- Japan

- /

- Auto Components

- /

- TSE:6473

3 Reliable Dividend Stocks To Consider With Up To 4.5% Yield

Reviewed by Simply Wall St

As global markets experience a mix of record highs in major U.S. indexes and political uncertainties in Europe, investors are navigating a landscape marked by growth stock rallies and sector divergences. Amidst these dynamic conditions, dividend stocks offer a compelling option for those seeking stability and income, with reliable yields that can provide a buffer against market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.60% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.98% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.99% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.71% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.41% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.83% | ★★★★★★ |

Click here to see the full list of 1929 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

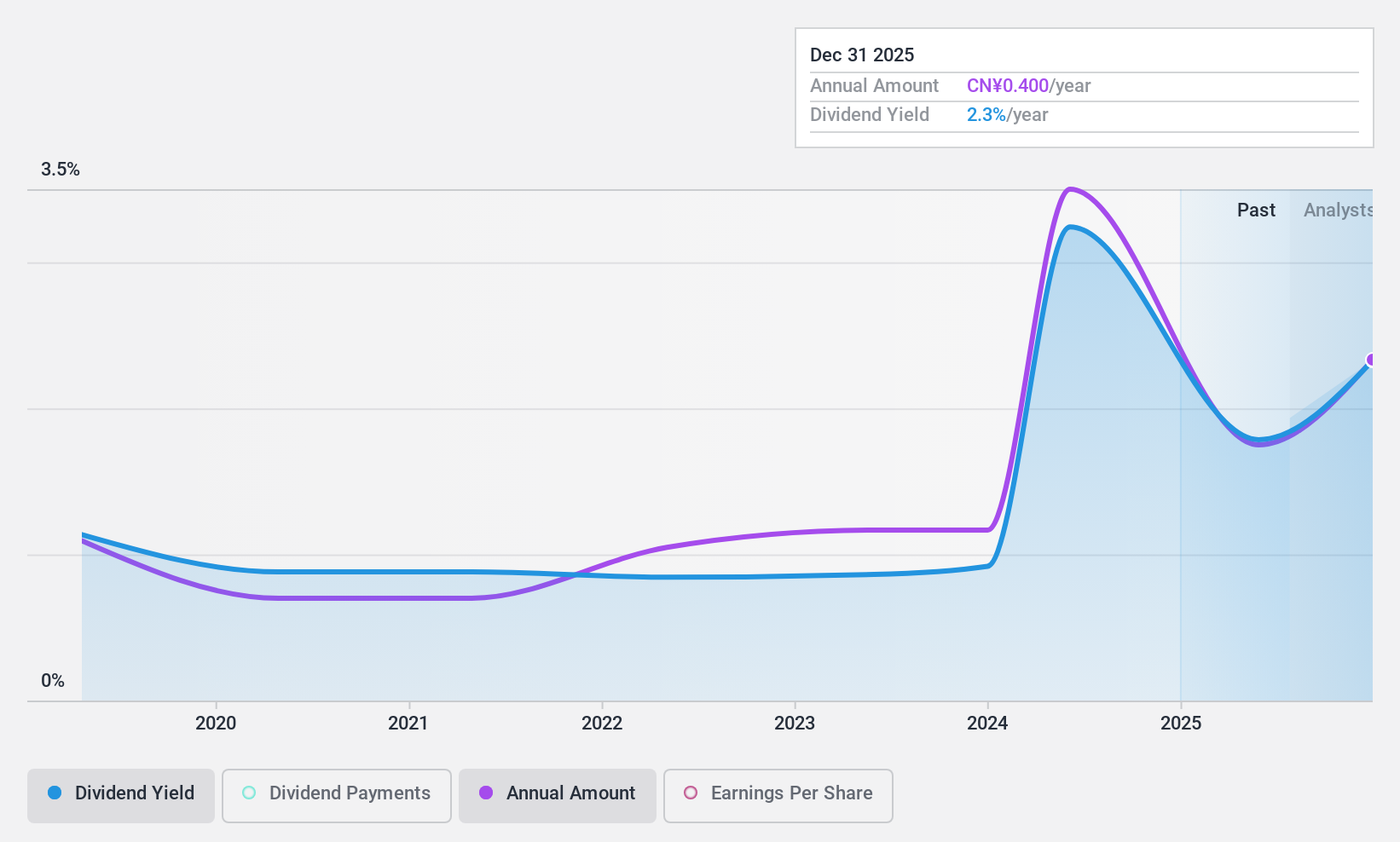

Ningbo Sunrise Elc TechnologyLtd (SZSE:002937)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ningbo Sunrise Elc Technology Co., Ltd manufactures and sells precision components, with a market cap of CN¥5.41 billion.

Operations: Ningbo Sunrise Elc Technology Co., Ltd generates its revenue from the manufacture and sale of precision components.

Dividend Yield: 3.3%

Ningbo Sunrise Elc Technology Ltd offers a dividend yield of 3.3%, placing it in the top 25% of CN market payers. Its dividends are well covered by earnings with a payout ratio of 33.4% and cash flow coverage at 81.1%. However, the company's dividend history is volatile, lacking stability over its six-year track record. Recent earnings show stable net income growth to CNY 192.44 million despite slight revenue decline, indicating some resilience in profitability.

- Navigate through the intricacies of Ningbo Sunrise Elc TechnologyLtd with our comprehensive dividend report here.

- Our valuation report unveils the possibility Ningbo Sunrise Elc TechnologyLtd's shares may be trading at a discount.

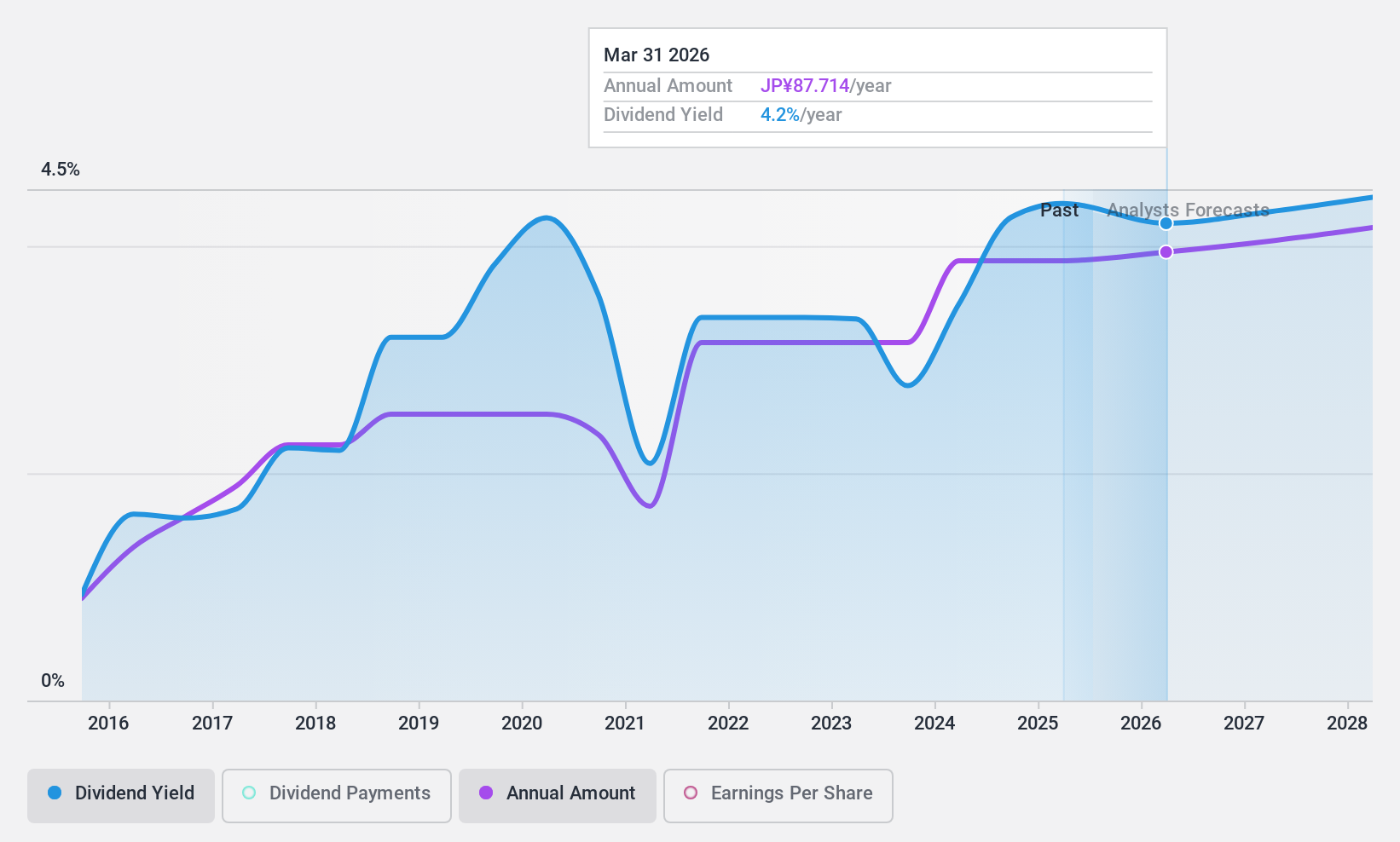

Toyota Boshoku (TSE:3116)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Toyota Boshoku Corporation develops, manufactures, and sells automotive interior systems in Japan, the United States, China, and internationally with a market cap of ¥360.01 billion.

Operations: Toyota Boshoku Corporation's revenue segments include automotive interior systems, with operations spanning Japan, the United States, China, and other international markets.

Dividend Yield: 4.3%

Toyota Boshoku's dividend yield of 4.26% ranks in the top 25% of Japanese market payers, with a sustainable payout ratio of 36.8% and cash flow coverage at 22.4%. Despite past volatility, dividends have grown over the last decade. Recent board decisions confirmed an interim dividend of JPY 43 per share, consistent with last year, supported by projected revenue of ¥1.87 trillion and profit attributable to owners at ¥43 billion for fiscal year ending March 2025.

- Dive into the specifics of Toyota Boshoku here with our thorough dividend report.

- Our expertly prepared valuation report Toyota Boshoku implies its share price may be lower than expected.

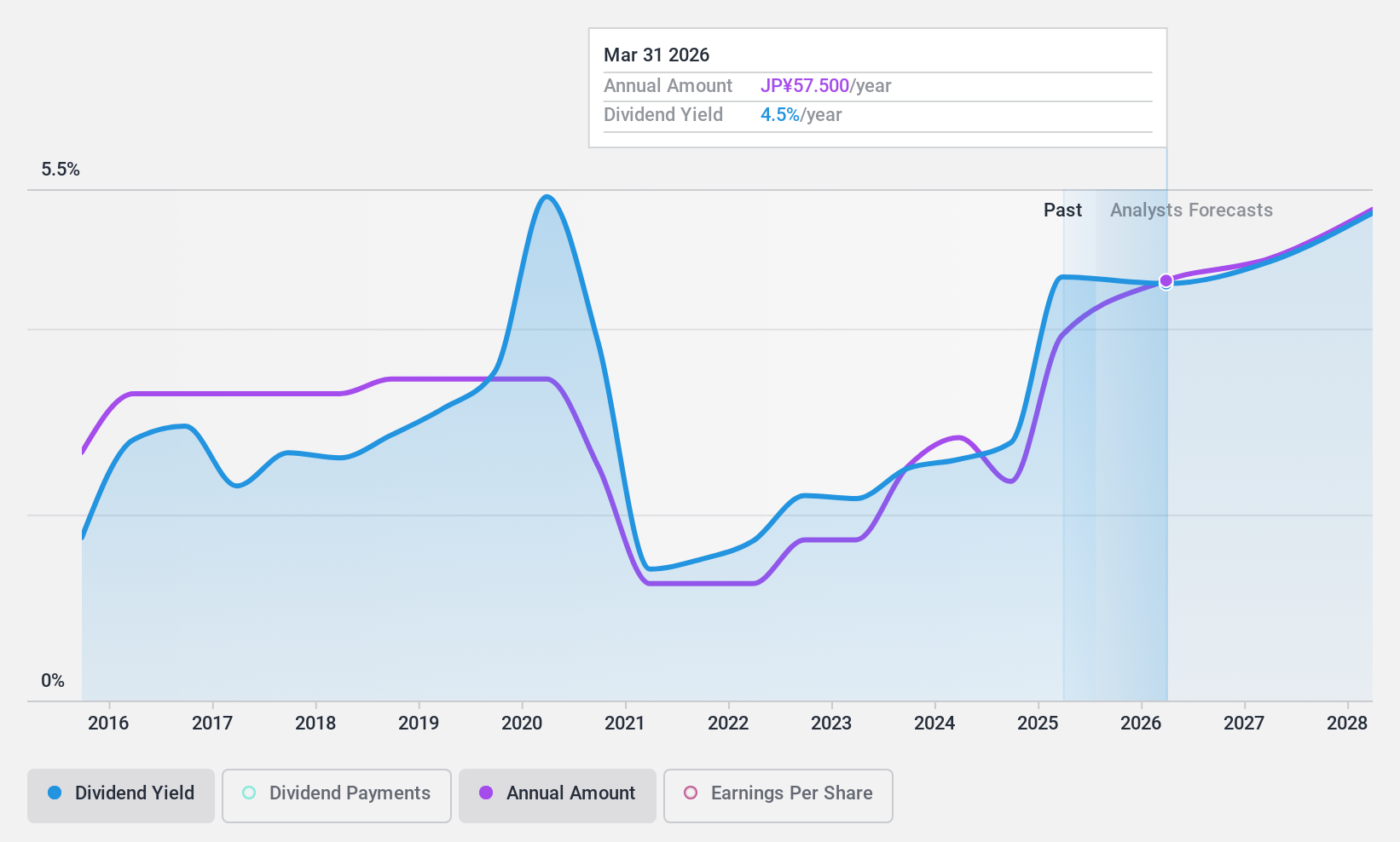

JTEKT (TSE:6473)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JTEKT Corporation manufactures and sells a range of products including steering systems, driveline components, bearings, machine tools, electronic control devices, and home accessory equipment with a market cap of ¥381.07 billion.

Operations: JTEKT Corporation's revenue segments include steering systems, driveline components, bearings, machine tools, electronic control devices, and home accessory equipment.

Dividend Yield: 4.5%

JTEKT Corporation's recent dividend increase to JPY 25 per share, up from JPY 16 last year, highlights its commitment to returning value despite financial challenges. However, the company's dividends have been historically volatile and are not well covered by cash flows, with a high cash payout ratio of 463.6%. The lowered earnings guidance reflects potential revenue and profit declines due to automotive industry trends. Trading significantly below fair value estimates may offer some appeal to investors seeking growth potential amidst dividend uncertainties.

- Delve into the full analysis dividend report here for a deeper understanding of JTEKT.

- Our valuation report here indicates JTEKT may be undervalued.

Where To Now?

- Discover the full array of 1929 Top Dividend Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6473

JTEKT

Manufactures and sells steering systems, driveline components, bearings, machine tools, electronic control devices, home accessory equipment, etc.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives