- Japan

- /

- Auto Components

- /

- TSE:5992

Chuo Spring Co.,Ltd. (TSE:5992) Soars 26% But It's A Story Of Risk Vs Reward

Chuo Spring Co.,Ltd. (TSE:5992) shares have continued their recent momentum with a 26% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 29% in the last year.

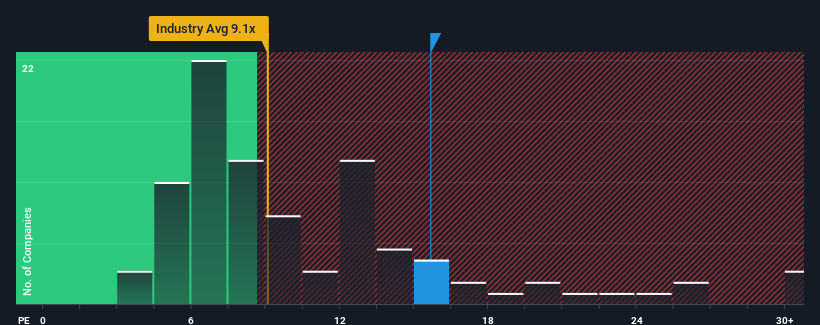

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Chuo SpringLtd's P/E ratio of 15.7x, since the median price-to-earnings (or "P/E") ratio in Japan is also close to 14x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Earnings have risen firmly for Chuo SpringLtd recently, which is pleasing to see. It might be that many expect the respectable earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Chuo SpringLtd

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Chuo SpringLtd's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 27% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 728% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Comparing that to the market, which is only predicted to deliver 11% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we find it interesting that Chuo SpringLtd is trading at a fairly similar P/E to the market. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Key Takeaway

Chuo SpringLtd's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Chuo SpringLtd revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look better than current market expectations. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Chuo SpringLtd, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Chuo SpringLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5992

Chuo SpringLtd

Engages in the manufacture and sale of springs, control cables, construction materials and equipment, and automotive accessories in Japan, North America, China, and Asia The company offers chassis springs, such as coil springs, stabilizers, leaf springs, torsion bars, and ODDS, an on demand disconnectable stabilizer; and precision springs, including precision coil springs, valve springs, heat resistant springs, power back door springs, spiral spring, wire springs, knitted mesh spring, and assembly products.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives