- Japan

- /

- Auto Components

- /

- TSE:5110

Sumitomo Rubber (TSE:5110): Does Recent Steady Share Price Growth Reflect True Valuation?

Reviewed by Simply Wall St

Sumitomo Rubber Industries (TSE:5110) has been on the radar lately, with some investors now wondering if its recent share price moves signal something meaningful or are just market noise. While there haven't been any splashy announcements or headline-grabbing events this week, the steady uptick in the stock's value over the past month has certainly sparked fresh curiosity around what might be driving the interest. For those weighing their options, it might feel like the story here is less about breaking news and more about whether the current price actually reflects the company’s long-term value.

Looking at the performance over the past year, Sumitomo Rubber Industries has posted a significant total return of 26%, with much of that momentum building in recent months. The company’s share price has gained 8% over the past three months, and a healthy 5% in just the last month. This follows a longer track record of strong multi-year gains, even as there have been some choppier periods. There haven't been any major moves that stand out in the headlines, but the gradual trend upward has gotten people talking again about where the stock’s real value lies.

After a year of solid growth, should investors see Sumitomo Rubber Industries as a value pick right now, or is the market already pricing in where the company is headed next?

Price-to-Sales Ratio of 0.4x: Is it justified?

Sumitomo Rubber Industries is currently valued using a price-to-sales ratio of 0.4x. This positions the company as good value compared to both its peers and fair value estimates.

The price-to-sales (P/S) ratio compares a company’s market capitalization to its total revenue, making it a useful indicator for businesses in industries where profitability may fluctuate, such as auto components. This multiple lets investors gauge how much they are paying for each unit of revenue, regardless of the company’s current profit status.

Sumitomo’s P/S ratio is lower than the peer average and estimated fair value. This may suggest the market is not fully recognizing its revenue generation or future turnaround prospects. Given the company is unprofitable right now and is forecast to grow earnings, the low P/S could signal opportunity for investors looking ahead.

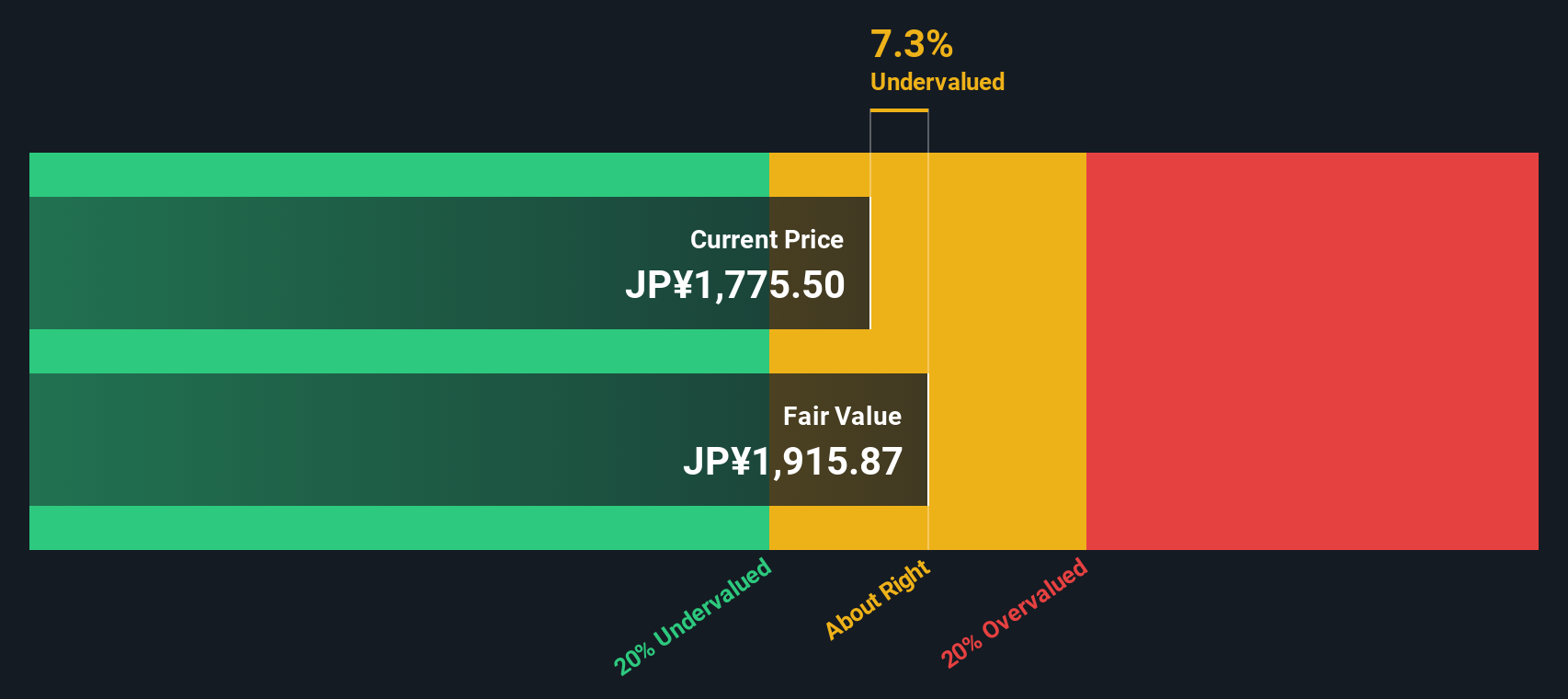

Result: Fair Value of ¥1,911.91 (UNDERVALUED)

See our latest analysis for Sumitomo Rubber Industries.However, continued net losses and sluggish revenue growth could threaten the case for near-term upside if operating improvements do not materialize as expected.

Find out about the key risks to this Sumitomo Rubber Industries narrative.Another View: DCF Tells a Similar Story

Looking through another lens, our DCF model also rates Sumitomo Rubber Industries as undervalued, which echoes the earlier finding from the price-to-sales perspective. But can two models built on different assumptions both be right?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Sumitomo Rubber Industries Narrative

If you see the story differently, or simply prefer exploring the numbers on your own terms, you can easily put together your own view in just a few minutes. Do it your way

A great starting point for your Sumitomo Rubber Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Smart Investing Opportunities?

Don't stop with just one idea. The market is full of fresh opportunities that you won't want to overlook. Use the tools below to pinpoint standout stocks and make your next move with confidence.

- Uncover fast-growing companies with robust cash flows by tapping into undervalued stocks based on cash flows to spot truly underappreciated businesses.

- Target high-yield portfolios and maximize your income with dividend stocks with yields > 3% for stocks offering yields above 3%.

- Get ahead of technology’s next wave by tracking quantum computing stocks set to reshape tomorrow’s digital landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSE:5110

Sumitomo Rubber Industries

Offers tires, sports, and industrial and other products in Japan and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives