Dividend paying stocks like A2A S.p.A. (BIT:A2A) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. If you are hoping to live on your dividends, it's important to be more stringent with your investments than the average punter. Regular readers know we like to apply the same approach to each dividend stock, and we hope you'll find our analysis useful.

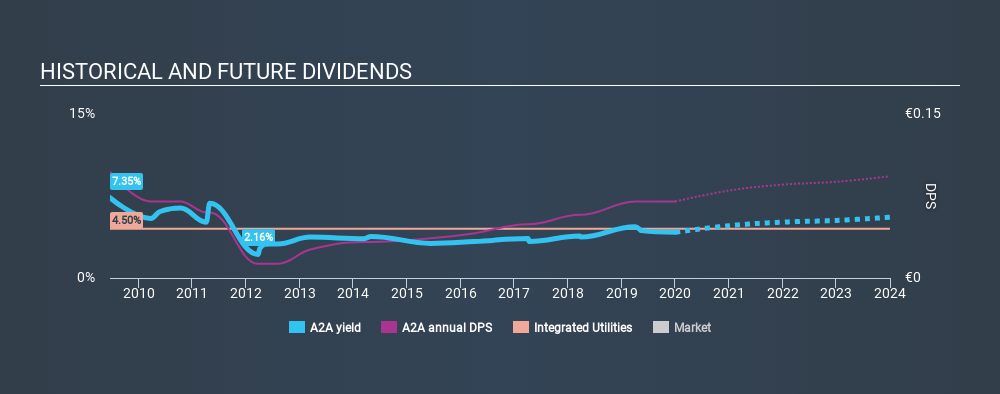

In this case, A2A likely looks attractive to investors, given its 4.2% dividend yield and a payment history of over ten years. We'd guess that plenty of investors have purchased it for the income. Some simple analysis can reduce the risk of holding A2A for its dividend, and we'll focus on the most important aspects below.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. A2A paid out 85% of its profit as dividends, over the trailing twelve month period. Paying out a majority of its earnings limits the amount that can be reinvested in the business. This may indicate a commitment to paying a dividend, or a dearth of investment opportunities.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. A2A paid out 111% of its free cash last year. Cash flows can be lumpy, but this dividend was not well covered by cash flow. While A2A's dividends were covered by the company's reported profits, free cash flow is somewhat more important, so it's not great to see that the company didn't generate enough cash to pay its dividend. Cash is king, as they say, and were A2A to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

Is A2A's Balance Sheet Risky?

As A2A has a meaningful amount of debt, we need to check its balance sheet to see if the company might have debt risks. A rough way to check this is with these two simple ratios: a) net debt divided by EBITDA (earnings before interest, tax, depreciation and amortisation), and b) net interest cover. Net debt to EBITDA measures total debt load relative to company earnings (lower = less debt), while net interest cover measures the ability to pay interest on the debt (higher = greater ability to pay interest costs). With net debt of 2.64 times its EBITDA, A2A has a noticeable amount of debt, although if business stays steady, this may not be overly concerning.

Net interest cover can be calculated by dividing earnings before interest and tax (EBIT) by the company's net interest expense. Net interest cover of 5.79 times its interest expense appears reasonable for A2A, although we're conscious that even high interest cover doesn't make a company bulletproof.

Consider getting our latest analysis on A2A's financial position here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. A2A has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. This dividend has been unstable, which we define as having fallen by at least 20% one or more times over this time. During the past ten-year period, the first annual payment was €0.097 in 2010, compared to €0.07 last year. This works out to be a decline of approximately 3.2% per year over that time. A2A's dividend hasn't shrunk linearly at 3.2% per annum, but the CAGR is a useful estimate of the historical rate of change.

When a company's per-share dividend falls we question if this reflects poorly on either external business conditions, or the company's capital allocation decisions. Either way, we find it hard to get excited about a company with a declining dividend.

Dividend Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. It's good to see A2A has been growing its earnings per share at 33% a year over the past five years. A2A earnings have been growing very quickly recently, but given that it is paying out more than half of its earnings, we wonder if it will have enough capital to fund further growth in the future.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. First, the company has a payout ratio that was within an average range for most dividend stocks, but it paid out virtually all of its generated cash flow. We were also glad to see it growing earnings, but it was concerning to see the dividend has been cut at least once in the past. Ultimately, A2A comes up short on our dividend analysis. It's not that we think it is a bad company - just that there are likely more appealing dividend prospects out there on this analysis.

Companies that are growing earnings tend to be the best dividend stocks over the long term. See what the 5 analysts we track are forecasting for A2A for free with public analyst estimates for the company.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About BIT:A2A

A2A

Engages in the production, sale, and distribution of gas and electricity, and district heating in Italy and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives