- Japan

- /

- Auto Components

- /

- TSE:5108

Exploring Bridgestone (TSE:5108) Valuation as Recent Momentum Slows and Fundamentals Stay Steady

Reviewed by Kshitija Bhandaru

Bridgestone (TSE:5108) shares have posted a modest gain over the past month, with the stock moving up 0.3%. Investors are keeping an eye on how the company's fundamentals support its current valuation, especially after a year of steady performance.

See our latest analysis for Bridgestone.

Bridgestone’s steady 12-month climb is reflected in its 1-year total shareholder return of 0.26%, indicating modest but persistent traction even as recent price momentum has slowed. While the latest movements have been quiet, the longer-term picture suggests investors still see opportunity and stable fundamentals in play.

If you’re keeping an eye on what’s happening across the sector, now is a great moment to broaden your search and discover See the full list for free.

With Bridgestone’s share price holding steady against the broader market, the real question becomes: Is there hidden value that investors are missing, or is future growth already fully reflected in today’s price?

Most Popular Narrative: 4.3% Undervalued

Bridgestone’s current share price sits just below the most widely followed fair value estimate. This brings focus on fundamental growth and future profitability projections that drive this number.

Bridgestone is focusing on restructuring and rebuilding its European and Latin American operations, particularly aiming to improve profitability by optimizing production and distribution. This effort should positively impact net margins as efficiency improves by 2026.

What’s really driving Bridgestone’s valuation estimate? It’s not just about where margins stand today, but also bold assumptions around future profit growth and operational turnarounds across key regions. The financial roadmap behind this price target relies on a mix of profitability improvements and market expansion strategies. Curious which numbers tip the balance? Unlock the full narrative to see the hidden levers at work.

Result: Fair Value of ¥7,150 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained cost pressures in key markets and a rise in low-priced imports could challenge Bridgestone’s progress and put pressure on future profit growth.

Find out about the key risks to this Bridgestone narrative.

Another View: What Do Valuation Multiples Reveal?

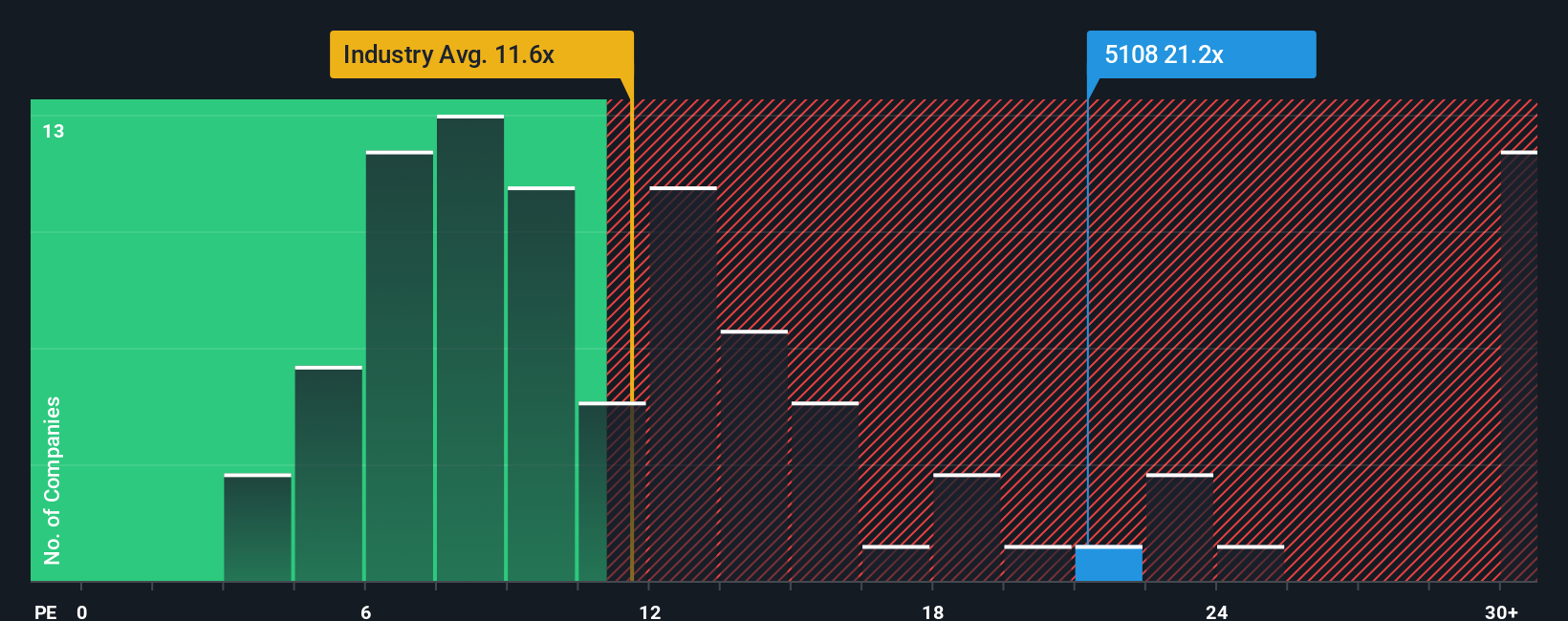

While fair value analysis points to Bridgestone as undervalued, the market’s traditional ratio tells a more cautious story. Its price-to-earnings ratio stands at 22.4x, which is far higher than both the Auto Components industry average of 11.2x and its peer average of 13.5x. Even when compared to its own fair ratio of 19.8x, the premium is clear. This suggests that while future growth is anticipated, investors may be paying up for it today. Is the optimism fully priced in, or does something bigger lie ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bridgestone Narrative

If you want to dig deeper, challenge the narrative, or shape your own perspective, you can build a custom analysis in just a few minutes. Do it your way

A great starting point for your Bridgestone research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never limit their options. Gain an edge by finding stocks that are undervalued, disrupt with AI, or generate reliable income, all in minutes.

- Find opportunities with high potential for growth and value by checking out these 900 undervalued stocks based on cash flows making waves in the market.

- Capitalize on the AI trend by seeing which companies are innovating fastest with these 24 AI penny stocks that could define tomorrow’s leaders.

- Secure steady returns by jumping into these 19 dividend stocks with yields > 3% offering yields above 3% for your portfolio’s stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bridgestone might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5108

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives