- Japan

- /

- Auto Components

- /

- TSE:5975

Top Global Dividend Stocks For July 2025

Reviewed by Simply Wall St

As global markets continue to rally, with indices like the S&P 500 and Nasdaq Composite reaching all-time highs, investors are keenly observing how inflationary pressures and international trade developments might influence future economic conditions. In this dynamic environment, dividend stocks offer a compelling opportunity for those seeking steady income streams and potential growth, as they often provide stability amidst market fluctuations.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.51% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.07% | ★★★★★★ |

| NCD (TSE:4783) | 4.27% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.33% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.64% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.45% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.02% | ★★★★★★ |

| Daicel (TSE:4202) | 4.99% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.79% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.49% | ★★★★★★ |

Click here to see the full list of 1544 stocks from our Top Global Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Zhejiang Hailide New MaterialLtd (SZSE:002206)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zhejiang Hailide New Material Co., Ltd operates in the research, development, production, and sales of chemical fibers, textile materials, and rubber and plastic products both domestically and internationally with a market cap of CN¥5.90 billion.

Operations: Zhejiang Hailide New Material Co., Ltd generates revenue from the production and sales of chemical fibers, textile materials, and rubber and plastic products in both domestic and international markets.

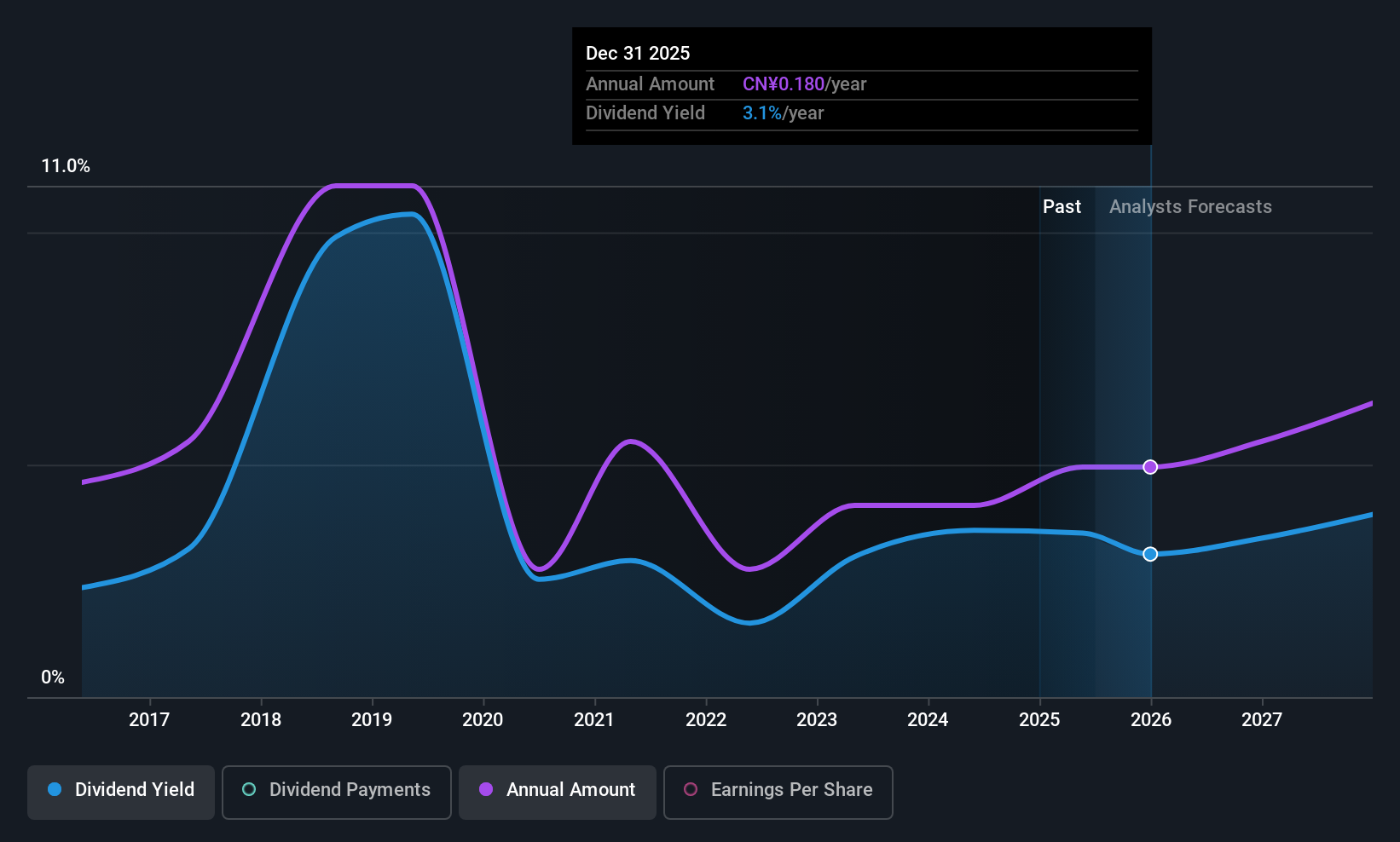

Dividend Yield: 3.1%

Zhejiang Hailide New Material Ltd. offers a dividend yield in the top 25% of the CN market, supported by a low payout ratio of 43.6%, indicating coverage by earnings and cash flows. However, its dividend history is marked by volatility and unreliability over the past decade. Recent financials show growth, with Q1 2025 net income at CNY 139.69 million compared to CNY 74.72 million a year ago, reflecting potential for future stability if sustained performance continues amidst recent board changes and governance amendments.

- Take a closer look at Zhejiang Hailide New MaterialLtd's potential here in our dividend report.

- Our valuation report unveils the possibility Zhejiang Hailide New MaterialLtd's shares may be trading at a discount.

Topre (TSE:5975)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Topre Corporation is a manufacturer and seller of components and products for automobiles, temperature-controlled logistics, air conditioning systems, and electronic equipment across Japan, the United States, China, Mexico, Thailand, Indonesia, and India with a market cap of approximately ¥94.58 billion.

Operations: Topre Corporation's revenue primarily comes from its Press-Related Product Business, generating ¥299.98 billion, and its Temperature-Controlled Logistics Business, contributing ¥58.39 billion.

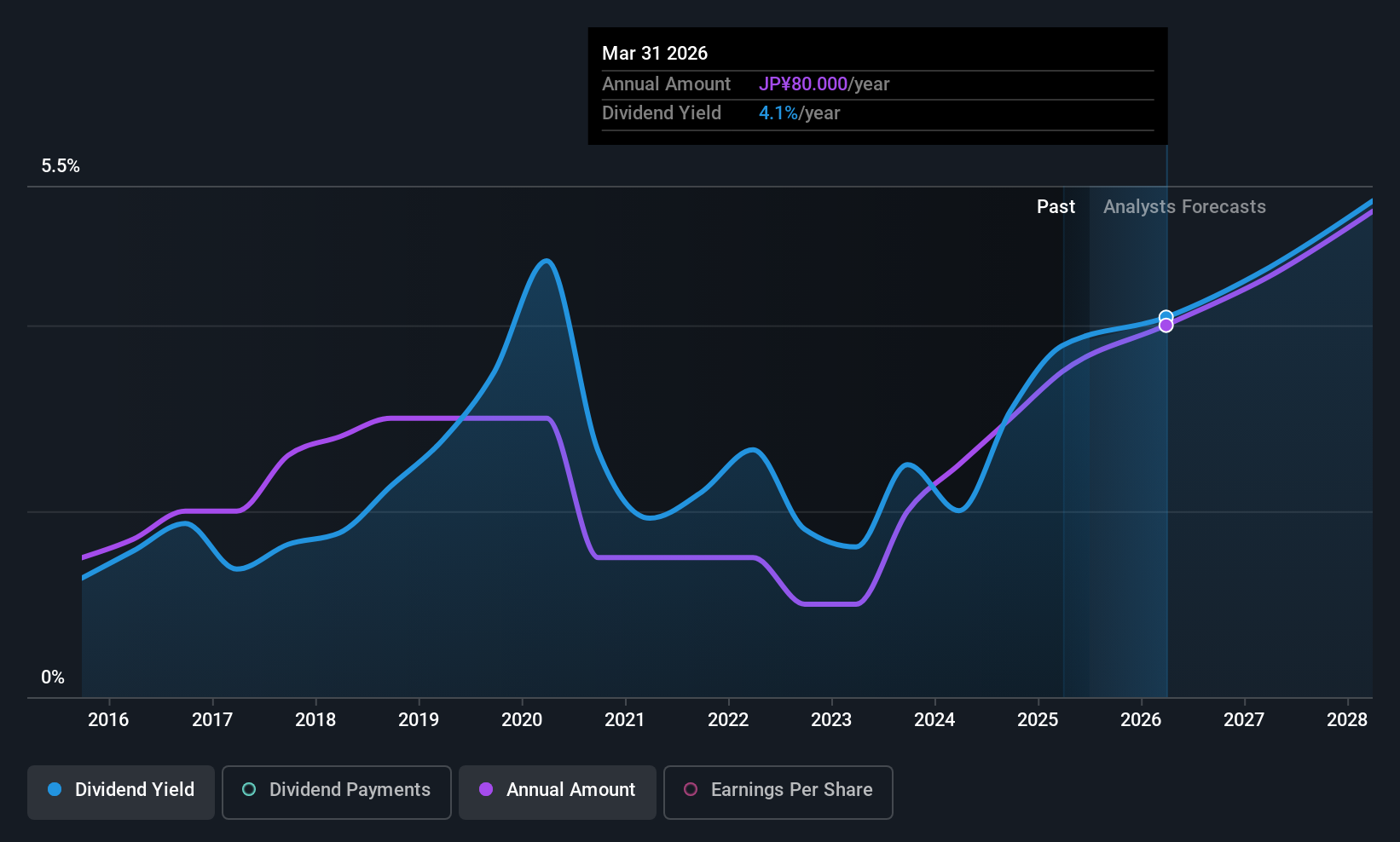

Dividend Yield: 4.1%

Topre Corporation's dividend yield ranks in the top 25% of the JP market, supported by a low payout ratio of 27%, ensuring coverage by earnings and cash flows. Despite this, its dividend history has been volatile and unreliable over the past decade. Recent increases in dividends from ¥30 to ¥40 per share for the year ended March 2025 highlight potential growth. A recent buyback program worth ¥2.22 billion indicates efforts to enhance capital efficiency amidst fluctuating management conditions.

- Click here and access our complete dividend analysis report to understand the dynamics of Topre.

- The valuation report we've compiled suggests that Topre's current price could be quite moderate.

Zojirushi (TSE:7965)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zojirushi Corporation manufactures and markets household products both in Japan and internationally, with a market cap of ¥107.43 billion.

Operations: Zojirushi Corporation generates revenue of ¥89.78 billion from its manufacturing and sale of household goods and related business activities.

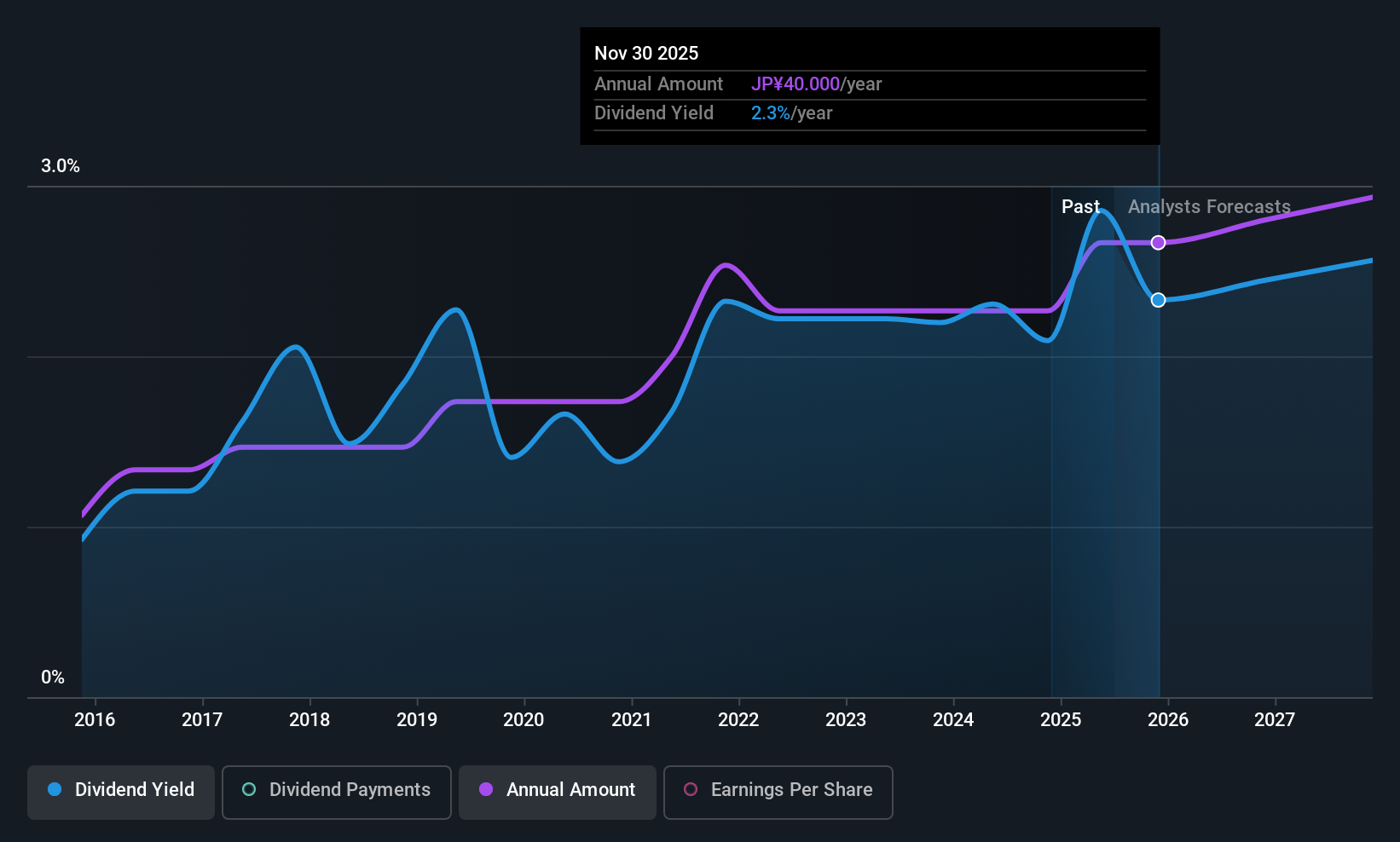

Dividend Yield: 3.6%

Zojirushi's dividend payments have been inconsistent over the past decade, with recent increases from ¥17 to ¥30 per share for Q2 and expected full-year dividends rising to ¥34. Despite volatility, dividends are covered by earnings (payout ratio: 69.3%) and cash flows (cash payout ratio: 73.3%). A new buyback program of ¥3.4 billion aims to improve shareholder returns and capital efficiency amid a volatile share price environment, although its yield remains below top-tier levels in the JP market.

- Click to explore a detailed breakdown of our findings in Zojirushi's dividend report.

- Our valuation report here indicates Zojirushi may be overvalued.

Next Steps

- Unlock more gems! Our Top Global Dividend Stocks screener has unearthed 1541 more companies for you to explore.Click here to unveil our expertly curated list of 1544 Top Global Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Topre might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5975

Topre

Engages in the press-related products and temperature-controlled logistics-related businesses in Japan.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives