- Italy

- /

- Telecom Services and Carriers

- /

- BIT:INW

INWIT (BIT:INW): Reviewing Valuation After Share Buyback, Sustainability Bond, and Revised Growth Outlook

Reviewed by Simply Wall St

Infrastrutture Wireless Italiane (BIT:INW) just wrapped up a notable quarter, reporting steady financial results. The company completed a tranche of its EUR 300 million share buyback program and issued its first sustainability-linked bond. Investors are watching closely as the company also adjusted its long-term growth outlook in response to postponed projects and evolving sector trends.

See our latest analysis for Infrastrutture Wireless Italiane.

Shares of Infrastrutture Wireless Italiane have been under pressure lately, with the stock falling 23.9% over the past three months as the market digests cautious sector sentiment and the company’s revised long-term outlook. Despite solid financial results and moves to increase shareholder value, the 1-year total shareholder return sits at -13.3%. This reflects lingering uncertainty but also potential for a turnaround if operating conditions improve.

If you’re interested in uncovering what else is being watched in the market right now, it’s a perfect time to expand your search and discover fast growing stocks with high insider ownership

This leaves investors weighing the recent share price drop against a stock now trading well below analyst targets. This prompts the question: is Infrastrutture Wireless Italiane undervalued, or is the market already factoring in its slower growth ahead?

Most Popular Narrative: 32% Undervalued

With the current share price sitting well below the narrative's fair value estimate, attention turns to the key growth and margin assumptions behind this bullish outlook. The narrative’s foundation sets up a dynamic discussion of sector transformation and INWIT’s evolving role.

The expansion of smart infrastructure (DAS and IoT solutions), with revenue up nearly 40% year-on-year and strong market potential for new locations by 2030, is expected to diversify income streams and drive higher-margin earnings while making INWIT a critical enabler of next-generation digital services.

Want the inside story on what pushes the valuation higher? The most optimistic assumptions rest on double-digit margin gains and aggressive revenue growth from a blend of new digital infrastructure projects. Only the full narrative reveals which key numbers and underlying trends create the gap between today’s price and that ambitious fair value target.

Result: Fair Value of $11.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained high leverage or a slowdown in organic network growth could quickly challenge the narrative and limit future upside for INWIT.

Find out about the key risks to this Infrastrutture Wireless Italiane narrative.

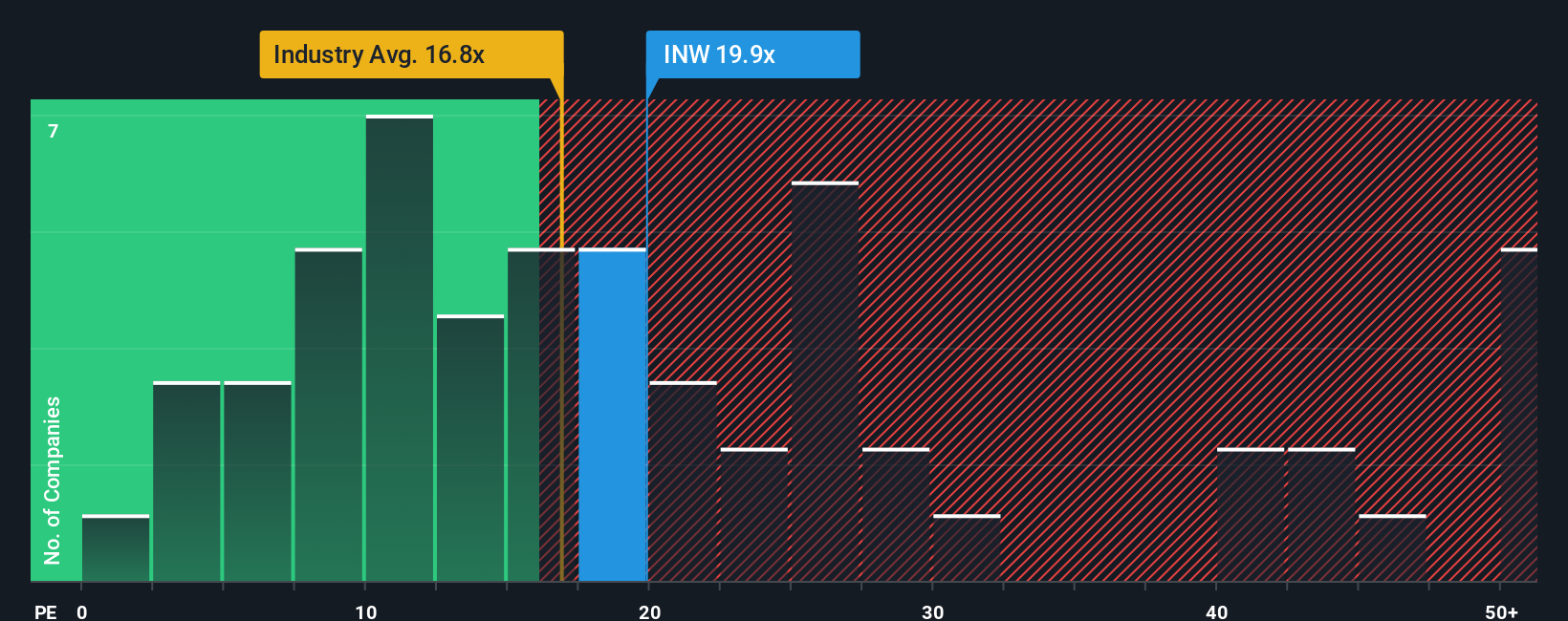

Another View: Comparing Price-to-Earnings Ratios

From a different angle, the price-to-earnings ratio suggests a less optimistic story. INW trades at 20 times earnings, noticeably higher than peers at 15.4 times and the industry average at 16.9. Even compared to the fair ratio of 17.6, INW looks expensive. Could this premium be justified, or is there more risk than meets the eye?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Infrastrutture Wireless Italiane Narrative

If you have a different perspective or want to explore the fundamentals yourself, you can craft your own story for INWIT in just a few minutes, so why not Do it your way

A great starting point for your Infrastrutture Wireless Italiane research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take your portfolio to the next level by actively moving into fresh opportunities. If you want to stay ahead, take a closer look at these top picks our community is using now:

- Secure dividend income by targeting proven performers with steady yields. Check out these 15 dividend stocks with yields > 3% to identify stocks that could help balance your returns.

- Gain an edge with pioneering companies pushing artificial intelligence boundaries. See which innovators lead the charge using these 26 AI penny stocks.

- Spot the undervalued gems that the crowd has overlooked and position yourself for potential upside with these 874 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:INW

Infrastrutture Wireless Italiane

Operates in the electronic communications infrastructure sector in Italy.

Acceptable track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives