European Growth Companies With High Insider Ownership February 2025

Reviewed by Simply Wall St

As the European markets navigate cautious optimism amid geopolitical tensions and evolving trade policies, investors are keenly observing growth opportunities within the region. In this landscape, companies with high insider ownership often stand out as they may signal strong internal confidence and alignment of interests with shareholders, making them compelling candidates for those seeking growth potential.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| TF Bank (OM:TFBANK) | 15.6% | 20% |

| Elicera Therapeutics (OM:ELIC) | 27.8% | 97.2% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 50.8% |

| Truecaller (OM:TRUE B) | 29.7% | 24.8% |

| XTPL (WSE:XTP) | 27.9% | 118% |

| BioArctic (OM:BIOA B) | 33.8% | 38.5% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 121.1% |

| MedinCell (ENXTPA:MEDCL) | 13.9% | 114.3% |

Here we highlight a subset of our preferred stocks from the screener.

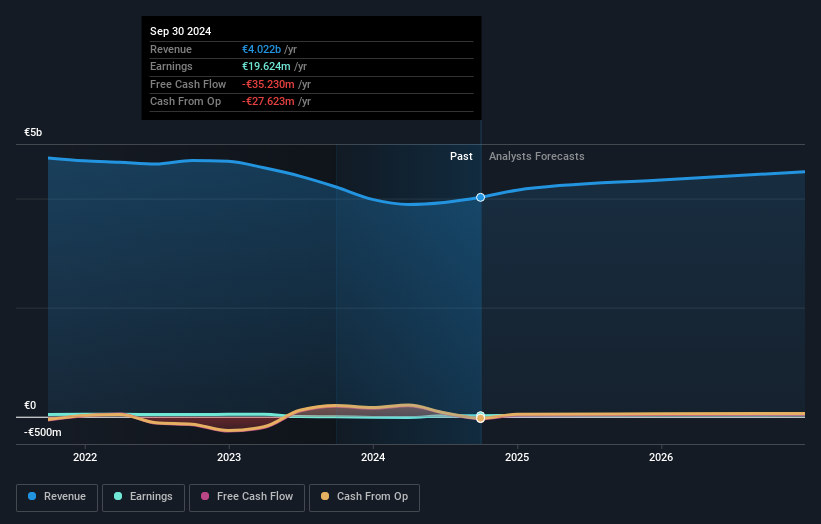

Esprinet (BIT:PRT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Esprinet S.p.A. is involved in the wholesale distribution of IT products and consumer electronics across Italy, Spain, Portugal, and other parts of Europe, with a market cap of €244.74 million.

Operations: Esprinet's revenue is derived from the wholesale distribution of IT products and consumer electronics throughout Italy, Spain, Portugal, and other European regions.

Insider Ownership: 13.4%

Earnings Growth Forecast: 22.1% p.a.

Esprinet is positioned for significant earnings growth at 22.1% annually, outpacing the Italian market's average. Despite trading 34.7% below estimated fair value and being a good relative value compared to peers, its Return on Equity is forecasted to be low at 7.9%. The company recently became profitable but faces challenges with interest coverage by earnings. Analysts agree on a potential stock price increase of 32%, indicating optimism about future performance.

- Click here to discover the nuances of Esprinet with our detailed analytical future growth report.

- Our expertly prepared valuation report Esprinet implies its share price may be lower than expected.

Admicom Oyj (HLSE:ADMCM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Admicom Oyj provides cloud-based software and business process automation solutions in Finland, with a market cap of €269.27 million.

Operations: The company's revenue is primarily derived from its Software & Programming segment, which amounts to €35.57 million.

Insider Ownership: 21.9%

Earnings Growth Forecast: 22% p.a.

Admicom Oyj, with strong insider ownership, is forecasted for significant earnings growth of 22% annually, surpassing the Finnish market average. Despite a slight dip in net income to €5.87 million for 2024, the company remains undervalued by 27.7% relative to its fair value estimate. Revenue growth is projected at 10.7%, outpacing the local market's rate. Admicom's Return on Equity is expected to reach a high of 29.6% in three years.

- Dive into the specifics of Admicom Oyj here with our thorough growth forecast report.

- Our expertly prepared valuation report Admicom Oyj implies its share price may be too high.

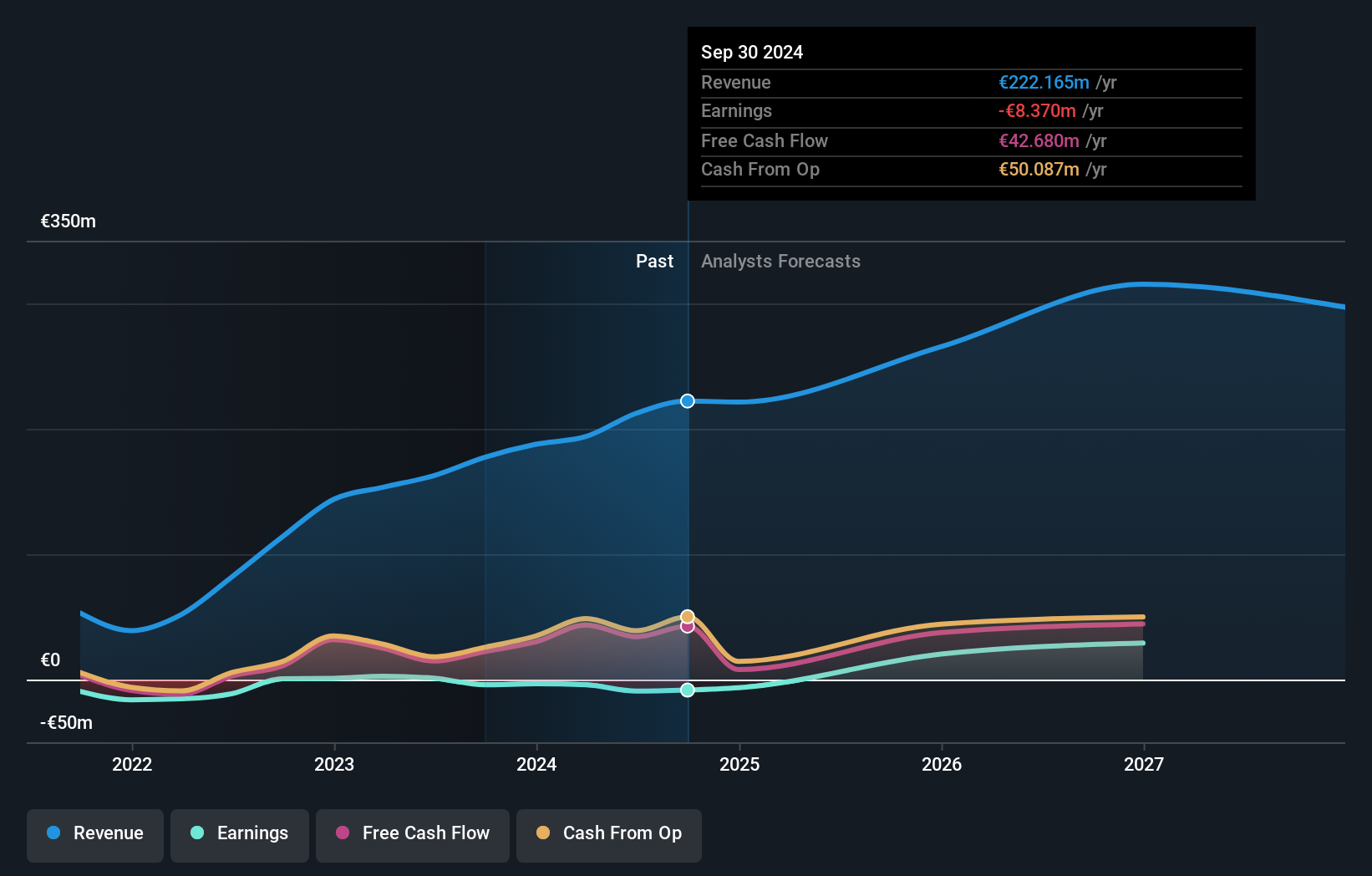

Brockhaus Technologies (XTRA:BKHT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Brockhaus Technologies AG is a private equity firm with a market cap of €253.88 million.

Operations: The company's revenue is primarily derived from its Security Technologies segment, which accounts for €35.20 million, and its HR Benefit & Mobility Platform segment, contributing €184.13 million.

Insider Ownership: 26.6%

Earnings Growth Forecast: 114.4% p.a.

Brockhaus Technologies is poised for substantial growth, with earnings expected to rise 114.4% annually, outpacing the German market's average. Despite trading at 71.2% below its estimated fair value, the company faces a low forecasted Return on Equity of 4.3% in three years. Revenue is projected to grow at 12.6% per year, slower than high-growth benchmarks but faster than the broader market's rate of 5.8%.

- Get an in-depth perspective on Brockhaus Technologies' performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Brockhaus Technologies is priced lower than what may be justified by its financials.

Seize The Opportunity

- Unlock more gems! Our Fast Growing European Companies With High Insider Ownership screener has unearthed 211 more companies for you to explore.Click here to unveil our expertly curated list of 214 Fast Growing European Companies With High Insider Ownership.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Esprinet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:PRT

Esprinet

Engages in the wholesale distribution of information technology (IT) products and consumer electronics in Italy, Spain, Portugal, and rest of Europe.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)