- Japan

- /

- Auto Components

- /

- TSE:5334

Niterra (TSE:5334) Valuation in Focus After Share Buyback and Dividend Increase Announcements

Reviewed by Simply Wall St

Niterra (TSE:5334) just rolled out a substantial share buyback, with plans to repurchase up to 3.62% of its issued shares. In addition, the company also announced increases to both its interim and year-end dividends.

See our latest analysis for Niterra.

Niterra’s recent share buyback and dividend hikes come against the backdrop of unusually strong price action this year. The stock is riding a wave of positive momentum, with a 1-month share price return of 10.03% and a striking 32.51% year-to-date gain. Long-term performance is even more impressive, as the company has delivered a robust 39.16% total shareholder return over the past year, and an outstanding 352.92% over five years. This signals enduring growth and renewed investor optimism.

If you’re looking to capture similar momentum, now is a smart time to see what else is gaining traction and discover See the full list for free.

But with such powerful returns and management’s clear drive to reward shareholders, investors may wonder if Niterra’s current valuation is still attractive. Alternatively, it is possible the market is already pricing in the company’s future growth potential and dividend prospects.

Price-to-Earnings of 13.6x: Is it justified?

Niterra currently trades at a price-to-earnings (P/E) ratio of 13.6x, above the auto components industry average but below the peer group average. With a last close price of ¥6,582, this premium reflects the market’s willingness to pay extra for Niterra compared to most industry peers.

The P/E ratio shows how much investors are paying for each unit of earnings. For established manufacturers like Niterra, it indicates how confident the market is in the company’s ability to keep growing profits. Higher P/E ratios often suggest expectations for robust future earnings or company-specific advantages.

Niterra's P/E ratio of 13.6x surpasses the Japanese auto components industry average of 10.6x, which signals a valuation premium relative to typical sector peers. However, it remains attractively priced compared to the peer group average of 16.3x. Compared to its estimated fair P/E ratio of 13.7x, the current multiple is basically in line. This suggests that the market’s current optimism is roughly justified.

Explore the SWS fair ratio for Niterra

Result: Price-to-Earnings of 13.6x (ABOUT RIGHT)

However, Niterra's current price sits above analyst targets, and slower revenue growth could limit further upside for shareholders in the near term.

Find out about the key risks to this Niterra narrative.

Another View: What Does Our DCF Model Say?

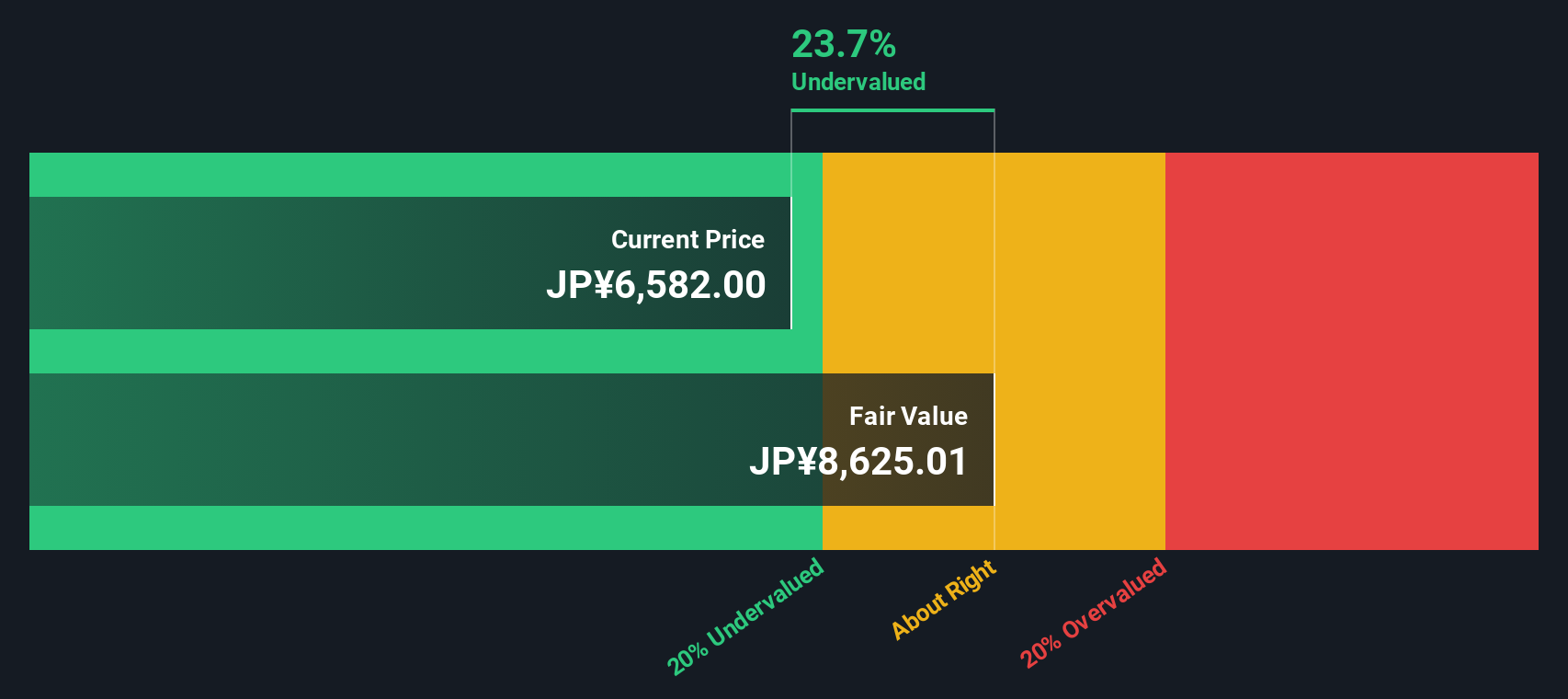

Looking through the lens of our SWS DCF model, Niterra appears to be trading at a significant discount to its estimated fair value. While the market prices the stock at ¥6,582, the DCF model suggests a fair value of ¥8,634.88. This indicates the shares could be undervalued by about 24%.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Niterra for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Niterra Narrative

If you have a different perspective or would like to investigate the data first-hand, crafting your own insight is quick and straightforward. Do it your way.

A great starting point for your Niterra research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

There’s a world of opportunity beyond Niterra waiting for you. Use these powerful tools now, so you’re never left behind as the market moves.

- Boost your income potential by uncovering companies with generous yields through these 16 dividend stocks with yields > 3%.

- Spot tomorrow’s big winners by analyzing these 874 undervalued stocks based on cash flows that are flying under Wall Street’s radar.

- Meet innovators changing healthcare forever by tapping into these 32 healthcare AI stocks in artificial intelligence and diagnostics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Niterra might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5334

Niterra

Manufactures and sells spark plugs and related products for internal-combustion engines and technical ceramics in Japan and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives