- Italy

- /

- Telecom Services and Carriers

- /

- BIT:INW

Can Inwit’s Rising Profits (BIT:INW) Reinforce Its Edge in Telecom Infrastructure?

Reviewed by Sasha Jovanovic

- Infrastrutture Wireless Italiane S.p.A. recently reported its third quarter and nine-month 2025 results, showing sales of €271.1 million and net income of €92.2 million for the quarter, both higher than the same period last year.

- The ongoing growth in both sales and net income signals positively for the company’s operational resilience and ability to capture demand in the evolving telecommunications infrastructure sector.

- We’ll now explore how this latest period of increased sales and net income may alter Infrastrutture Wireless Italiane’s investment narrative going forward.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Infrastrutture Wireless Italiane Investment Narrative Recap

To be a shareholder in Infrastrutture Wireless Italiane (INWIT), you need confidence in the ongoing expansion of Italy’s telecommunications infrastructure and a belief in the company’s ability to keep growing revenue and earnings amid a shifting digital landscape. This quarter’s beat on both sales and net income shows operational strength, but does not materially change short term catalysts such as new 5G deployments, or the biggest current risk, which remains high leverage constraining future investments if financing costs rise.

The recently announced debt tender offer is particularly relevant in this context. INWIT invited holders of €1 billion in notes due July 2026 to tender their bonds for cash, a move aimed at managing its debt maturity profile more efficiently. As leverage and funding flexibility remain a key risk for the business, how the company handles refinancing and capital structure adjustments will be important to watch, especially with new infrastructure deployments on the horizon.

But despite steady financial results, investors should stay aware that if financing conditions worsen and leverage remains high, INWIT’s flexibility to fund future growth could...

Read the full narrative on Infrastrutture Wireless Italiane (it's free!)

Infrastrutture Wireless Italiane's narrative projects €1.2 billion revenue and €434.5 million earnings by 2028. This requires 5.1% yearly revenue growth and a €74.4 million earnings increase from €360.1 million today.

Uncover how Infrastrutture Wireless Italiane's forecasts yield a €11.59 fair value, a 45% upside to its current price.

Exploring Other Perspectives

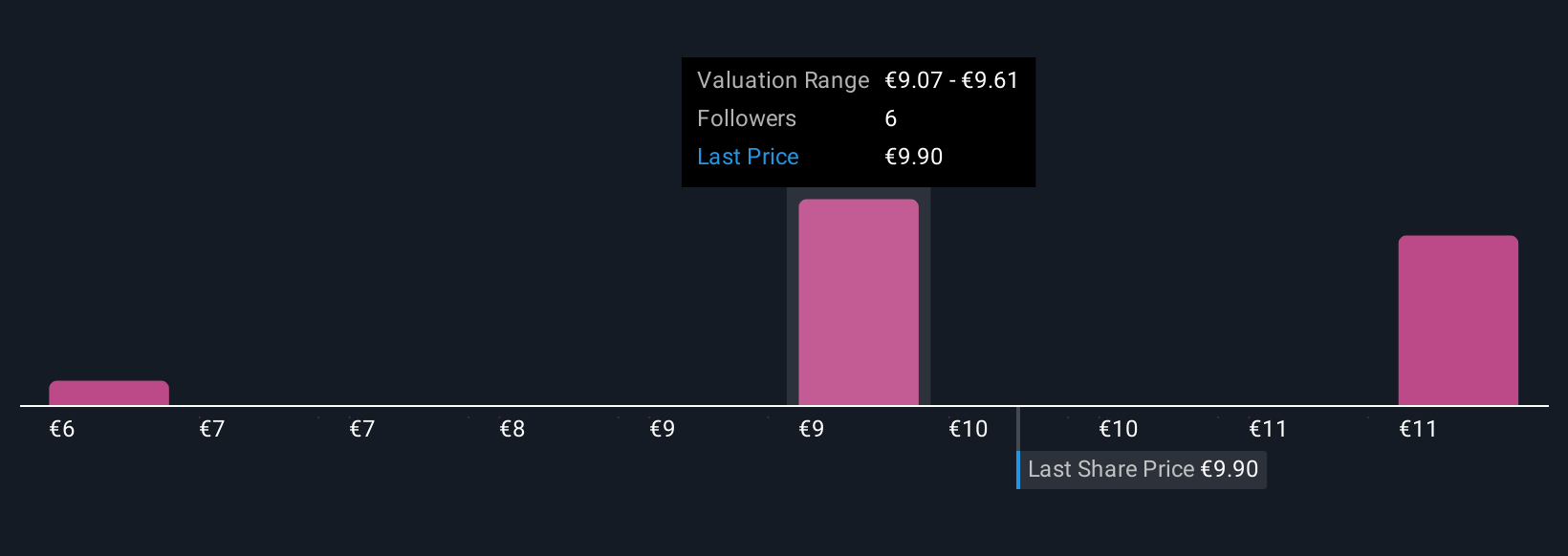

Simply Wall St Community members estimate INWIT’s fair value anywhere from €6.33 to €11.59 across three analyses. While earnings have grown modestly, sustained high leverage continues to be a central concern for future investments and financial strength, so your own assessment could differ widely from others in the market.

Explore 3 other fair value estimates on Infrastrutture Wireless Italiane - why the stock might be worth as much as 45% more than the current price!

Build Your Own Infrastrutture Wireless Italiane Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Infrastrutture Wireless Italiane research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Infrastrutture Wireless Italiane research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Infrastrutture Wireless Italiane's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:INW

Infrastrutture Wireless Italiane

Operates in the electronic communications infrastructure sector in Italy.

Acceptable track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives