- Italy

- /

- Telecom Services and Carriers

- /

- BIT:CVG

Convergenze S.p.A. Società Benefit's (BIT:CVG) Price Is Right But Growth Is Lacking After Shares Rocket 28%

Convergenze S.p.A. Società Benefit (BIT:CVG) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 47% over that time.

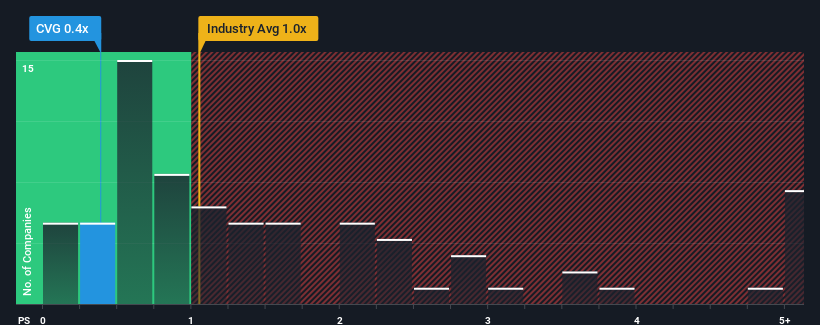

Although its price has surged higher, Convergenze. Società Benefit may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.4x, since almost half of all companies in the Telecom industry in Italy have P/S ratios greater than 1x and even P/S higher than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Convergenze. Società Benefit

How Has Convergenze. Società Benefit Performed Recently?

With revenue growth that's superior to most other companies of late, Convergenze. Società Benefit has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Convergenze. Società Benefit.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Convergenze. Società Benefit would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 18%. Pleasingly, revenue has also lifted 58% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 10% as estimated by the two analysts watching the company. That's not great when the rest of the industry is expected to grow by 7.9%.

In light of this, it's understandable that Convergenze. Società Benefit's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Convergenze. Società Benefit's P/S?

The latest share price surge wasn't enough to lift Convergenze. Società Benefit's P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Convergenze. Società Benefit's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware Convergenze. Società Benefit is showing 4 warning signs in our investment analysis, and 2 of those don't sit too well with us.

If you're unsure about the strength of Convergenze. Società Benefit's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:CVG

Convergenze. Società Benefit

Provides Internet services, voice, energy, and natural gas services.

Undervalued with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026