- Japan

- /

- Auto Components

- /

- TSE:5184

Exploring Undiscovered Gems In Japan July 2024

Reviewed by Simply Wall St

As of July 2024, Japan's stock markets have experienced significant volatility, with the Nikkei 225 and TOPIX indices both posting sharp weekly losses. This downturn reflects broader concerns about global economic stability and has particularly impacted Japanese technology stocks amid a strengthening yen. In this context, exploring undiscovered gems within Japan's market could offer intriguing opportunities for investors looking beyond mainstream options and seeking potential in less visible sectors.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 5.16% | 12.45% | ★★★★★★ |

| QuickLtd | 0.74% | 9.42% | 13.89% | ★★★★★★ |

| Icom | NA | 4.02% | 13.06% | ★★★★★★ |

| Uoriki | NA | 3.84% | 2.73% | ★★★★★★ |

| Techno Ryowa | 0.25% | 0.34% | 0.12% | ★★★★★☆ |

| Cresco | 8.62% | 7.79% | 9.50% | ★★★★★☆ |

| Ogaki Kyoritsu Bank | 130.22% | 1.61% | -0.98% | ★★★★★☆ |

| GENOVA | 6.23% | 24.87% | 31.14% | ★★★★☆☆ |

| Nippon Sharyo | 60.53% | -1.01% | -17.30% | ★★★★☆☆ |

| Yukiguni Maitake | 158.67% | -5.22% | -32.27% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Bourbon (TSE:2208)

Simply Wall St Value Rating: ★★★★★☆

Overview: Bourbon Corporation is a Japanese company engaged in the manufacturing and sales of food and beverage products, with a market capitalization of ¥57.25 billion.

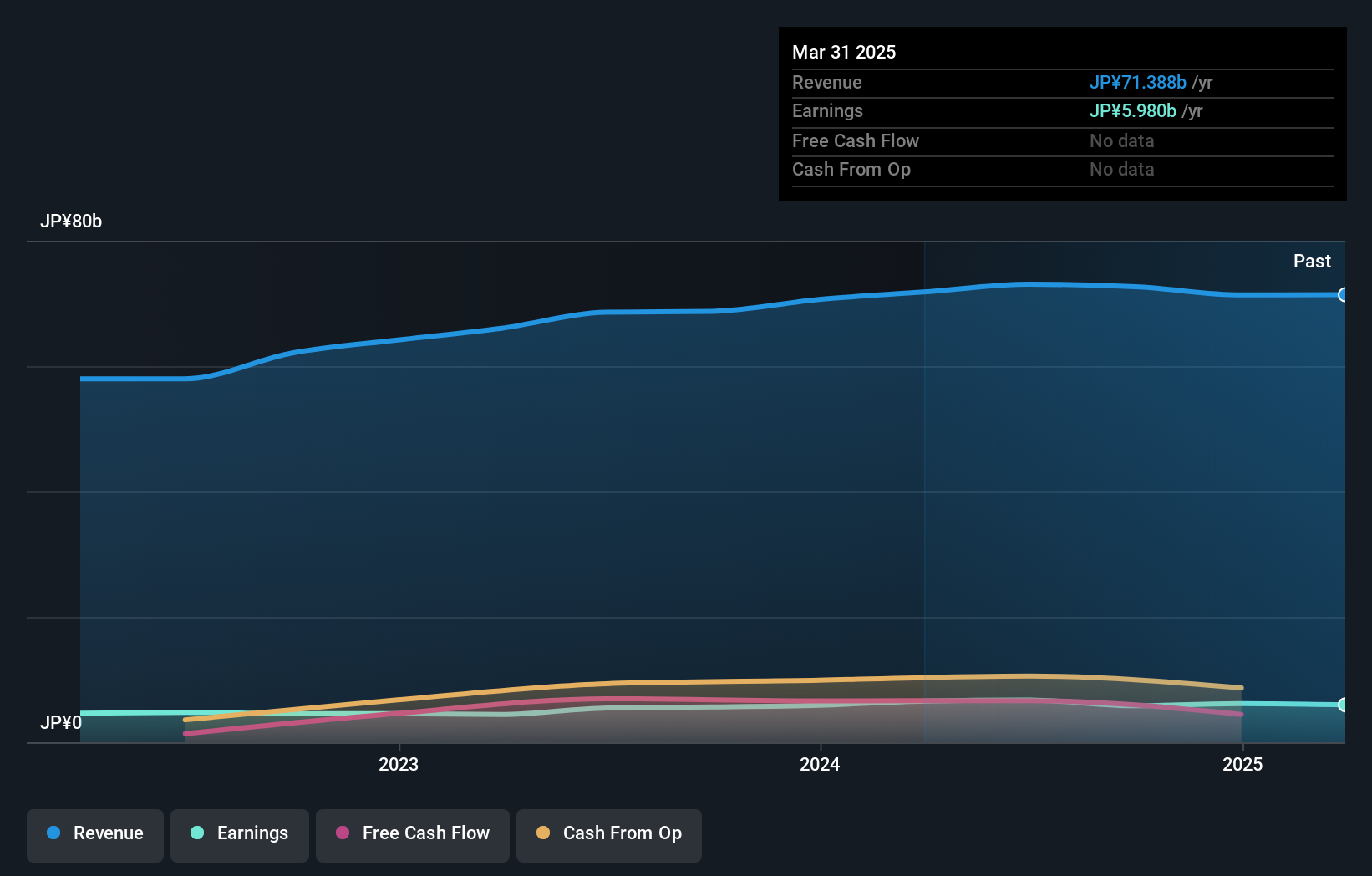

Operations: The company generates revenue primarily through the sale of goods, with consistent gross profit margins averaging around 41.9% over multiple periods. The major expenses include cost of goods sold (COGS) and operating expenses, notably sales & marketing and general & administrative costs, which form significant portions of the total expenditures.

Bourbon, a lesser-known entity in Japan's food industry, has recently outperformed its sector with a year-over-year earnings growth of 180.2%, significantly surpassing the industry average of 35.8%. Despite a general decline in earnings by 4.5% annually over the past five years, Bourbon trades at 57% below its estimated fair value, suggesting potential upside. The company's debt to equity ratio modestly rose from 5% to 8.5%, yet it maintains more cash than total debt, ensuring financial stability amidst expansion efforts.

- Click to explore a detailed breakdown of our findings in Bourbon's health report.

Assess Bourbon's past performance with our detailed historical performance reports.

Nichirin (TSE:5184)

Simply Wall St Value Rating: ★★★★★★

Overview: Nichirin Co., Ltd. specializes in the production and distribution of automotive and housing hoses, along with related parts, operating both in Japan and globally, with a market capitalization of approximately ¥52.09 billion.

