- Italy

- /

- Other Utilities

- /

- BIT:A2A

Investors Who Bought A2A (BIT:A2A) Shares Three Years Ago Are Now Down 17%

One of the frustrations of investing is when a stock goes down. But it's hard to avoid some disappointing investments when the overall market is down. The A2A S.p.A. (BIT:A2A) is down 17% over three years, but the total shareholder return is -3.6% once you include the dividend. And that total return actually beats the market decline of 11%. In the last ninety days we've seen the share price slide 26%. Of course, this share price action may well have been influenced by the 20% decline in the broader market, throughout the period.

View our latest analysis for A2A

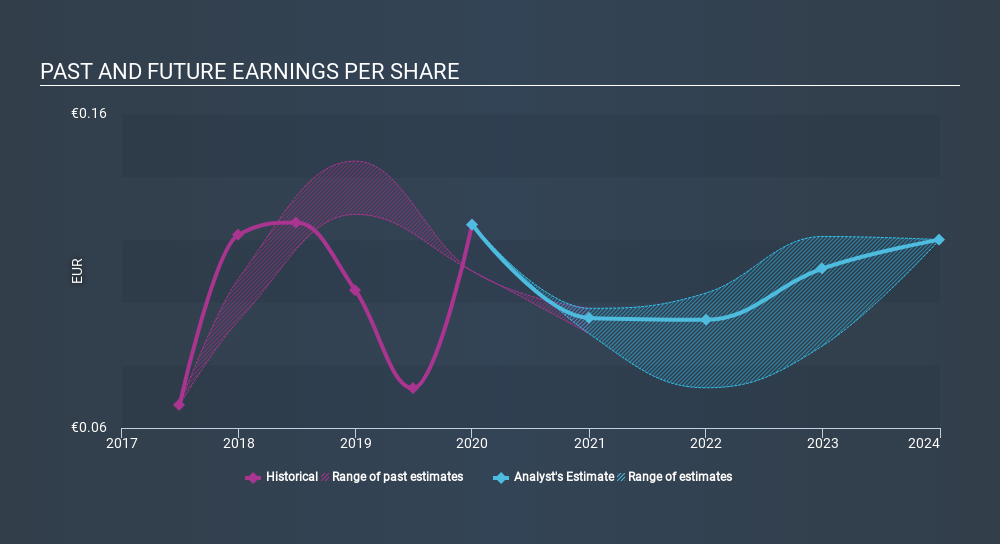

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, A2A's TSR for the last 3 years was -3.6%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

The total return of 10% received by A2A shareholders over the last year isn't far from the market return of -11%. The silver lining is that longer term investors would have made a total return of 6.3% per year over half a decade. If the fundamental data remains strong, and the share price is simply down on sentiment, then this could be an opportunity worth investigating. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - A2A has 3 warning signs we think you should be aware of.

But note: A2A may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About BIT:A2A

A2A

Engages in the production, sale, and distribution of gas and electricity, and district heating in Italy and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives