- Italy

- /

- Renewable Energy

- /

- BIT:ECK

European Penny Stocks Under €30M Market Cap Revealed

Reviewed by Simply Wall St

As the European markets navigate a landscape marked by mixed performances across major indices, opportunities continue to emerge for investors seeking value in less conventional areas. Penny stocks, a term that may feel outdated but still relevant, often represent smaller or newer companies with potential for growth. This article explores three such penny stocks in Europe that demonstrate financial resilience and may offer both stability and upside potential amidst the current economic climate.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Lucisano Media Group (BIT:LMG) | €1.09 | €16.19M | ✅ 4 ⚠️ 5 View Analysis > |

| DigiTouch (BIT:DGT) | €1.94 | €26.81M | ✅ 3 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €227.2M | ✅ 2 ⚠️ 2 View Analysis > |

| Hove (CPSE:HOVE) | DKK4.58 | DKK115.8M | ✅ 2 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €4.69 | €38.03M | ✅ 3 ⚠️ 3 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.966 | €77.95M | ✅ 3 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.045 | €282.66M | ✅ 4 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.08 | €8.46M | ✅ 2 ⚠️ 3 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.926 | €31.01M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 277 stocks from our European Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Ecosuntek (BIT:ECK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ecosuntek S.p.A. is involved in photovoltaic electricity generation both in Italy and internationally, with a market cap of €38.38 million.

Operations: The company generates revenue primarily from Ricavireseller/Energy and Gas Trading at €1.03 billion and Power Generation at €5.14 million.

Market Cap: €38.38M

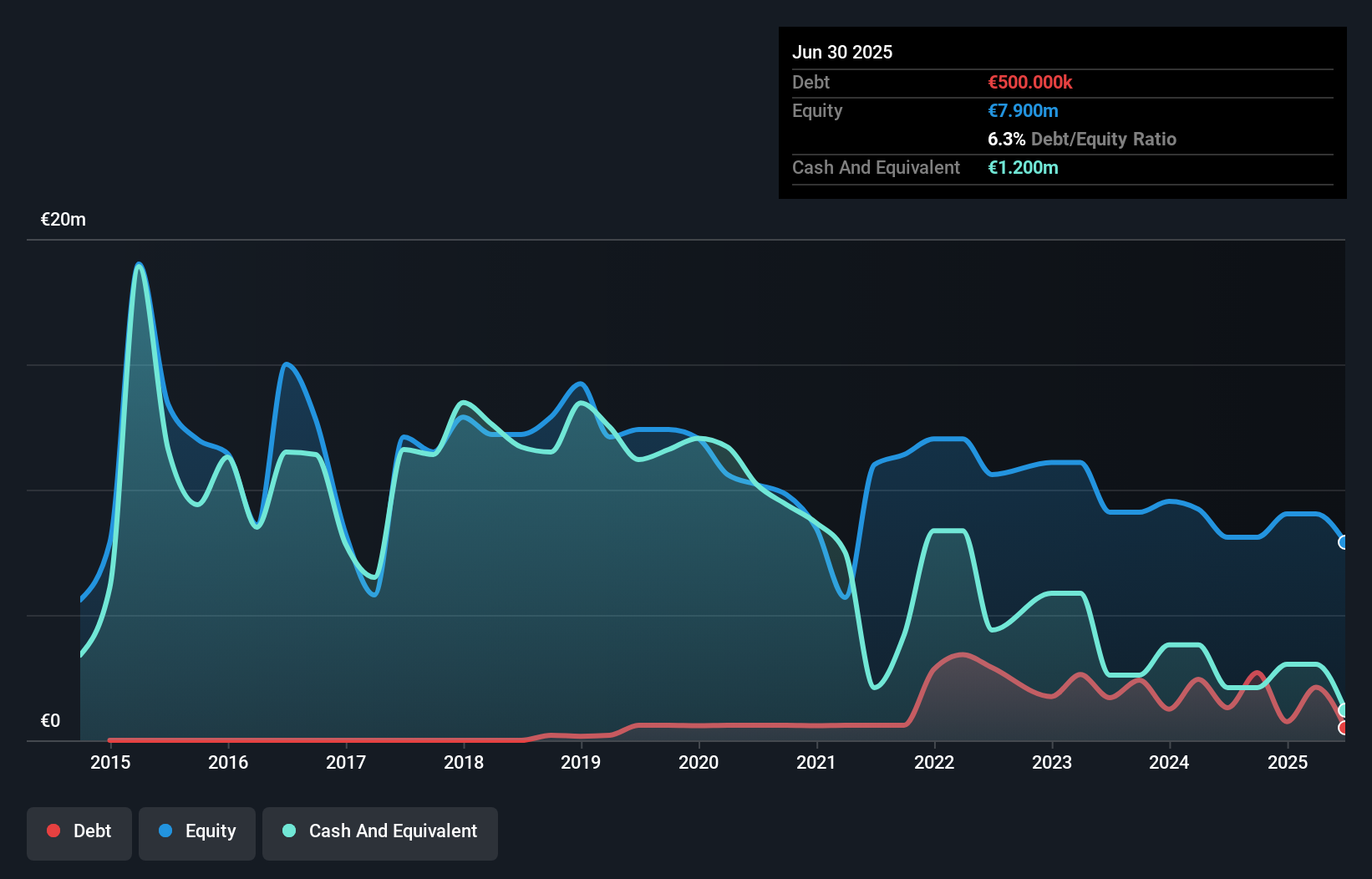

Ecosuntek S.p.A. has demonstrated solid revenue growth, with recent half-year sales reaching €596.63 million, a significant increase from the previous year. However, the company's net income slightly declined to €1.09 million due to narrow profit margins of 0.1%. Despite this, Ecosuntek's earnings growth rate of 23.9% surpasses its five-year average and industry benchmarks, indicating robust performance in a challenging sector. The company is financially stable with more cash than total debt and well-covered operating cash flow relative to debt levels but faces high share price volatility and insufficient short-term asset coverage for liabilities.

- Click here to discover the nuances of Ecosuntek with our detailed analytical financial health report.

- Gain insights into Ecosuntek's outlook and expected performance with our report on the company's earnings estimates.

SSH Communications Security Oyj (HLSE:SSH1V)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: SSH Communications Security Oyj is a cybersecurity company specializing in protecting humans, systems, and networks across the Americas, Asia Pacific, Europe, the Middle East, and Africa with a market cap of €164.69 million.

Operations: SSH Communications Security Oyj generates revenue primarily from its Software Business, which amounted to €22.85 million.

Market Cap: €164.69M

SSH Communications Security Oyj, a cybersecurity firm, has seen significant client wins for its PrivX solution, enhancing its growth prospects. Despite being unprofitable with increasing losses over the past five years, the company maintains a positive free cash flow and sufficient cash runway for over three years. The firm's strategic partnership with Leonardo S.p.A., including a €20 million investment, bolsters its financial position. However, SSH faces challenges such as high share price volatility and short-term liabilities exceeding assets. The management team is experienced but earnings remain negative with volatile returns on equity.

- Click to explore a detailed breakdown of our findings in SSH Communications Security Oyj's financial health report.

- Learn about SSH Communications Security Oyj's future growth trajectory here.

Petrolia (OB:PSE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Petrolia SE, with a market cap of NOK288.68 million, operates in the rental and sale of energy service equipment to the energy industry across Norway, Europe, Asia, and Australia.

Operations: The company generates revenue from its Energy Service segment, amounting to $55.55 million.

Market Cap: NOK288.68M

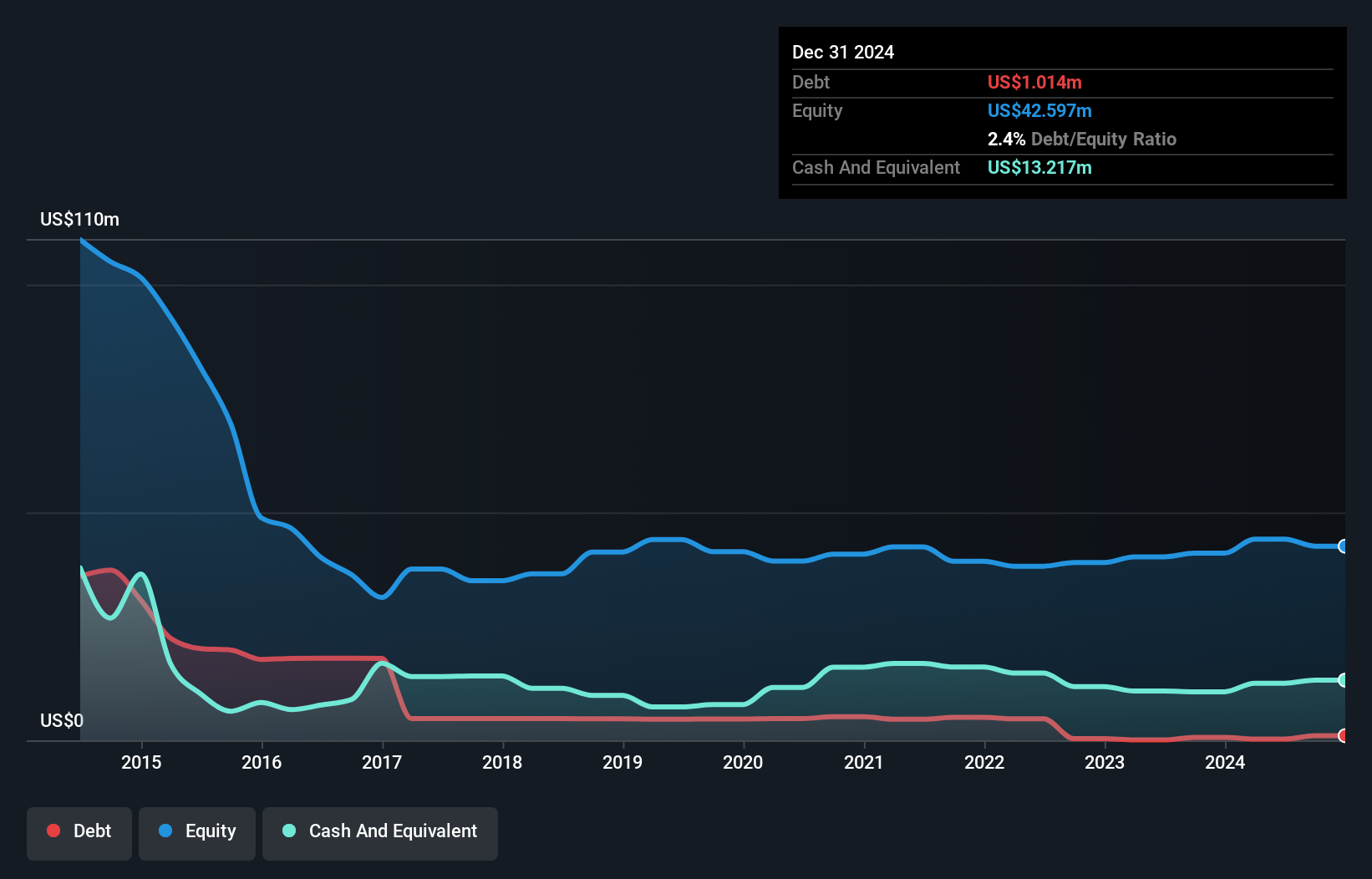

Petrolia SE, with a market cap of NOK288.68 million, operates in the energy service equipment sector and has shown financial resilience despite challenges. The company reported sales of US$27.85 million for the first half of 2025, slightly up from the previous year, though net income decreased to US$3.33 million. Petrolia's short-term assets exceed both its short-term and long-term liabilities, indicating strong liquidity. While its return on equity is low at 6.4%, Petrolia's debt levels have significantly reduced over five years and are well-covered by operating cash flow, reflecting prudent financial management amidst high share price volatility.

- Navigate through the intricacies of Petrolia with our comprehensive balance sheet health report here.

- Assess Petrolia's previous results with our detailed historical performance reports.

Seize The Opportunity

- Dive into all 277 of the European Penny Stocks we have identified here.

- Contemplating Other Strategies? Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ecosuntek might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ECK

Ecosuntek

Engages in the photovoltaic electricity generation activities in Italy and internationally.

Good value with proven track record.

Market Insights

Community Narratives