Exploring None's Hidden Gems And 2 Other Small Caps With Strong Potential

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks have been navigating a complex environment marked by tariff uncertainties and mixed economic indicators. With the S&P 600 Index reflecting these challenges, investors are keenly observing how manufacturing expansions and cooling labor markets might influence small-cap performance. Identifying promising stocks in this climate involves looking for companies that demonstrate resilience and adaptability amid economic shifts, making them potential hidden gems worth exploring.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Boursa Kuwait Securities Company K.P.S.C | NA | 14.28% | 2.26% | ★★★★★★ |

| Interactive Digital Technologies | 1.30% | 6.10% | 4.63% | ★★★★★☆ |

| Berger Paints Bangladesh | 3.72% | 10.32% | 7.30% | ★★★★★☆ |

| Eclatorq Technology | 37.47% | 8.43% | 18.41% | ★★★★★☆ |

| National Investments Company K.S.C.P | 26.01% | 3.66% | 4.99% | ★★★★☆☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

A.L.A. società per azioni (BIT:ALA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: A.L.A. società per azioni provides supply chain solutions to the aerospace, defense, rail, and high-tech sectors with a market cap of €243.81 million.

Operations: Revenue streams for A.L.A. società per azioni are derived from providing supply chain solutions across various sectors, including aerospace and defense. The company's cost structure is influenced by sector-specific operational expenses, impacting its overall profitability. Gross profit margin trends have shown variability over recent periods, reflecting changes in cost management and pricing strategies.

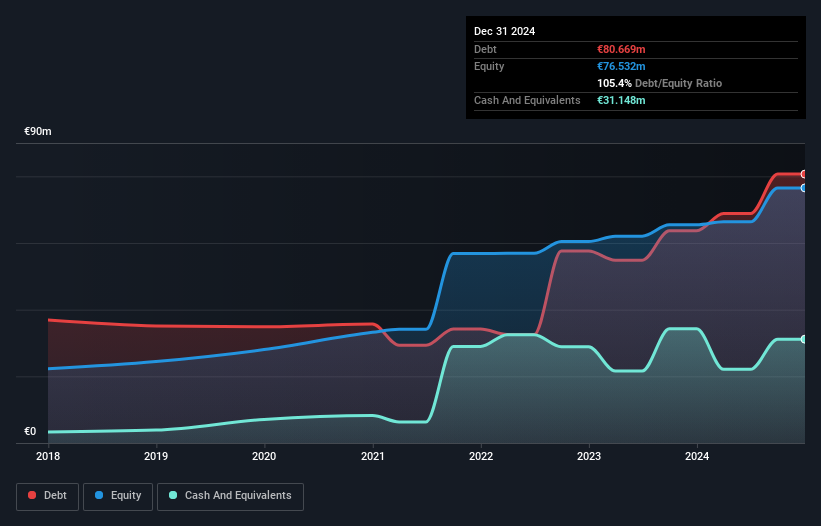

A.L.A. società per azioni, a smaller player in the logistics sector, has been navigating a complex financial landscape. Its earnings grew by 11% last year, outpacing industry peers and indicating robust performance despite its share price volatility over recent months. The company's debt to equity ratio improved from 133% to 104% in five years, showing progress in managing leverage. However, with a net debt to equity ratio at 70%, it still faces challenges regarding high debt levels relative to operating cash flow. Trading at nearly 33% below estimated fair value suggests potential upside if growth forecasts of 28% annually materialize.

Pihlajalinna Oyj (HLSE:PIHLIS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Pihlajalinna Oyj operates as a provider of social, healthcare, and wellbeing services in Finland with a market capitalization of €267.50 million.

Operations: The company generates revenue primarily from its healthcare facilities and services, amounting to €704.40 million.

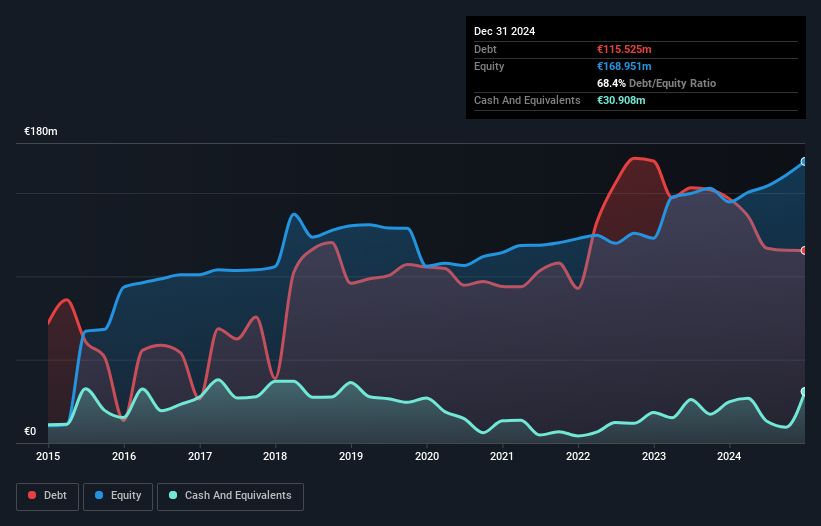

Pihlajalinna Oyj, a dynamic player in the healthcare sector, has shown remarkable financial performance with earnings growth of 378.3% over the past year, significantly outpacing the industry average of 14.9%. The company is trading at an attractive valuation, being 53.5% below its estimated fair value. Despite having a high net debt to equity ratio at 50.2%, Pihlajalinna's interest payments are well covered by EBIT at 5.6x coverage, indicating robust financial health. Recent results revealed a turnaround from a net loss to EUR 27.4 million in net income for the full year ended December 2024, with basic earnings per share rising to EUR 1.13 from EUR 0.19 previously.

- Click here and access our complete health analysis report to understand the dynamics of Pihlajalinna Oyj.

Assess Pihlajalinna Oyj's past performance with our detailed historical performance reports.

Formosa Taffeta (TWSE:1434)

Simply Wall St Value Rating: ★★★★★☆

Overview: Formosa Taffeta Co., Ltd. operates in the textile industry across Taiwan and Asia, with a market capitalization of NT$31.80 billion.

Operations: Formosa Taffeta's primary revenue streams include the Oil Products Business generating NT$11.00 billion and The First Business Group contributing NT$13.11 billion. The Cord Fabric Division adds NT$3.48 billion to the total revenue, while adjustments and write-offs account for a reduction of NT$1.09 billion in overall figures.

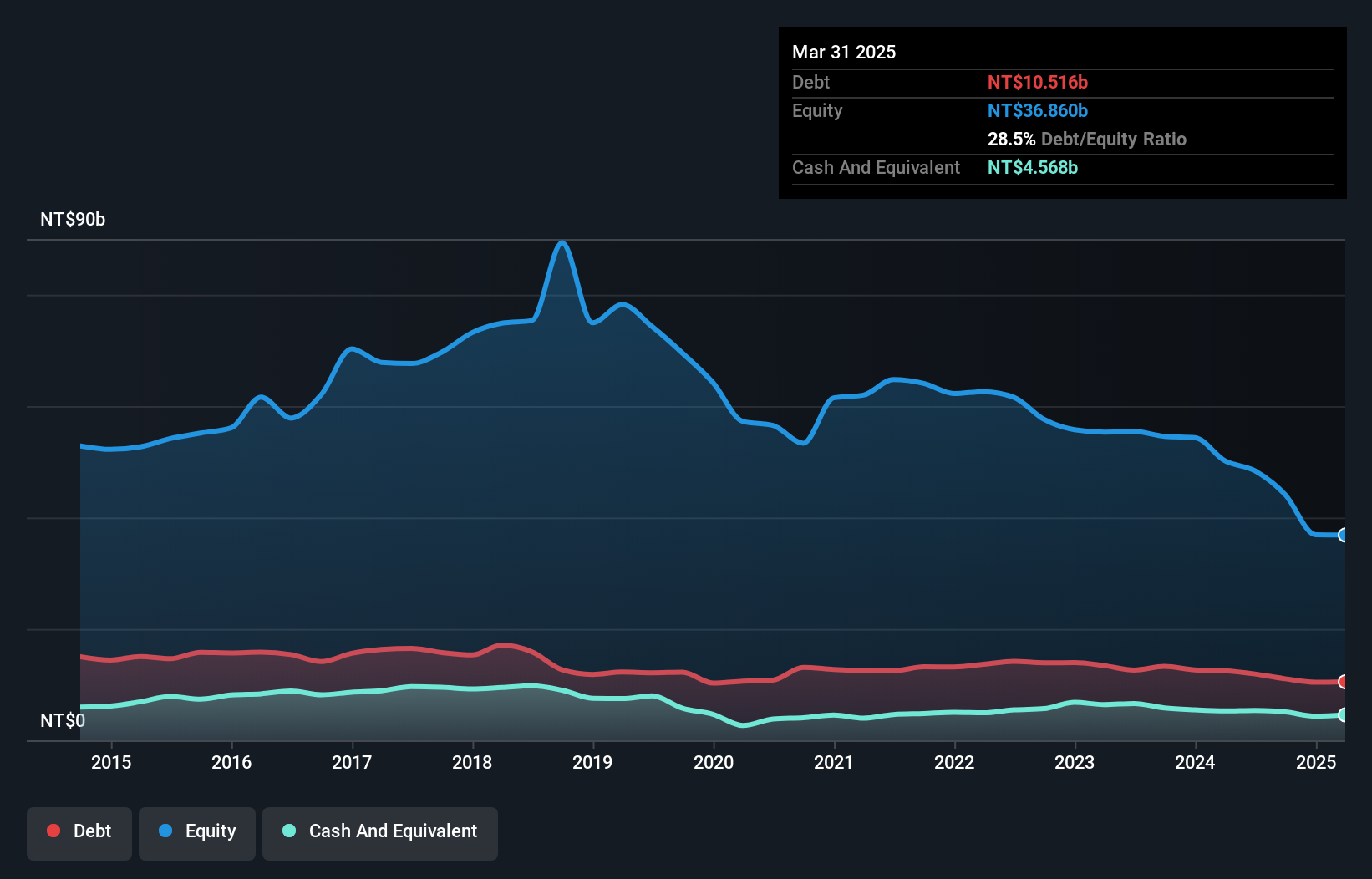

With a reputation for high-quality earnings, Formosa Taffeta has seen its earnings grow by 49% over the past year, outpacing the luxury industry average of 13.9%. Despite this impressive growth, it's worth noting that their debt to equity ratio has increased from 17.6% to 25% in five years. The company remains profitable with a satisfactory net debt to equity ratio of 13.5%, indicating sound financial health and interest coverage is not an issue. As they prepare to announce operational results soon, investors may find potential value in this under-the-radar player in textiles.

- Delve into the full analysis health report here for a deeper understanding of Formosa Taffeta.

Evaluate Formosa Taffeta's historical performance by accessing our past performance report.

Key Takeaways

- Gain an insight into the universe of 4701 Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1434

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion