- Italy

- /

- Telecom Services and Carriers

- /

- BIT:TIT

Investors Aren't Buying Telecom Italia S.p.A.'s (BIT:TIT) Revenues

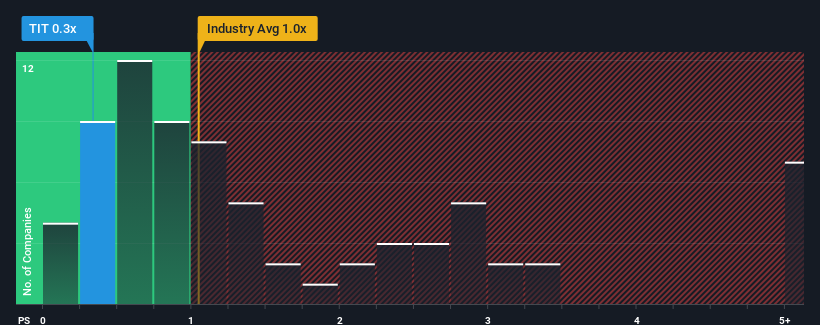

You may think that with a price-to-sales (or "P/S") ratio of 0.3x Telecom Italia S.p.A. (BIT:TIT) is a stock worth checking out, seeing as almost half of all the Telecom companies in Italy have P/S ratios greater than 0.9x and even P/S higher than 5x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Telecom Italia

What Does Telecom Italia's Recent Performance Look Like?

Recent times have been advantageous for Telecom Italia as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Telecom Italia's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Telecom Italia's to be considered reasonable.

Retrospectively, the last year delivered a decent 12% gain to the company's revenues. Revenue has also lifted 6.4% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue growth is heading into negative territory, declining 2.2% each year over the next three years. Meanwhile, the broader industry is forecast to expand by 3.1% each year, which paints a poor picture.

With this in consideration, we find it intriguing that Telecom Italia's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's clear to see that Telecom Italia maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Telecom Italia with six simple checks.

If these risks are making you reconsider your opinion on Telecom Italia, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Telecom Italia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:TIT

Telecom Italia

Engages in the fixed and mobile telecommunications services in Italy and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives