- Japan

- /

- Auto Components

- /

- TSE:5802

Subdued Growth No Barrier To Sumitomo Electric Industries, Ltd. (TSE:5802) With Shares Advancing 34%

Sumitomo Electric Industries, Ltd. (TSE:5802) shareholders are no doubt pleased to see that the share price has bounced 34% in the last month, although it is still struggling to make up recently lost ground. Taking a wider view, although not as strong as the last month, the full year gain of 14% is also fairly reasonable.

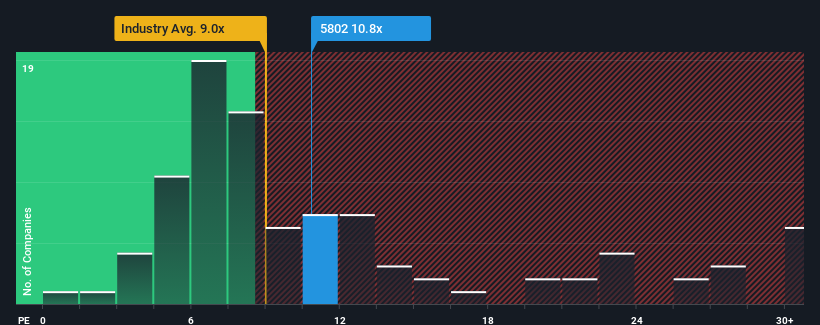

Although its price has surged higher, it's still not a stretch to say that Sumitomo Electric Industries' price-to-earnings (or "P/E") ratio of 10.8x right now seems quite "middle-of-the-road" compared to the market in Japan, where the median P/E ratio is around 13x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

We've discovered 2 warning signs about Sumitomo Electric Industries. View them for free.With earnings growth that's superior to most other companies of late, Sumitomo Electric Industries has been doing relatively well. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Sumitomo Electric Industries

What Are Growth Metrics Telling Us About The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Sumitomo Electric Industries' to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 29% last year. Pleasingly, EPS has also lifted 101% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings should grow by 4.3% per year over the next three years. With the market predicted to deliver 9.3% growth each year, the company is positioned for a weaker earnings result.

In light of this, it's curious that Sumitomo Electric Industries' P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Sumitomo Electric Industries' P/E

Its shares have lifted substantially and now Sumitomo Electric Industries' P/E is also back up to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Sumitomo Electric Industries currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you take the next step, you should know about the 2 warning signs for Sumitomo Electric Industries (1 is a bit unpleasant!) that we have uncovered.

If these risks are making you reconsider your opinion on Sumitomo Electric Industries, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:5802

Sumitomo Electric Industries

Manufactures and sells electric wires and cables worldwide.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives