- Japan

- /

- Auto Components

- /

- TSE:5101

Yokohama Rubber (TSE:5101): Is the Stock’s Quiet Momentum Reflected in Its Current Valuation?

Reviewed by Simply Wall St

Price-to-Earnings of 14.3x: Is it justified?

Based on the price-to-earnings (P/E) ratio, Yokohama Rubber Company is currently trading at 14.3 times its earnings, which appears somewhat expensive compared to industry averages. The company’s stock is priced above both its peers and the broader auto components sector on this specific multiple.

The P/E ratio compares a company’s current share price to its per-share earnings. In the auto components industry, investors watch this figure closely to judge whether a stock is fairly valued for its earnings power. A higher multiple could mean the market expects stronger future earnings growth. Conversely, a lower multiple can signal underappreciated profit potential or increased risk.

With Yokohama Rubber Company’s current multiple above the peer and sector average, investors should consider whether recent growth justifies paying a premium. The current valuation suggests optimism is already priced in and this may raise the threshold for future upside.

Result: Fair Value of ¥5,679 (OVERVALUED)

See our latest analysis for Yokohama Rubber Company.However, ongoing volatility in global auto demand or unexpected shifts in profit margins could quickly challenge the recent momentum and current optimism regarding valuation.

Find out about the key risks to this Yokohama Rubber Company narrative.Another View: What Does the DCF Model Say?

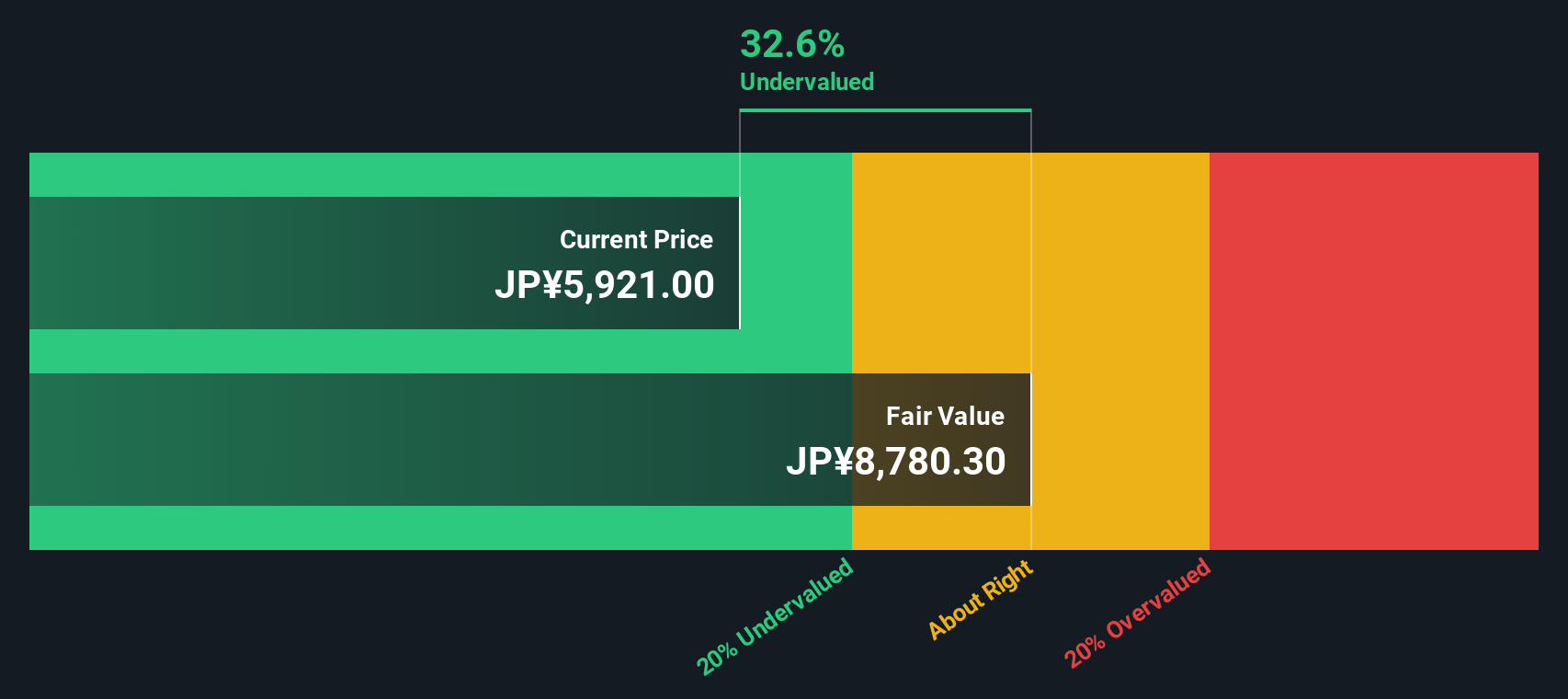

While the current valuation looks steep when compared to sector averages, our DCF model suggests a very different story. It hints that the shares might actually be undervalued at today’s price. Could expectations around future cash flows be painting a more optimistic picture than the market sees?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Yokohama Rubber Company to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Yokohama Rubber Company Narrative

If you see things differently, or want to dig deeper into the data yourself, you can craft your own analysis in just a few minutes. Do it your way

A great starting point for your Yokohama Rubber Company research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t miss the chance to strengthen your portfolio by searching for tomorrow’s standouts. Use Simply Wall Street’s powerful tools to uncover unique ideas you may not have considered.

- Target income and stability. Get ahead with companies offering impressive yields by checking out dividend stocks with yields > 3% right now.

- Harness the AI revolution. Pinpoint innovative businesses transforming industries by tapping into AI penny stocks before others catch on.

- Take an edge with undervalued gems. Spot stocks that trade below their potential using undervalued stocks based on cash flows to maximize your returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSE:5101

Yokohama Rubber Company

Engages in the manufacture and sale of tires in Japan and internationally.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Community Narratives