.5 times its earnings. This is significantly higher than both peer and industry averages. This elevated multiple suggests the market is assigning a steep premium to the company compared to its Auto Components peers in Japan, where the average tends to be much lower.

The P/E ratio is a key valuation metric in this sector. It reflects how much investors are willing to pay for each yen of profit. In industries like auto components, where stable fundamentals and moderate growth are typical, a high P/E can indicate optimism about future earnings growth or point to overvaluation if profit gains are not forthcoming.

In JTEKT’s case, the market is currently pricing in a substantial amount of growth, even though recent profit margins and returns have been underwhelming. This raises questions about whether such a premium is sustainable given the company’s earnings profile and outlook.

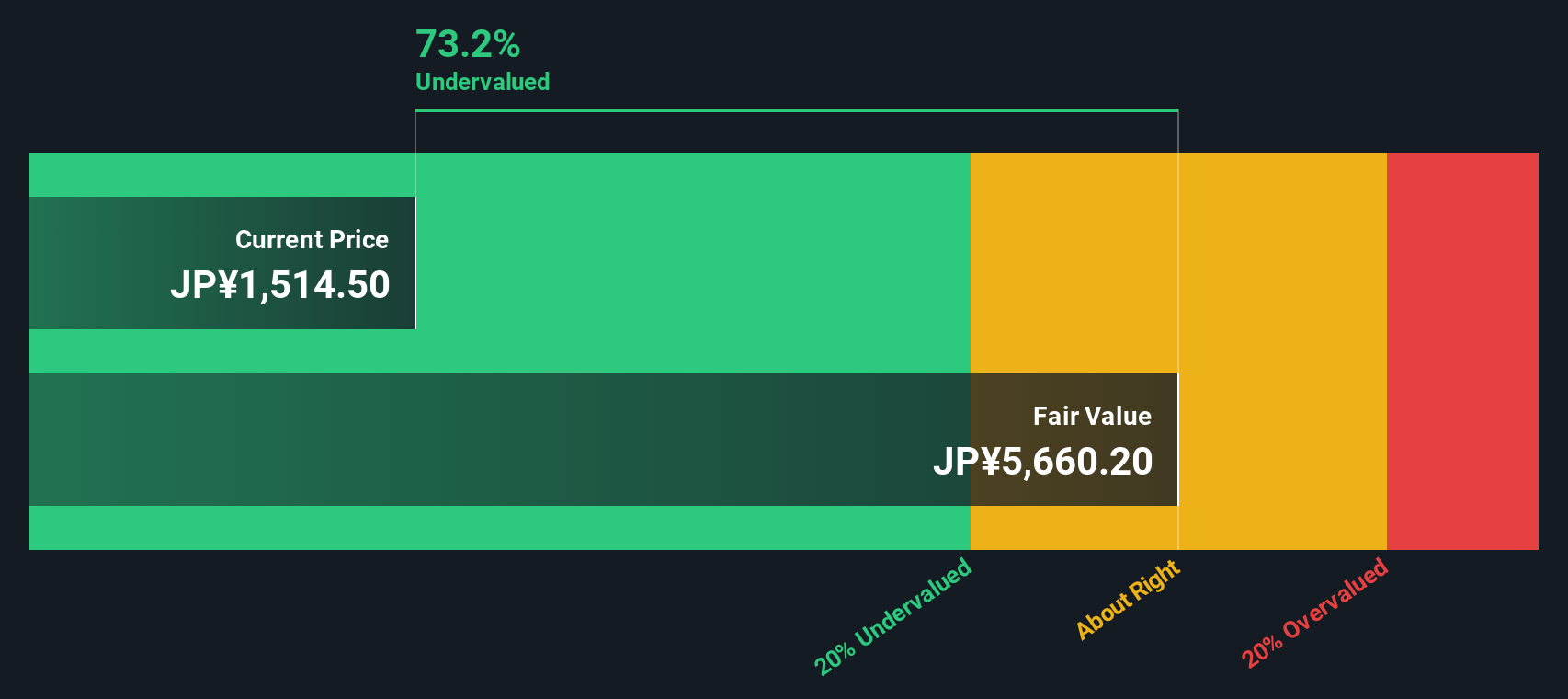

Result: Fair Value of ¥5,671.52 (UNDERVALUED)

See our latest analysis for JTEKT.However, slowing revenue growth and high valuation mean that any earnings miss or market shift could quickly reverse recent gains.

Find out about the key risks to this JTEKT narrative.Another View: What Does Our DCF Model Say?

Looking beyond the earnings ratio, our SWS DCF model offers a different perspective by analyzing JTEKT’s future cash flows instead of profits. This approach also suggests the stock is currently undervalued. However, is this the full story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own JTEKT Narrative

If you have a different perspective or want to draw your own conclusions from the numbers, you can easily craft your own narrative in just a few minutes. Do it your way

A great starting point for your JTEKT research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit yourself to just one opportunity. Give yourself a better shot at impressive returns by checking out top-rated markets and hidden trends today.

- Uncover strong yield plays by exploring selections of dividend stocks with yields > 3% that help boost your income and balance your portfolio.

- Ride the AI momentum by scanning the hottest innovators driving transformational change with AI penny stocks and stay ahead in this booming sector.

- Target exceptional value with well-priced opportunities when you explore undervalued stocks based on cash flows primed for growth and stronger future potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6473

JTEKT

Manufactures and sells steering systems, driveline components, bearings, machine tools, electronic control devices, and home accessory equipment.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives