- Japan

- /

- Trade Distributors

- /

- TSE:7570

Top Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets navigate the early days of President Trump's administration, U.S. stocks are reaching record highs, buoyed by optimism around potential trade deals and advancements in artificial intelligence. Against this backdrop of economic activity and political developments, dividend stocks continue to attract investors seeking stability and income amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Financial Institutions (NasdaqGS:FISI) | 4.44% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.22% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.84% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.67% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.44% | ★★★★★★ |

Click here to see the full list of 1949 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

NPR-Riken (TSE:6209)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: NPR-Riken Corporation, along with its subsidiaries, produces and distributes automobile and marine engine parts both domestically in Japan and internationally, with a market cap of ¥67.82 billion.

Operations: NPR-Riken Corporation generates revenue from the production and distribution of automobile engine parts and marine engine parts in both domestic and international markets.

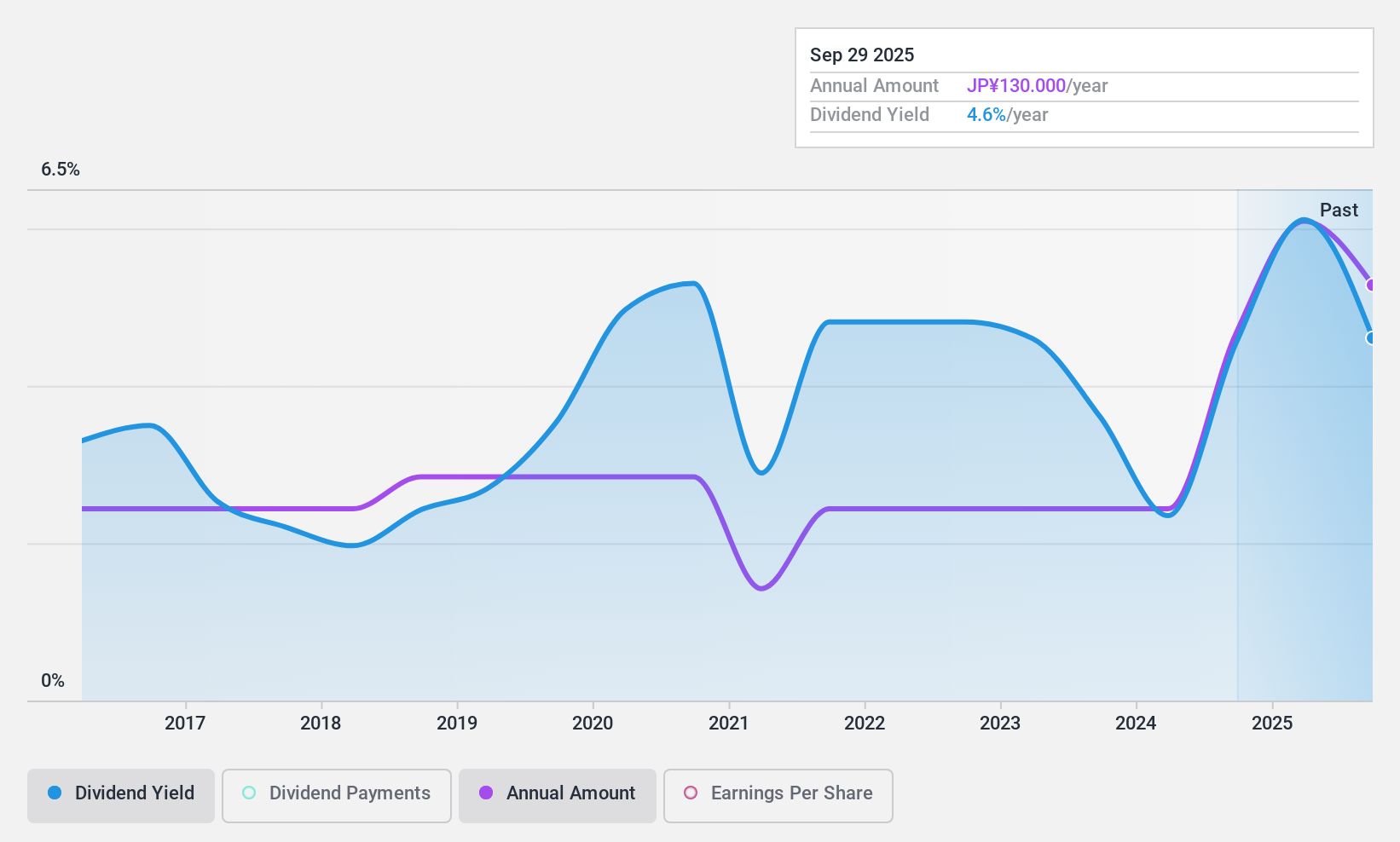

Dividend Yield: 5.9%

NPR-Riken offers a compelling dividend yield of 5.94%, placing it in the top quartile of Japanese dividend payers. Despite this attractive yield, the company's dividends have been volatile over the past decade, with instances of significant annual drops. However, dividends are well covered by both earnings and cash flows, boasting payout ratios of 6.7% and 30% respectively. The stock trades at a substantial discount to its estimated fair value, potentially offering good value for investors seeking income with growth potential in earnings evidenced by recent growth figures.

- Navigate through the intricacies of NPR-Riken with our comprehensive dividend report here.

- The valuation report we've compiled suggests that NPR-Riken's current price could be quite moderate.

Hashimoto Sogyo HoldingsLtd (TSE:7570)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hashimoto Sogyo Holdings Co., Ltd. operates in Japan, focusing on the processing, manufacture, and sale of plumbing and housing equipment, with a market cap of ¥24.72 billion.

Operations: Hashimoto Sogyo Holdings Co., Ltd.'s revenue is primarily derived from Piping Materials (¥46.11 billion), Sanitary Ceramic and Fittings (¥46.70 billion), Air Conditioners & Pumps (¥37.92 billion), and Housing Facilities and Equipment (¥28.69 billion).

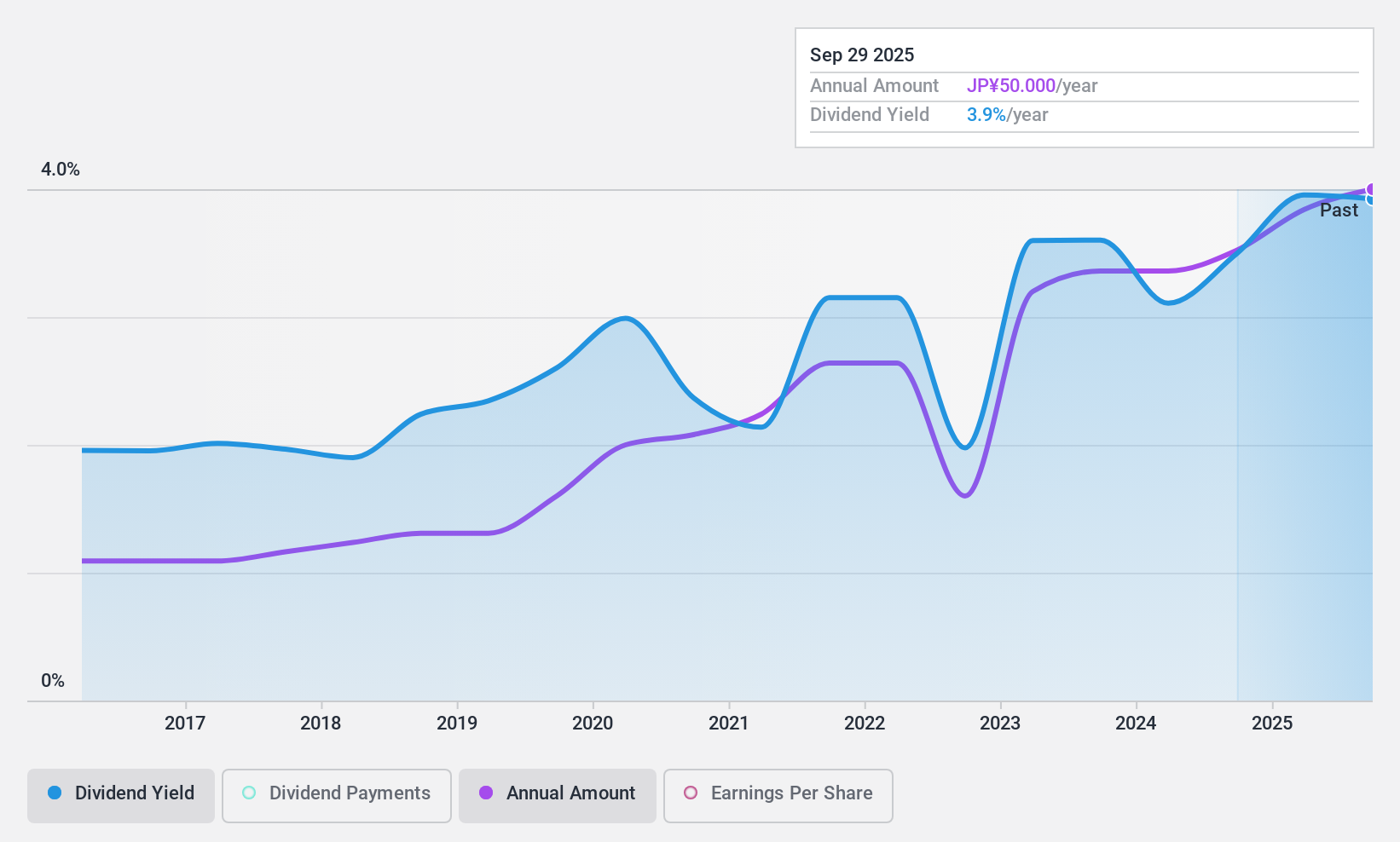

Dividend Yield: 3.9%

Hashimoto Sogyo Holdings Ltd. offers a dividend yield of 3.87%, ranking in the top 25% of Japanese dividend payers. The company has maintained stable and growing dividends over the past decade, though these are not covered by free cash flows, indicating potential sustainability concerns. Despite high non-cash earnings impacting quality, its payout ratio is reasonably low at 34.1%, suggesting dividends are well covered by earnings alone. The stock's P/E ratio of 9.3x suggests it may be undervalued compared to the market average.

- Click here to discover the nuances of Hashimoto Sogyo HoldingsLtd with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Hashimoto Sogyo HoldingsLtd is priced higher than what may be justified by its financials.

Ricoh Leasing Company (TSE:8566)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ricoh Leasing Company, Ltd. operates in Japan, offering leasing, investment, and financial services with a market cap of ¥157.82 billion.

Operations: Ricoh Leasing Company, Ltd.'s revenue is primarily derived from its Leasing & Finance Business at ¥289.42 billion, followed by the Service Business at ¥9.05 billion and the Investment Business at ¥8.27 billion.

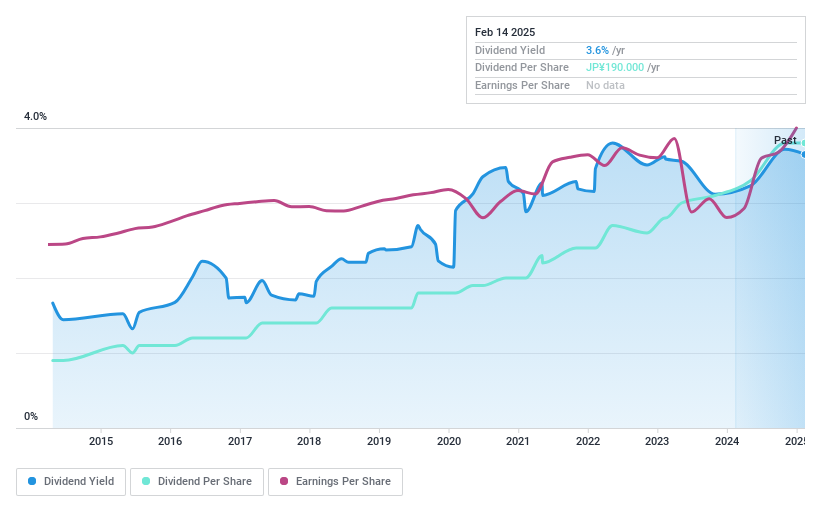

Dividend Yield: 3.4%

Ricoh Leasing Company offers a stable dividend history over the past decade, with recent increases reflecting a commitment to shareholders. However, its 3.42% yield is below top-tier Japanese payers. Despite a low payout ratio of 33.7%, dividends are not covered by free cash flow, raising sustainability concerns. Recent guidance indicates strong financial performance with projected net sales of ¥315 billion and profit of ¥14.7 billion for FY2025, supporting potential future dividend growth amidst ongoing treasury share disposals and remuneration considerations.

- Take a closer look at Ricoh Leasing Company's potential here in our dividend report.

- According our valuation report, there's an indication that Ricoh Leasing Company's share price might be on the cheaper side.

Taking Advantage

- Unlock our comprehensive list of 1949 Top Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hashimoto Sogyo HoldingsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7570

Hashimoto Sogyo HoldingsLtd

Engages in the processing, manufacture, and sale of plumbing and housing equipment in Japan.

Established dividend payer with proven track record.

Market Insights

Community Narratives