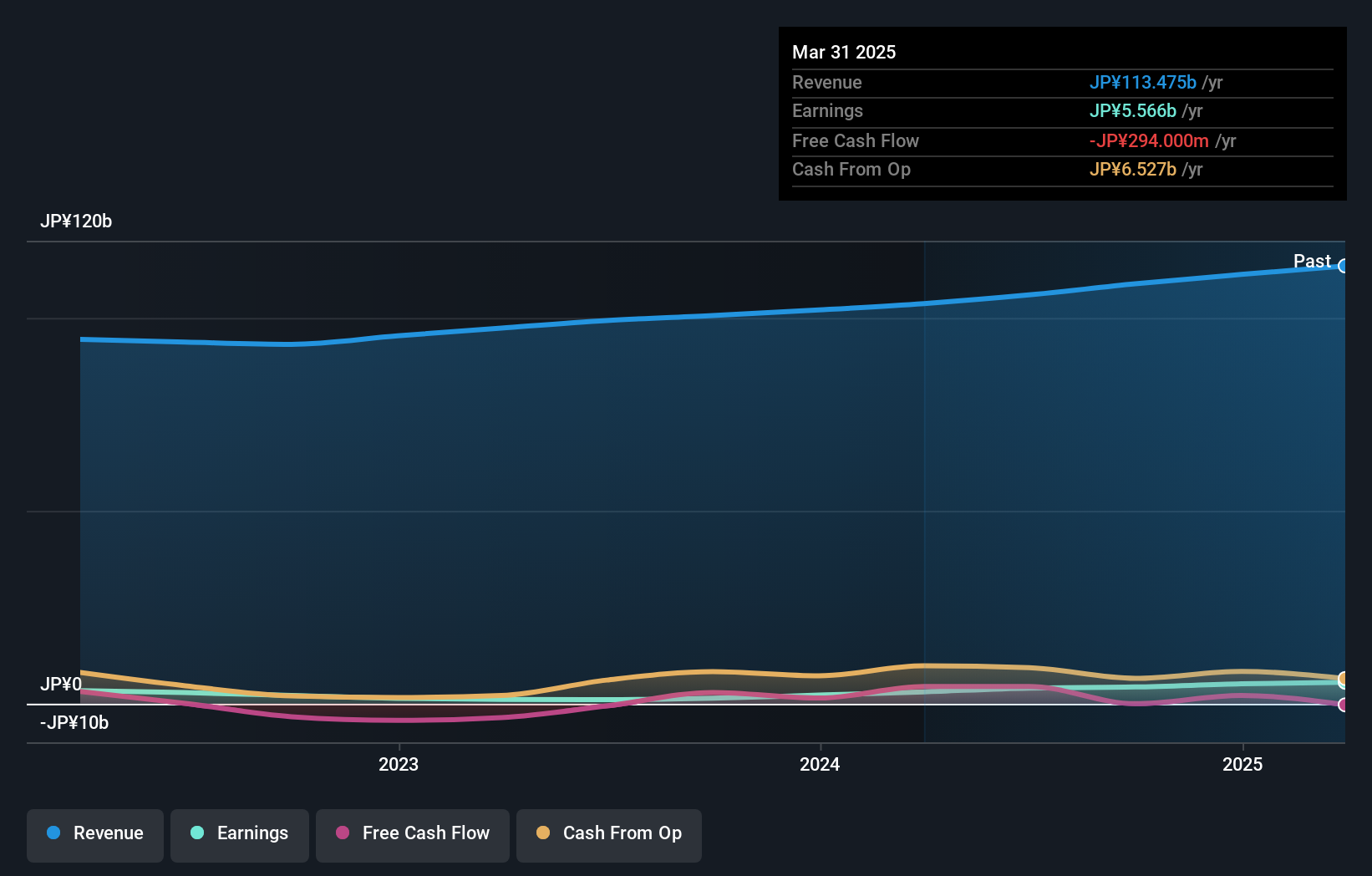

Operations: The company generates revenue primarily through the sale of products, which incurs significant costs of goods sold (COGS), consistently forming a large portion of its expenses. Its operational model also involves substantial operating and non-operating expenses, with general and administrative as well as sales and marketing expenses being notable recurrent costs. The firm's gross profit margin has shown an upward trend over recent years, indicating an improving difference between revenue and COGS relative to total revenue.

Nichirin, a lesser-known entity in Japan's auto components sector, demonstrates robust financial health with a 16.5% annual earnings growth over the past five years. The company's strategic debt management is evident as its debt to equity ratio impressively dropped from 6.3% to 1%. Despite not outpacing the industry growth rate last year, Nichirin trades at a compelling 58.1% below estimated fair value, suggesting potential for appreciation. This combination of strong earnings quality and significant undervaluation positions Nichirin as an attractive prospect in the market.

- Click here and access our complete health analysis report to understand the dynamics of Nichirin.

Understand Nichirin's track record by examining our Past report.

Starzen (TSE:8043)

Simply Wall St Value Rating: ★★★★★★

Overview: Starzen Company Limited is a Japanese firm specializing in the processing, manufacturing, and sale of meat and meat products, with a market capitalization of ¥59.10 billion.

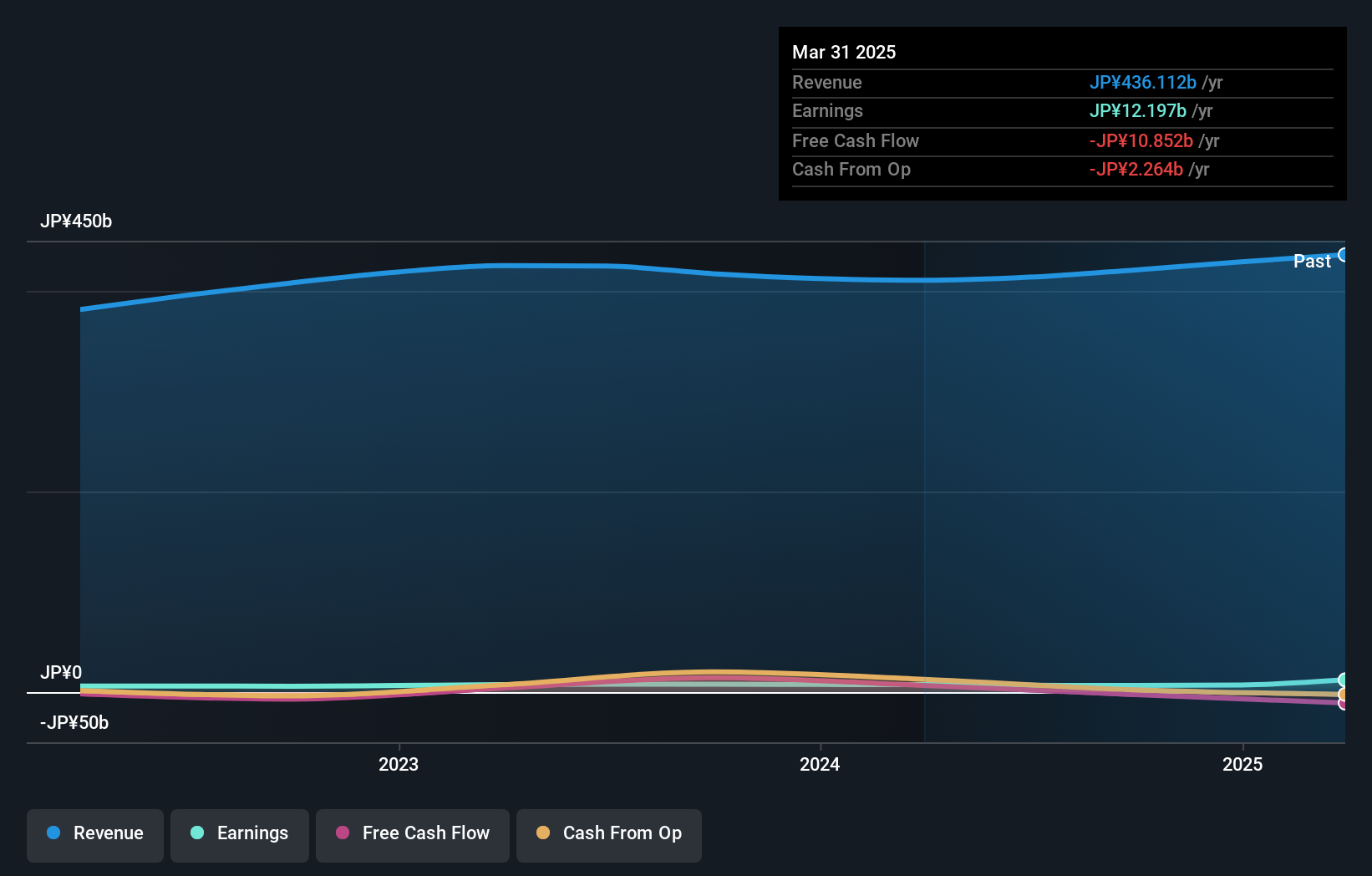

Operations: The company generates revenue primarily through the sale of goods, incurring substantial costs of goods sold (COGS) which typically represent a high percentage of total revenue. It consistently manages a variety of operating expenses, including significant sales and marketing costs and general administrative expenses, contributing to its overall financial performance characterized by a net income margin that has shown variability over the periods observed.

Starzen, a lesser-known entity in Japan's food sector, showcases robust financial health with a debt to equity ratio improvement from 75.2% to 50.4% over five years, reflecting prudent financial management. Despite earnings growth of only 0.4% last year, lagging behind the industry's 35.8%, its overall earnings have surged by an average of 16.6% annually over the past five years. The company also boasts a price-to-earnings ratio of 7.9x, well below the market average of 14.1x, coupled with high-quality earnings and satisfactory debt levels at 28.6%. These factors position Starzen as an intriguing prospect for those exploring untapped potential in Japan’s vibrant market landscape.

- Unlock comprehensive insights into our analysis of Starzen stock in this health report.

Gain insights into Starzen's past trends and performance with our Past report.

Next Steps

- Discover the full array of 738 Japanese Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nichirin might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5184

Nichirin

Manufactures and sells automotive and housing hoses, and related parts in Japan and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives