Esprinet S.p.A. (BIT:PRT) Soars 27% But It's A Story Of Risk Vs Reward

Esprinet S.p.A. (BIT:PRT) shares have continued their recent momentum with a 27% gain in the last month alone. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 2.8% in the last twelve months.

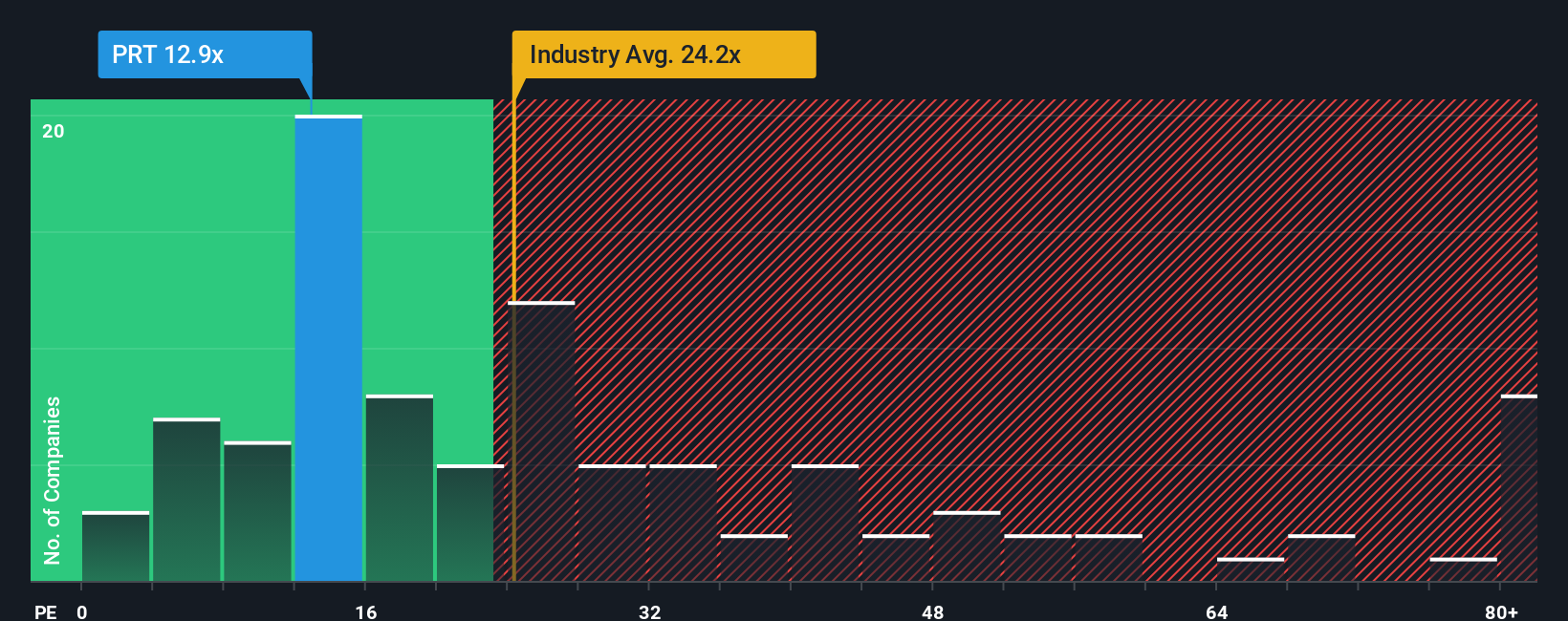

In spite of the firm bounce in price, Esprinet may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 12.9x, since almost half of all companies in Italy have P/E ratios greater than 18x and even P/E's higher than 29x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings growth that's superior to most other companies of late, Esprinet has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Esprinet

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Esprinet's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered an exceptional 16% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 46% drop in EPS in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 19% per annum over the next three years. That's shaping up to be similar to the 21% per annum growth forecast for the broader market.

With this information, we find it odd that Esprinet is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On Esprinet's P/E

The latest share price surge wasn't enough to lift Esprinet's P/E close to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Esprinet's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Esprinet (3 are concerning) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Esprinet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:PRT

Esprinet

Engages in the wholesale distribution of information technology (IT) products and consumer electronics in Italy, Spain, Portugal, and rest of Europe.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives