Qingdao Citymedia Co And 2 Other Reliable Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate through uncertainties like tariff tensions and mixed economic signals, investors are increasingly seeking stability in their portfolios. Dividend stocks, known for providing regular income and potential for capital appreciation, can be a reliable choice amid such volatile conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.88% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.98% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.12% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.04% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.31% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.82% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.51% | ★★★★★★ |

| Archer-Daniels-Midland (NYSE:ADM) | 4.46% | ★★★★★☆ |

Click here to see the full list of 1973 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

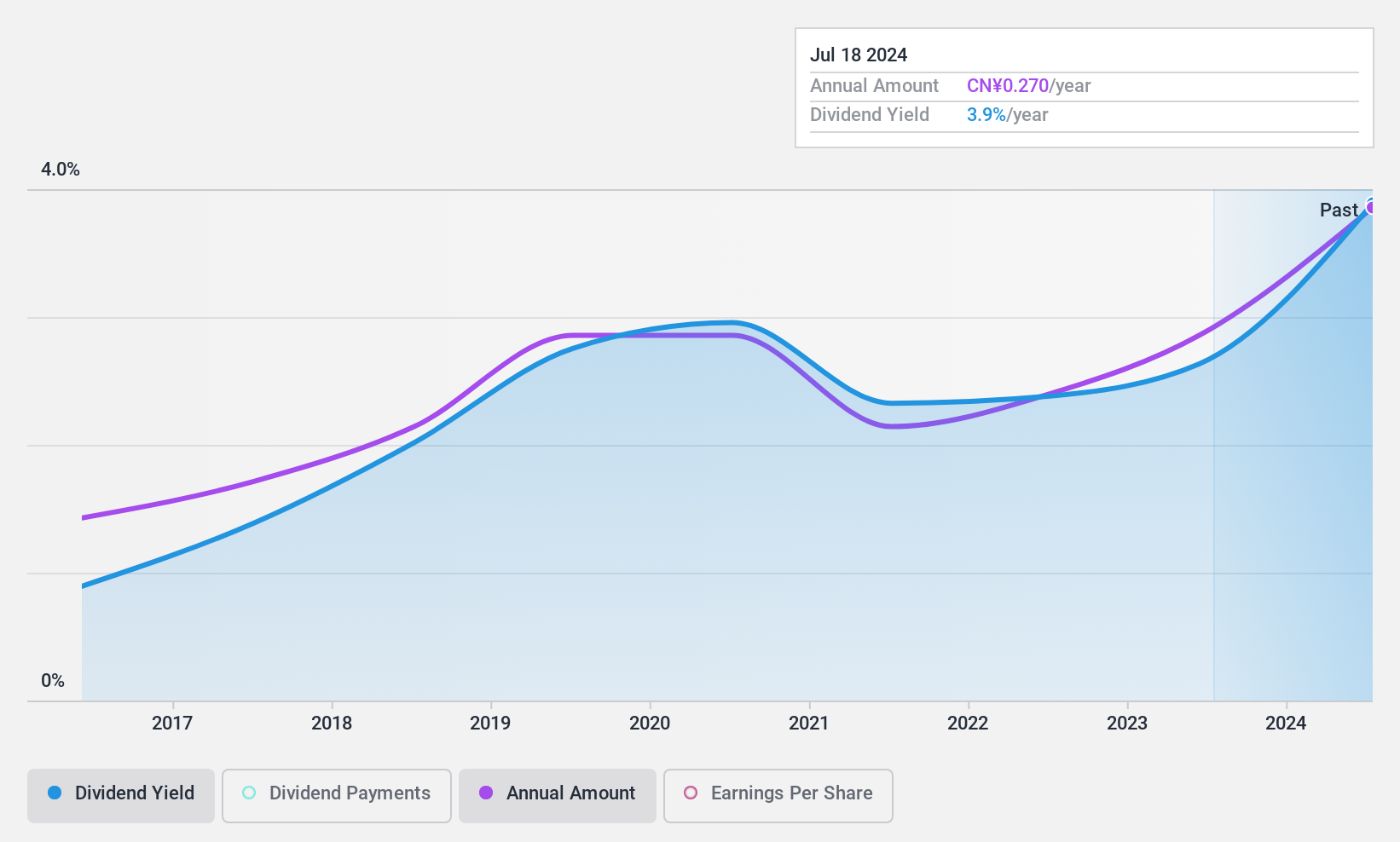

Qingdao Citymedia Co (SHSE:600229)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Qingdao Citymedia Co., Ltd. operates in China, focusing on the publication and distribution of books, periodicals, journals, and electronic audio-visual publications, with a market cap of approximately CN¥4.82 billion.

Operations: Qingdao Citymedia Co., Ltd.'s revenue primarily stems from its activities in publishing and distributing books, periodicals, journals, and electronic audio-visual materials within China.

Dividend Yield: 3.7%

Qingdao Citymedia Co.'s dividend yield is in the top 25% of CN market payers, with a payout ratio of 62.6% and cash payout ratio of 56.4%, indicating dividends are covered by earnings and cash flows. However, its dividend track record is less stable, with payments being volatile over its nine-year history. Although trading slightly below fair value, large one-off items affect financial results, impacting overall earnings quality and reliability for long-term investors.

- Get an in-depth perspective on Qingdao Citymedia Co's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Qingdao Citymedia Co's share price might be too pessimistic.

