- Sweden

- /

- Metals and Mining

- /

- OM:NIO

European Penny Stocks To Watch In December 2025

Reviewed by Simply Wall St

As the European markets navigate a mixed landscape with some indices gaining and others slipping, investors are closely watching central bank policies and economic indicators for cues. Penny stocks, though often considered a niche investment area, continue to offer intriguing opportunities for those looking beyond the larger market names. These smaller or newer companies can present growth potential at lower price points, particularly when they demonstrate strong financial health and solid fundamentals.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.45 | €1.54B | ✅ 4 ⚠️ 2 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.72 | €83.82M | ✅ 4 ⚠️ 1 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.00 | €14.86M | ✅ 4 ⚠️ 5 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €223.46M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.14 | €66.6M | ✅ 3 ⚠️ 3 View Analysis > |

| Hultstrom Group (OM:HULT B) | SEK3.12 | SEK189.82M | ✅ 2 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.295 | €379.61M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.265 | €313.07M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.772 | €25.85M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 291 stocks from our European Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Olidata (BIT:OLI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Olidata S.p.A. is a systems integration and technology consulting company with a market capitalization of €41.85 million.

Operations: The company generates revenue primarily from its Computer Hardware segment, which accounts for €72.23 million.

Market Cap: €41.85M

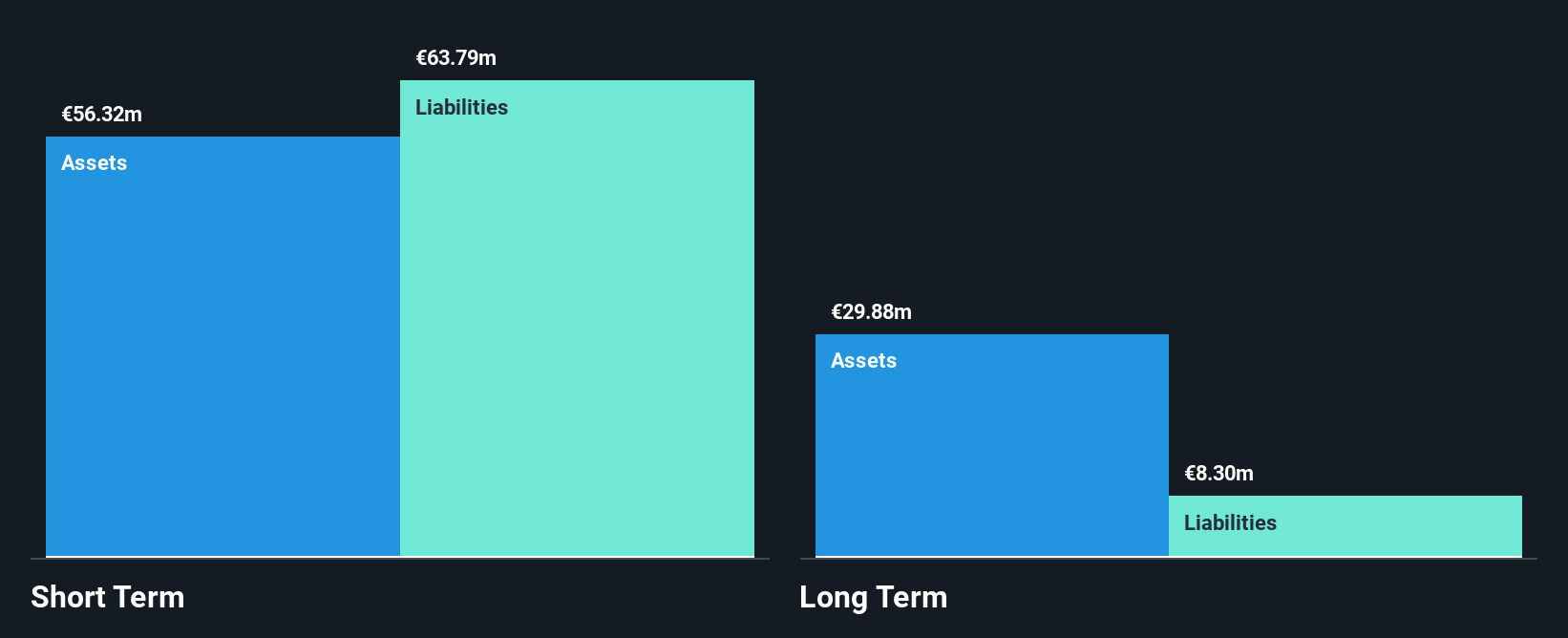

Olidata S.p.A., with a market capitalization of €41.85 million, reported declining revenue and a net loss for the half year ending June 2025, highlighting challenges in its financial performance. Despite this, the company maintains more cash than total debt and has not significantly diluted shareholders recently. However, Olidata's board lacks experience with an average tenure of 1.5 years, and short-term liabilities exceed short-term assets by €7.5 million. The company faced a large one-off loss impacting recent results but forecasts suggest potential earnings growth of 66.23% annually, indicating possible future recovery opportunities in its operations.

- Click to explore a detailed breakdown of our findings in Olidata's financial health report.

- Examine Olidata's earnings growth report to understand how analysts expect it to perform.

SHT Smart High-Tech (DB:7H6)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: SHT Smart High-Tech AB (publ) develops and sells nano-based materials and solutions for thermal management applications across multiple regions including Sweden, Europe, the United States, China, Japan, South Korea, and Southeast Asia with a market cap of €502.35 million.

Operations: The company generates SEK 8.77 million in revenue from its Electronic Components & Parts segment.

Market Cap: €502.35M

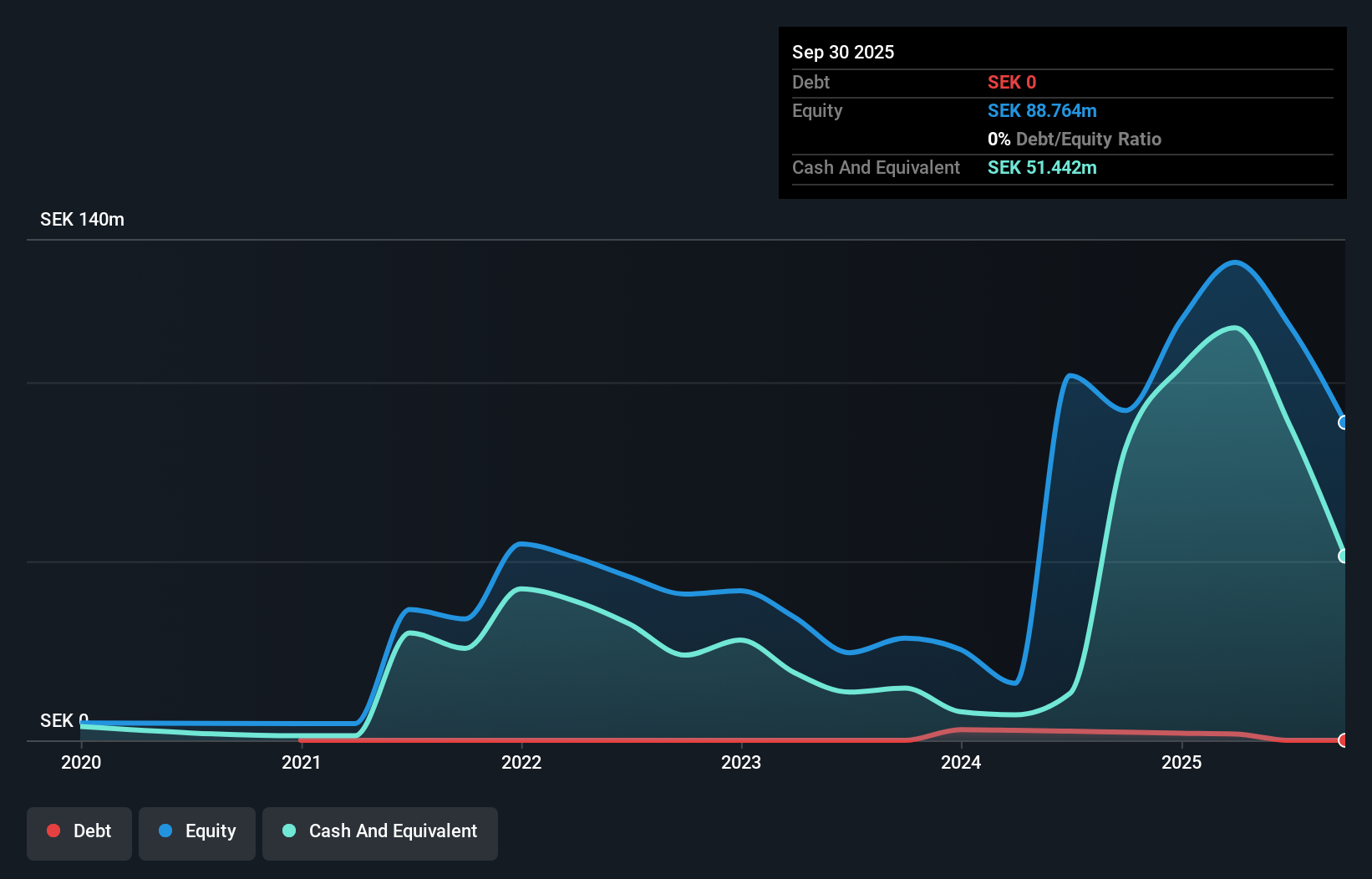

SHT Smart High-Tech AB, with a market cap of €502.35 million, is navigating the penny stock landscape with its focus on nano-based materials for thermal management. Despite generating SEK 9.71 million in revenue over nine months ending September 2025, the company remains pre-revenue by US$ standards and unprofitable, with losses growing annually by 49.3%. It holds no debt and covers short-term liabilities with SEK 66.5 million in assets but faces high volatility and less than a year of cash runway. The board's experience contrasts with an inexperienced management team averaging under one year in tenure.

- Jump into the full analysis health report here for a deeper understanding of SHT Smart High-Tech.

- Learn about SHT Smart High-Tech's historical performance here.

Nordic Iron Ore (OM:NIO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nordic Iron Ore AB (publ) focuses on the exploration, development, and mining of iron ore deposits in Västerbergslagen, Sweden, with a market cap of SEK338.90 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: SEK338.9M

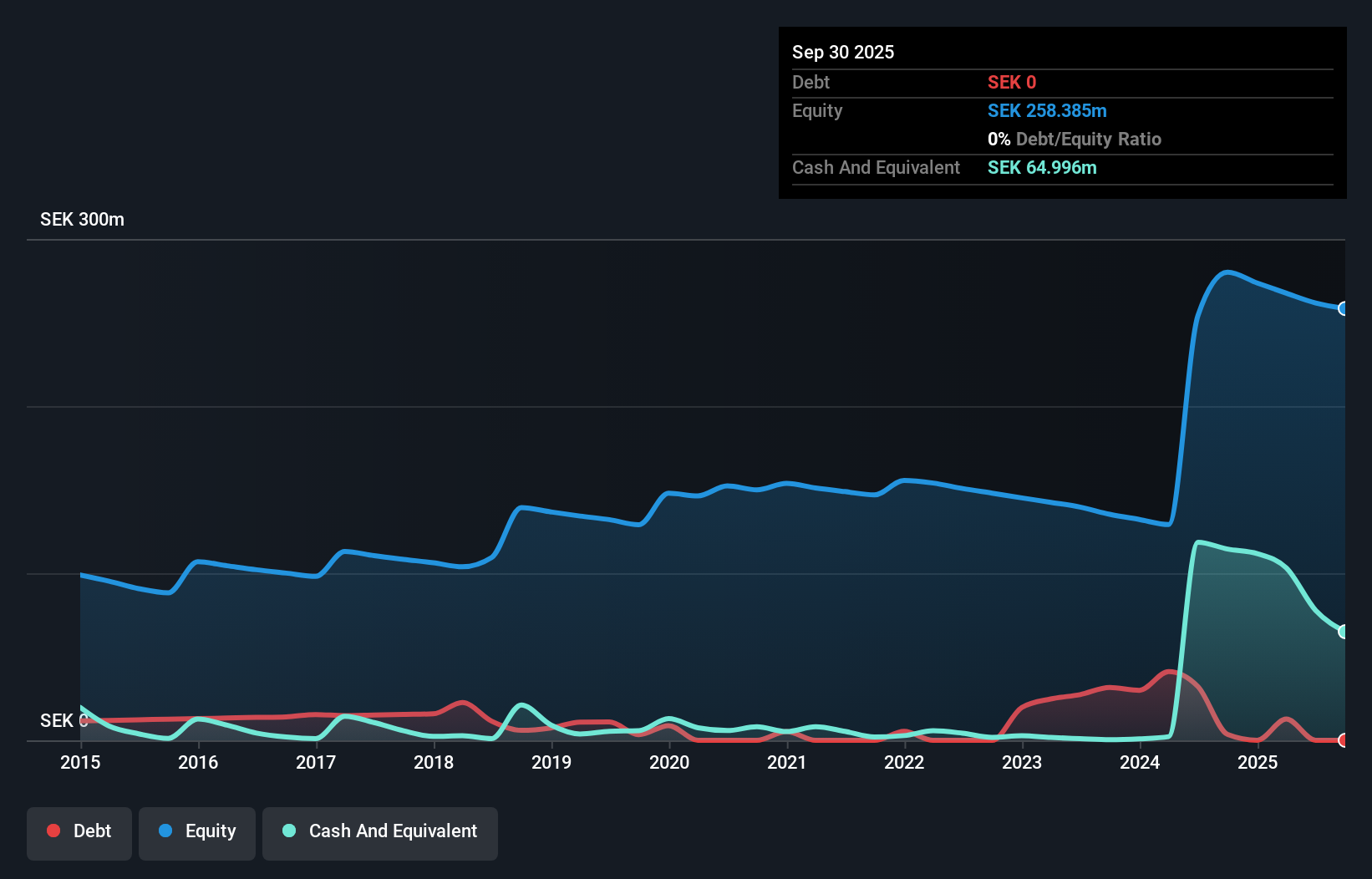

Nordic Iron Ore AB, with a market cap of SEK338.90 million, is pre-revenue and currently unprofitable, reporting increased losses of SEK 15.26 million for the first nine months of 2025. The company is debt-free and has sufficient cash runway for over a year under stable conditions, though its cash runway would be less than a year if free cash flow continues to decline. Recent exploration efforts at Blotberget show potential for expanding mineral resources significantly if successful. However, both the management team and board are relatively inexperienced with short average tenures.

- Get an in-depth perspective on Nordic Iron Ore's performance by reading our balance sheet health report here.

- Explore historical data to track Nordic Iron Ore's performance over time in our past results report.

Next Steps

- Investigate our full lineup of 291 European Penny Stocks right here.

- Curious About Other Options? We've found 13 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nordic Iron Ore might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NIO

Nordic Iron Ore

Engages in the exploration, development, and mining of iron ore deposits in Västerbergslagen, Sweden.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion