- Japan

- /

- Communications

- /

- TSE:6675

3 Global Dividend Stocks Yielding At Least 3.2%

Reviewed by Simply Wall St

As global markets navigate a landscape marked by mixed performances and cautious optimism around trade negotiations, investors are keenly observing the impact of economic policies on indices like the S&P 500 and Nasdaq Composite. Amidst this backdrop, dividend stocks offering yields of at least 3.2% present an attractive option for those seeking stable income streams, especially when market volatility underscores the importance of reliable returns.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.77% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.19% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.57% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.02% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.72% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.92% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.36% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.23% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.40% | ★★★★★★ |

Click here to see the full list of 1534 stocks from our Top Global Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Nihon Tokushu Toryo (TSE:4619)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nihon Tokushu Toryo Co., Ltd. manufactures and sells automobile products, paints, and coatings in Japan, with a market cap of ¥35.17 billion.

Operations: Nihon Tokushu Toryo Co., Ltd. generates revenue from its core operations in the manufacture and sale of automobile products, as well as paints and coatings within Japan.

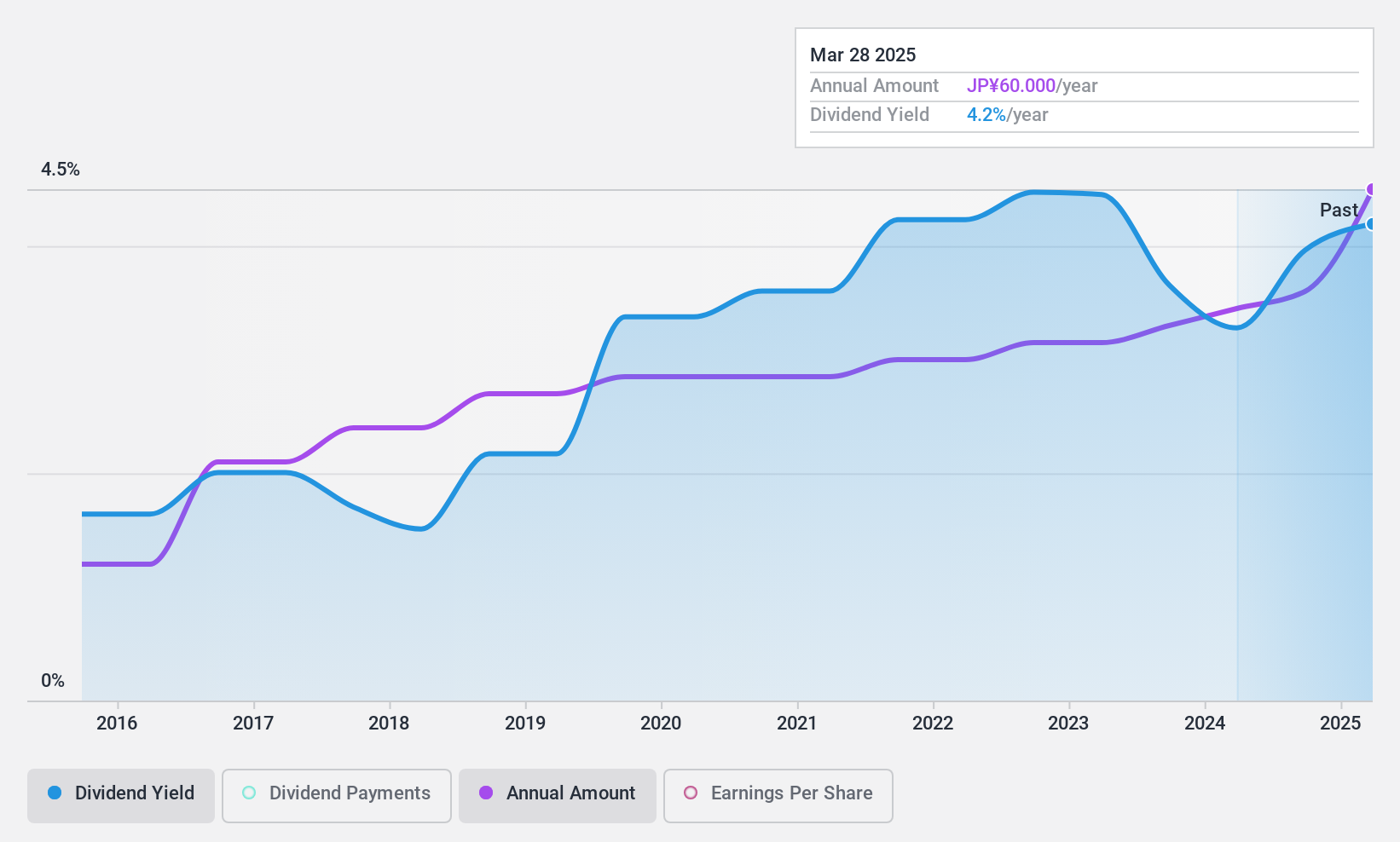

Dividend Yield: 3.4%

Nihon Tokushu Toryo Co., Ltd. offers a stable and growing dividend, having increased its year-end dividend to JPY 38.00 per share from JPY 25.00 last year. The company's dividends are well-supported by a low payout ratio of 24.1% and cash flow coverage of 42.7%. Despite trading at a discount to its estimated fair value, its dividend yield of 3.38% is below the top quartile in the Japanese market but remains reliable with consistent growth over the past decade.

- Click to explore a detailed breakdown of our findings in Nihon Tokushu Toryo's dividend report.

- According our valuation report, there's an indication that Nihon Tokushu Toryo's share price might be on the cheaper side.

ANEST IWATA (TSE:6381)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ANEST IWATA Corporation is engaged in the air energy and coating business across Japan, Europe, the Americas, China, and other international markets with a market cap of ¥43.40 billion.

Operations: ANEST IWATA Corporation generates revenue through its air energy and coating operations across various regions including Japan, Europe, the Americas, and China.

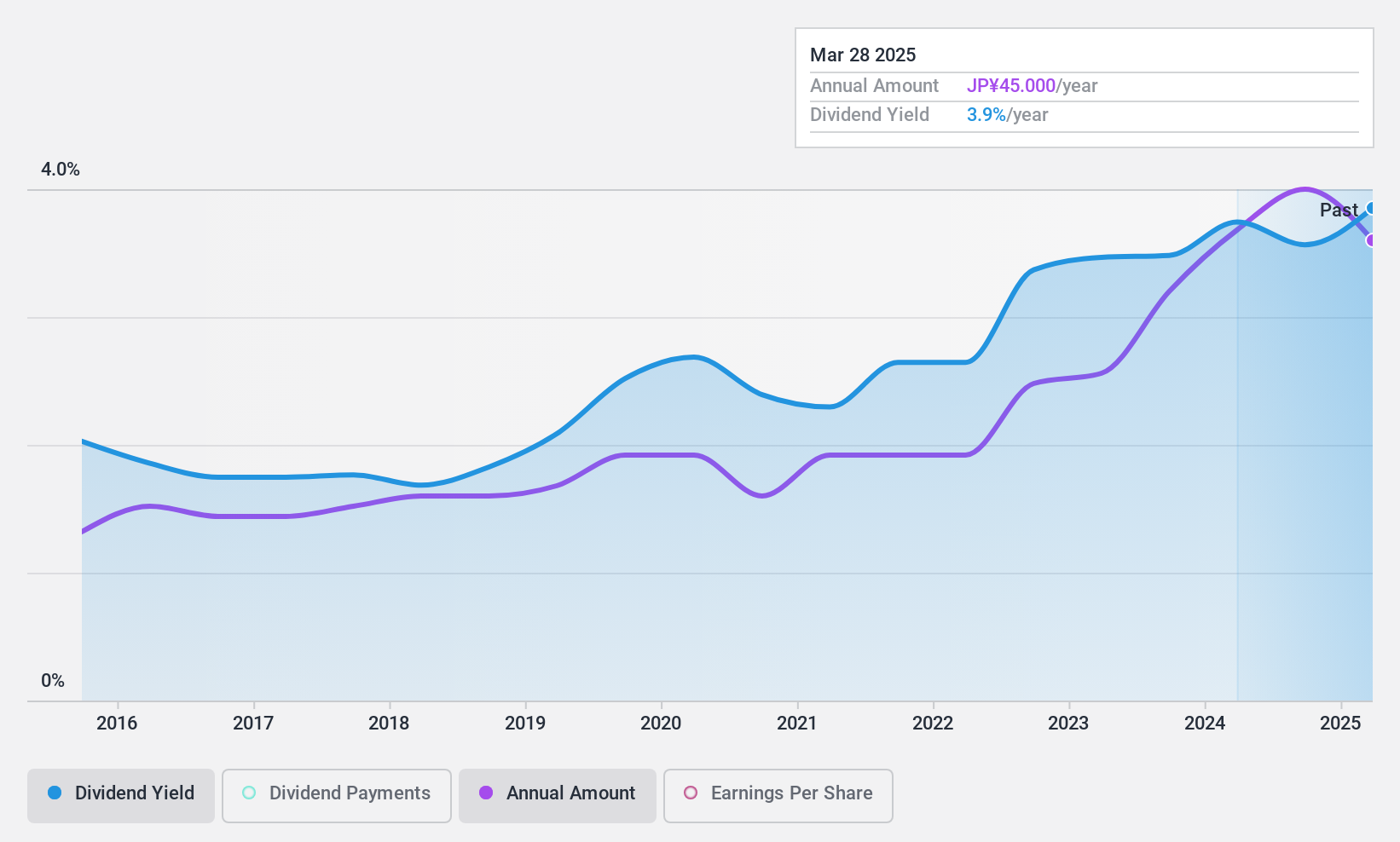

Dividend Yield: 3.2%

ANEST IWATA's dividends are well-covered by earnings and cash flows, with payout ratios of 39.9% and 32.8%, respectively. However, its dividend yield of 3.21% is lower than the top quartile in Japan, and its dividend track record has been volatile over the past decade despite some growth. Recently, the company reduced its year-end dividend forecast to JPY 23 per share due to challenging market conditions impacting profitability projections for fiscal year ending March 2025.

- Delve into the full analysis dividend report here for a deeper understanding of ANEST IWATA.

- The analysis detailed in our ANEST IWATA valuation report hints at an inflated share price compared to its estimated value.

SAXA (TSE:6675)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SAXA, Inc., with a market cap of ¥17.86 billion, develops, manufactures, and sells equipment and components for information and communication systems in Japan through its subsidiaries.

Operations: SAXA, Inc. generates revenue by developing, manufacturing, and selling equipment and components for information and communication systems in Japan through its subsidiaries.

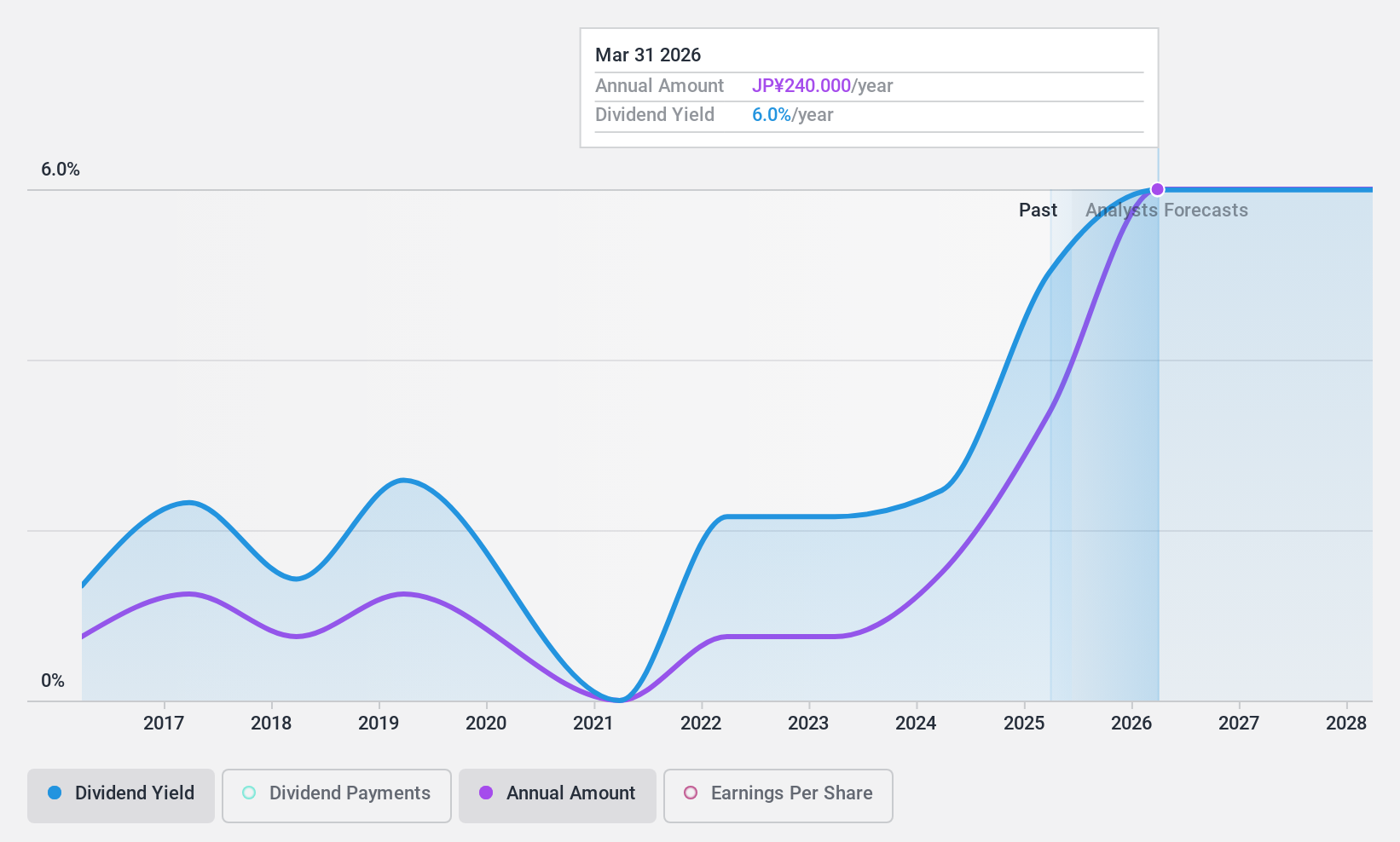

Dividend Yield: 3.6%

SAXA's dividend yield of 4.38% ranks in the top 25% of Japanese dividend payers, though its payments have been volatile and unreliable over the past decade. The company's low payout ratio of 22.8% indicates dividends are well-covered by earnings, yet a high cash payout ratio of 341.3% suggests poor coverage by free cash flows, raising sustainability concerns despite strong earnings growth averaging 45.5% annually over five years.

- Navigate through the intricacies of SAXA with our comprehensive dividend report here.

- According our valuation report, there's an indication that SAXA's share price might be on the expensive side.

Taking Advantage

- Investigate our full lineup of 1534 Top Global Dividend Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6675

SAXA

Through its subsidiaries, develops, manufactures, and sells equipment and components for information and communication systems in Japan.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives