- Italy

- /

- Telecom Services and Carriers

- /

- BIT:INW

Assessing INWIT (BIT:INW) Valuation as Subtle Price Moves Raise Investor Interest

Reviewed by Simply Wall St

If you have been watching Infrastrutture Wireless Italiane (BIT:INW), you may have noticed that the stock is moving quietly but steadily, sparking some questions around its current valuation. There has been no headline-grabbing event or clear news catalyst in recent days, yet the share price continues to shift in ways that could catch any investor's eye. In markets where catalysts often drive strong sentiment changes, an absence of news can be just as intriguing as a major announcement. Sometimes, it is these subtle movements that invite the biggest questions about what comes next.

Looking back over the past year, shares of INW have edged lower overall, with a gradual decline that contrasts with its moderate gain so far this year. Short-term dips over the past month and quarter have further muted enthusiasm, but longer-term investors may point to the stock’s substantial gains over three and five years as evidence of staying power. Small but persistent moves, coupled with modest annual growth in revenue and net income, hint that momentum is neither accelerating nor collapsing at this stage. The real driver right now seems to be ongoing investor expectations rather than any specific recent event.

With that backdrop, is the recent drift in INW’s share price an opportunity to buy quality at a discount, or is the market simply reflecting the company’s true long-term prospects?

Most Popular Narrative: 14% Undervalued

According to the most widely followed narrative, shares of Infrastrutture Wireless Italiane are trading at a discount to fair value, with analysts forecasting meaningful upside if key trends play out.

Opportunities arising from urbanization and the digital transformation of public spaces, such as smart cities, transport corridors, and indoor high-traffic venues, are expanding INWIT's addressable market and asset base. This is enabling additional leasing contracts and supporting stable, recurring revenue and long-term free cash flow growth.

These bullish predictions make one thing clear: there is a hidden engine behind the valuation uplift. Want to know what secret assumptions on future growth and profit margins are powering this price target? The narrative hinges on aggressive forecasts that could send shares higher for years. Ready to uncover the critical numbers that drive this undervaluation call?

Result: Fair Value of €11.8 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slowing growth in new tower deployments or financial strain at major tenants could quickly undermine the bullish case for INWIT’s future valuation.

Find out about the key risks to this Infrastrutture Wireless Italiane narrative.Another Perspective: Market Comparison

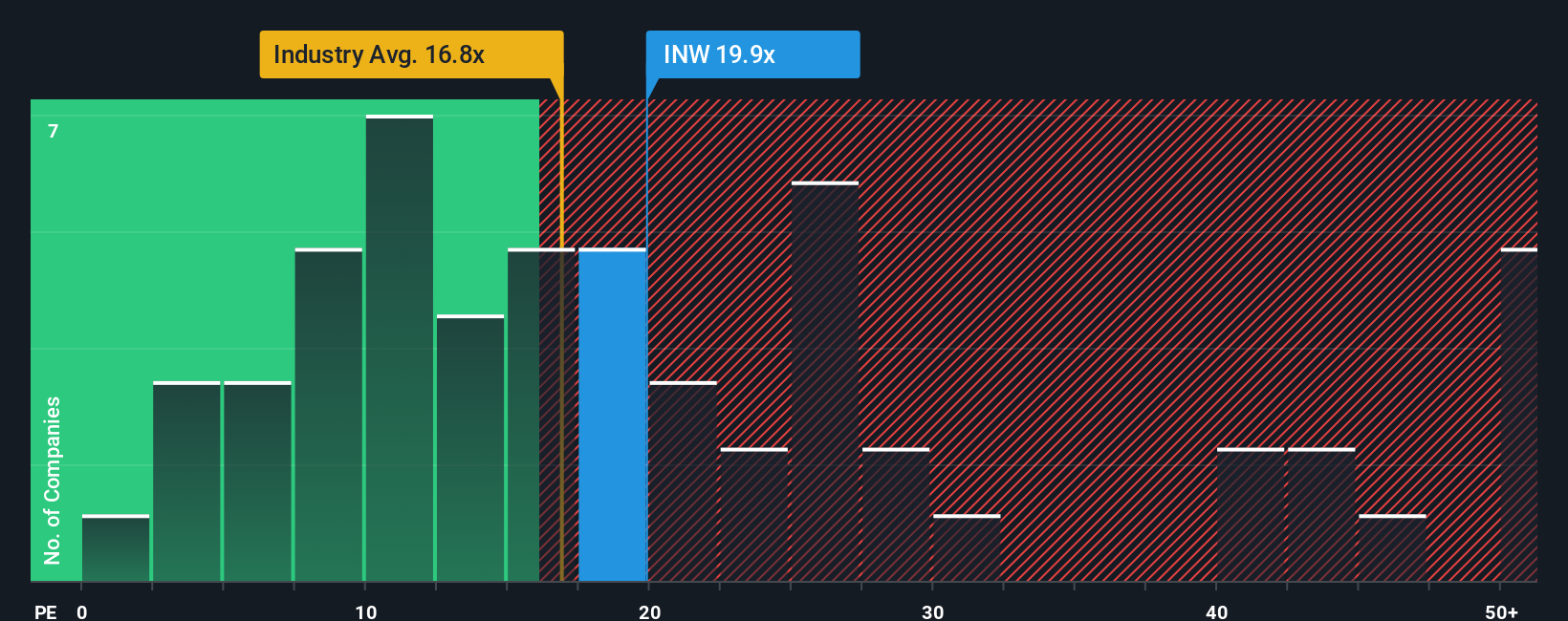

While analysts suggest INW is undervalued, comparing its price-to-earnings against sector peers provides a less optimistic view. The shares appear expensive using this approach. This raises the question: is the market already pricing in future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Infrastrutture Wireless Italiane to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Infrastrutture Wireless Italiane Narrative

If you want to reach your own conclusion or prefer hands-on analysis over consensus opinions, you can shape your own perspective in just a few minutes. Do it your way.

A great starting point for your Infrastrutture Wireless Italiane research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t just stick to the obvious. Give yourself an edge with tools that reveal fresh, genuine opportunities in today’s market. Miss these and you might miss your next winner.

- Spot emerging technology leaders shaking up healthcare and AI by using healthcare AI stocks woven into hospital systems and biotech breakthroughs.

- Boost your income strategy by seeking companies with strong yields above 3% through dividend stocks with yields > 3%, helping your investments work harder for you every month.

- Go after undervalued gems before the crowd with undervalued stocks based on cash flows as your shortcut to stocks trading below their true worth based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About BIT:INW

Infrastrutture Wireless Italiane

Operates in the electronic communications infrastructure sector in Italy.

Acceptable track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives