Exploring None And 2 High Growth Tech Stocks For Your Portfolio

Reviewed by Simply Wall St

Amid recent global market fluctuations, including a dip in major U.S. indices due to geopolitical tensions and consumer spending concerns, investors are closely watching economic indicators such as the U.S. Services PMI entering contraction territory and declining retail sales. In this environment, identifying high-growth tech stocks that can potentially withstand broader market volatility involves looking for companies with strong fundamentals and innovative capabilities that align with emerging trends and resilient sectors.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 24.94% | 24.24% | ★★★★★★ |

| Travere Therapeutics | 27.14% | 66.43% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| AVITA Medical | 27.78% | 55.33% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.83% | 59.08% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1196 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

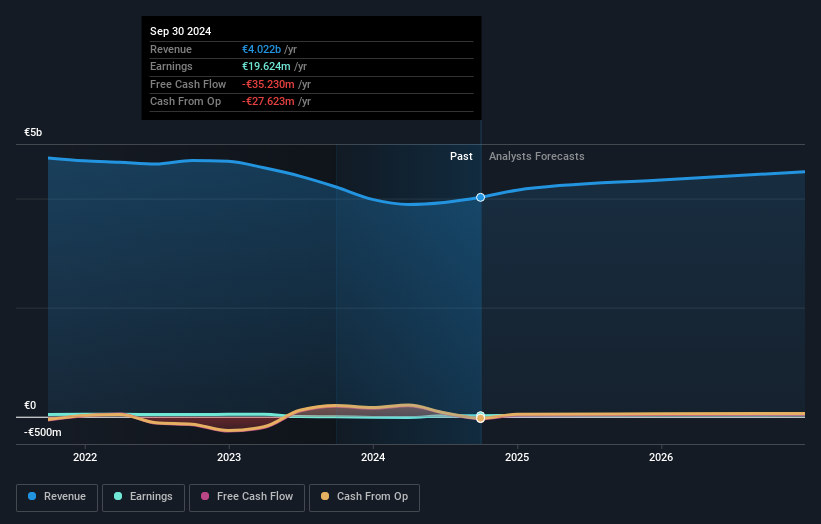

Seco (BIT:IOT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Seco S.p.A. is a tech company that develops and delivers cutting-edge solutions, with a market capitalization of €239.74 million.

Operations: Seco S.p.A. focuses on developing and delivering advanced technological solutions. The company has a market capitalization of €239.74 million, reflecting its position in the tech industry.

SECO, amidst a volatile market, is weaving strategic partnerships to amplify its tech footprint, notably through a recent MOU with Nayax to integrate payment solutions into its IoT products. This collaboration aims to enhance SECO's smart vending machines and other automated services with secure, AI-driven business intelligence capabilities. Despite lacking profitability currently, SECO shows promising signs of growth with expected revenue increases at 11.5% annually and an impressive forecast of earnings growth at 117.4% per year. These moves could position SECO favorably in the competitive IoT landscape as it transitions towards profitability over the next three years while maintaining a focus on innovation and operational efficiency in its sector.

- Delve into the full analysis health report here for a deeper understanding of Seco.

Understand Seco's track record by examining our Past report.

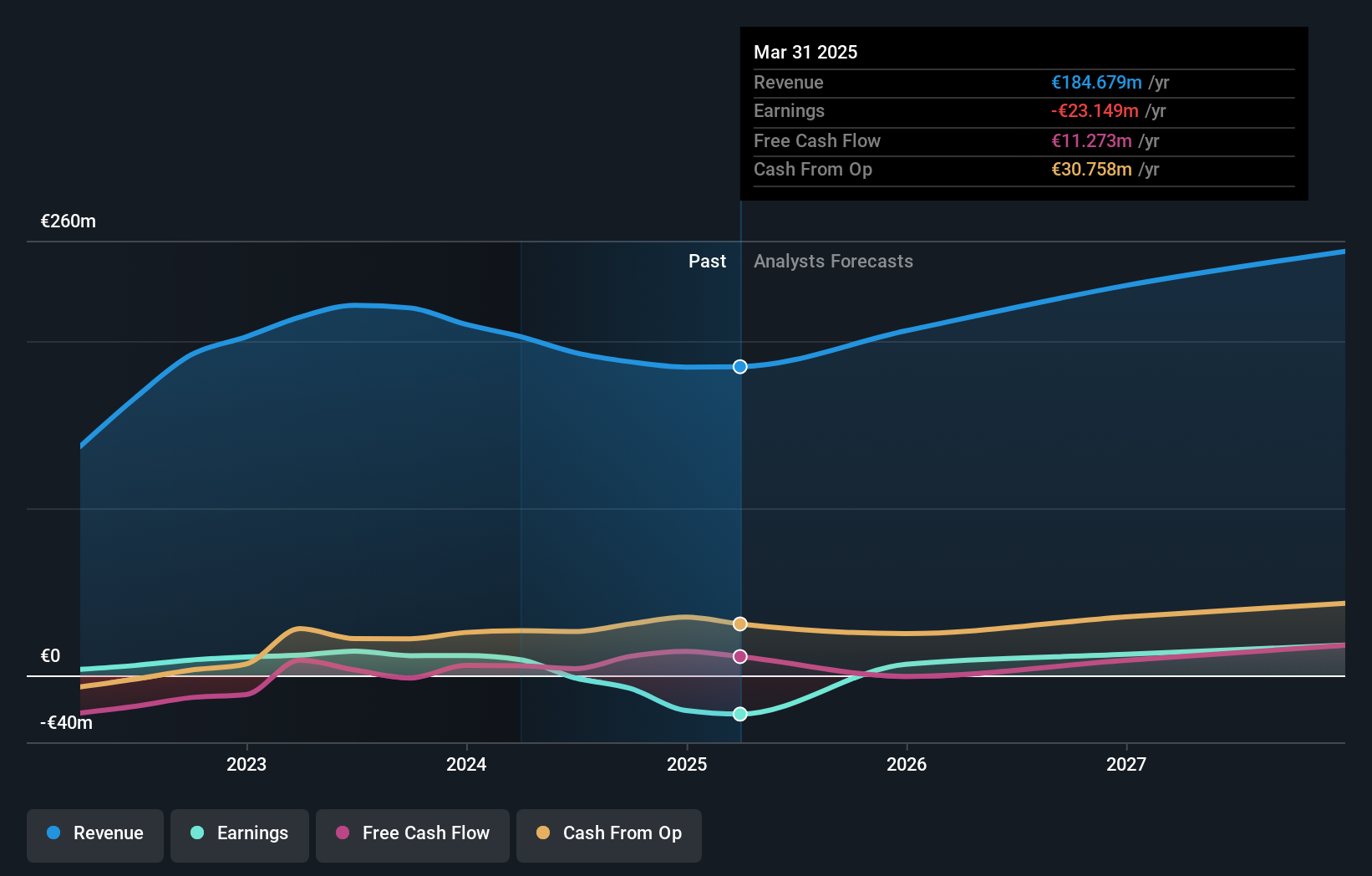

Esprinet (BIT:PRT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Esprinet S.p.A. operates as a wholesale distributor of IT products and consumer electronics across Italy, Spain, Portugal, and other parts of Europe with a market capitalization of €244.74 million.

Operations: The company generates revenue primarily through the wholesale distribution of IT products and consumer electronics across several European countries. Its operations span Italy, Spain, Portugal, and other regions in Europe.

Esprinet, navigating through a competitive tech landscape, has recently transitioned into profitability, showcasing its adaptability and potential for sustained growth. With an annual revenue increase projected at 4.6% and earnings expected to surge by 22.1% annually, the firm is outpacing the broader Italian market's growth rates of 4.2% in revenue and 7.8% in earnings respectively. This performance is underpinned by strategic initiatives that enhance operational efficiencies and market positioning, although it currently faces challenges in covering interest payments from earnings robustly. Moving forward, Esprinet's focus on expanding its market share while enhancing financial health could make it a notable contender in the evolving tech sector.

- Get an in-depth perspective on Esprinet's performance by reading our health report here.

Gain insights into Esprinet's historical performance by reviewing our past performance report.

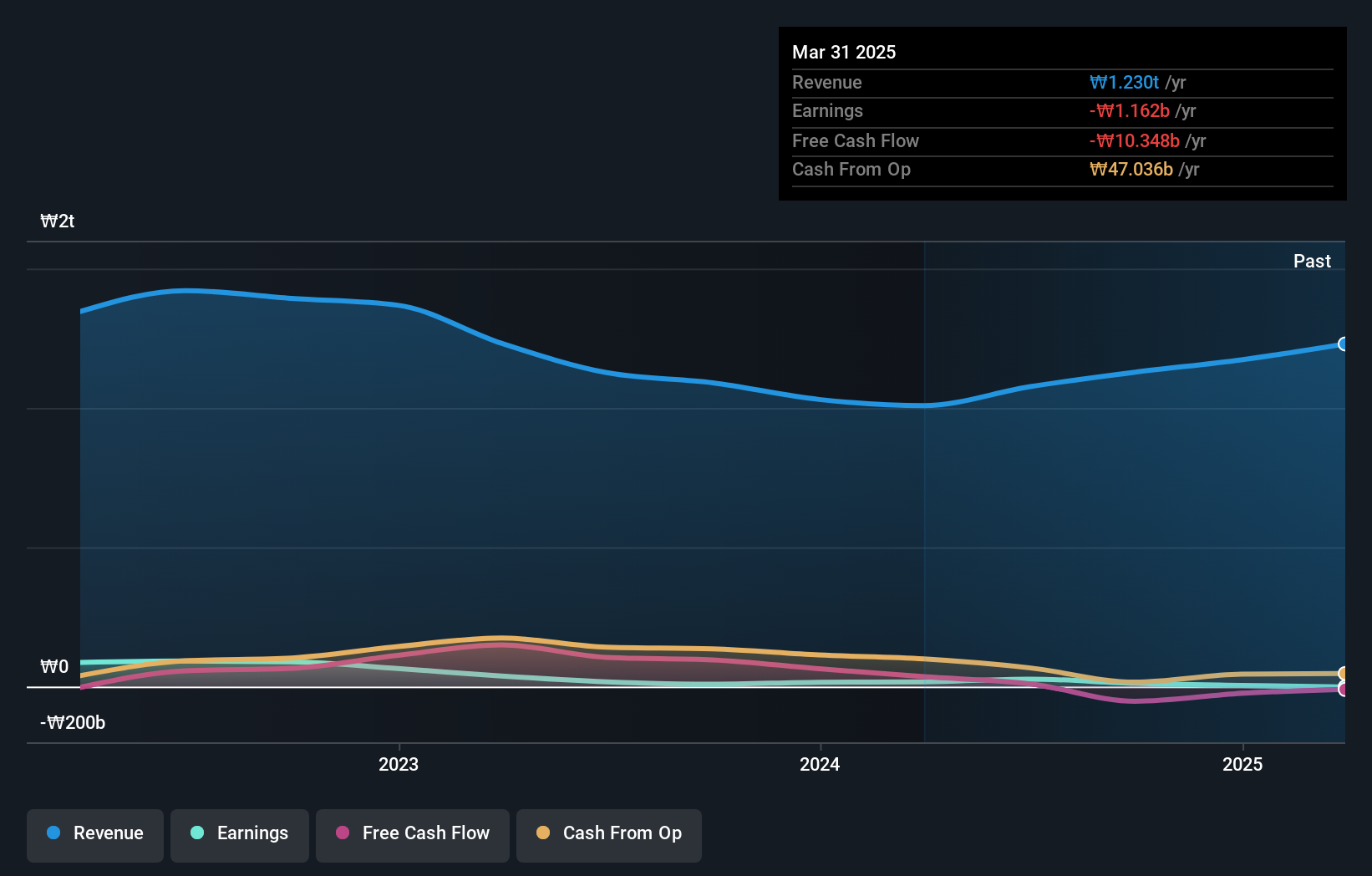

DREAMTECH (KOSE:A192650)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DREAMTECH Co., Ltd. specializes in the design, development, and manufacture of modules with operations both in South Korea and internationally, and has a market capitalization of approximately ₩528.32 billion.

Operations: DREAMTECH Co., Ltd. generates revenue primarily from IT & Mobile Communications and Compact Camera Modules (CCM), contributing ₩455.56 billion and ₩441.55 billion, respectively. The Biometrics, Healthcare & Convergence segment adds another ₩230.61 billion to the company's revenue stream.

DREAMTECH stands out in the high-growth tech sector with its robust earnings growth of 36.5% annually, surpassing the broader Korean market's average of 26%. This impressive performance is supported by a significant revenue increase forecast at 14.7% per year, notably higher than the market's 9.2%. Innovations and strategic investments in R&D have played a crucial role here; last year alone, DREAMTECH allocated $1.2 billion to research and development, which is about 15% of their total revenue, underscoring their commitment to staying at the forefront of technological advancements. As they continue to outpace industry growth rates and invest heavily in future technologies, DREAMTECH’s trajectory suggests a promising outlook for its role in shaping tech innovations.

Where To Now?

- Access the full spectrum of 1196 High Growth Tech and AI Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Esprinet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:PRT

Esprinet

Engages in the wholesale distribution of information technology (IT) products and consumer electronics in Italy, Spain, Portugal, and rest of Europe.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)