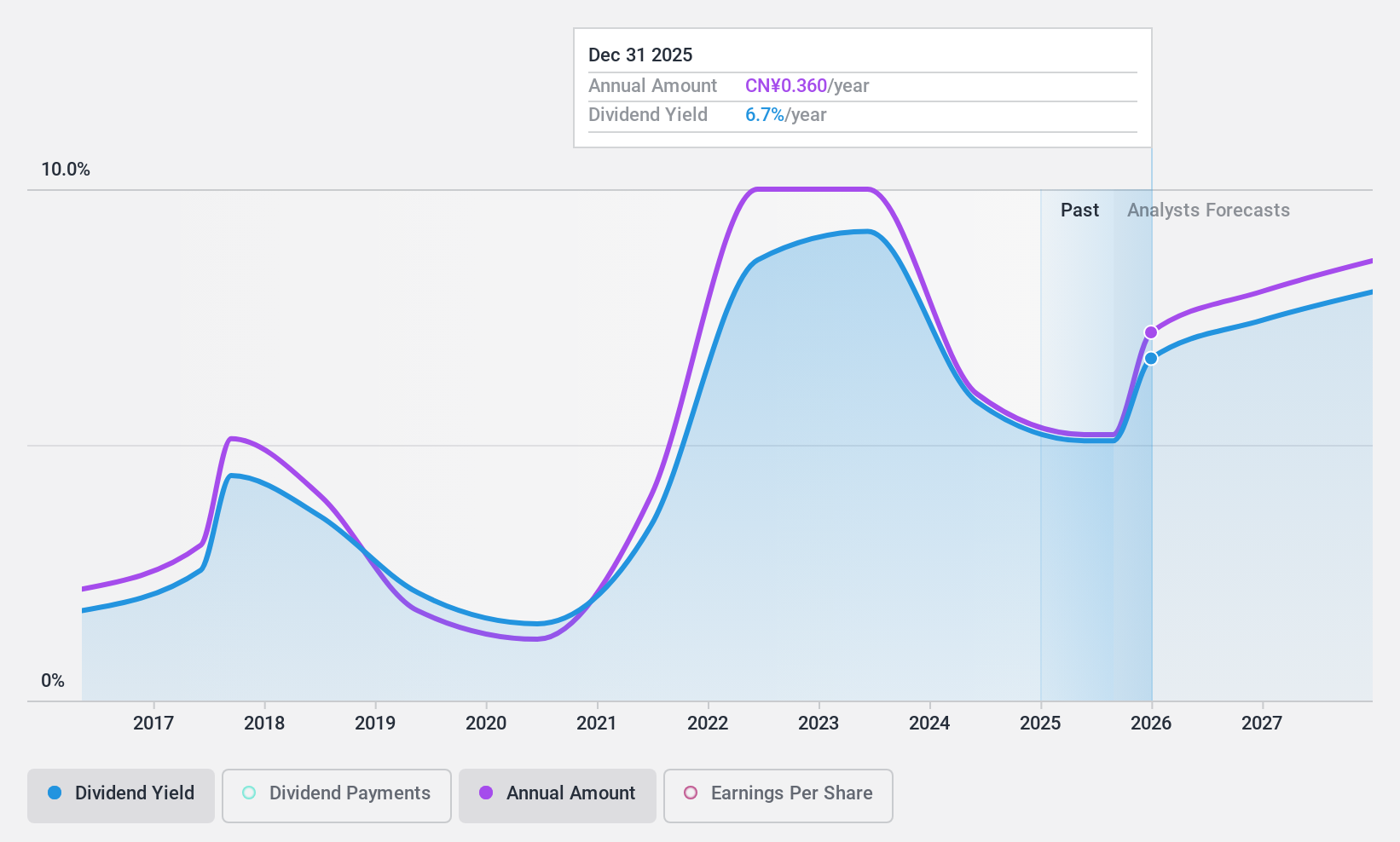

Bros Eastern.Ltd (SHSE:601339)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bros Eastern., Ltd is involved in the research, development, production, and sales of top-dyed mélange yarn and color-spun yarn with a market cap of CN¥7.94 billion.

Operations: Bros Eastern., Ltd generates its revenue primarily from the yarn segment, which accounts for CN¥7.44 billion.

Dividend Yield: 5.6%

Bros Eastern Ltd.'s dividend yield is among the top 25% in the CN market, yet its high payout ratio of 121% indicates dividends are not well covered by earnings, though cash flows cover them with a lower cash payout ratio of 30.7%. Despite a decade of growth, dividends have been volatile and unreliable. The company trades at a favorable price-to-earnings ratio compared to the market but faces challenges with declining profit margins and large one-off items affecting financial results.

- Take a closer look at Bros Eastern.Ltd's potential here in our dividend report.

- Our valuation report unveils the possibility Bros Eastern.Ltd's shares may be trading at a discount.

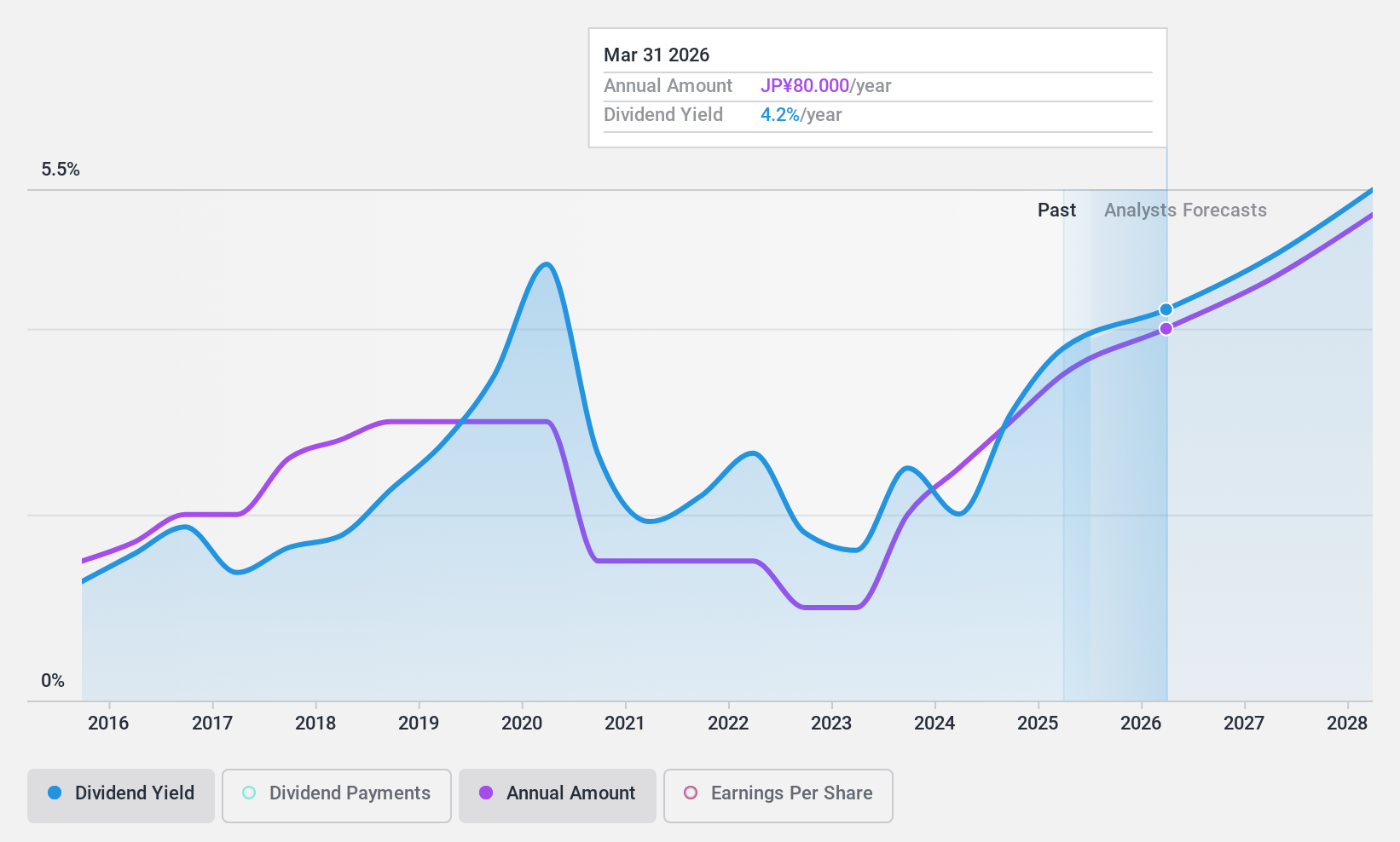

Topre (TSE:5975)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Topre Corporation manufactures and sells components and products for automobiles, temperature-controlled logistics, air conditioning systems, and electronic equipment across Japan, the United States, China, Mexico, Thailand, Indonesia, and India with a market cap of ¥94.98 billion.

Operations: Topre Corporation's revenue is primarily derived from its Press-Related Product Business, generating ¥299.27 billion, and its Thermostat Related Segment, contributing ¥53.85 billion.

Dividend Yield: 3.7%

Topre Corporation's dividend has increased recently, with a full-year expectation of ¥35.00 per share compared to ¥30.00 last year, yet its historical dividend reliability is questionable due to volatility. The payout ratio of 52.8% suggests dividends are covered by earnings and cash flows, supported by a low cash payout ratio of 21.7%. Despite trading below estimated fair value and forecasted earnings growth, profit margins have declined from the previous year, impacting overall financial stability for dividend investors.

- Navigate through the intricacies of Topre with our comprehensive dividend report here.

- Our valuation report here indicates Topre may be undervalued.

Turning Ideas Into Actions

- Discover the full array of 1973 Top Dividend Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qingdao Citymedia Co might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600229

Qingdao Citymedia Co

Engages in the publication and distribution of books, periodicals, journals, and electronic audio-visual publications in China.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives