The European market has shown resilience, with the pan-European STOXX Europe 600 Index rising by 2.10% as optimism grew following a de-escalation in trade tensions between the U.S. and China, alongside positive economic indicators such as industrial production gains in the eurozone and robust GDP growth in the UK. In this environment of improving sentiment and economic activity, high-growth tech stocks can be particularly appealing due to their potential for innovation-driven expansion and ability to capitalize on technological advancements amidst evolving market dynamics.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| KebNi | 21.29% | 66.10% | ★★★★★★ |

| Intellego Technologies | 31.55% | 51.31% | ★★★★★★ |

| Bonesupport Holding | 29.14% | 56.14% | ★★★★★★ |

| Pharma Mar | 25.21% | 43.09% | ★★★★★★ |

| Yubico | 20.18% | 30.36% | ★★★★★★ |

| Elicera Therapeutics | 75.80% | 107.14% | ★★★★★★ |

| Elliptic Laboratories | 23.60% | 51.89% | ★★★★★★ |

| CD Projekt | 33.41% | 37.39% | ★★★★★★ |

| XTPL | 86.66% | 143.68% | ★★★★★★ |

| Xbrane Biopharma | 24.95% | 56.77% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Datalogic (BIT:DAL)

Simply Wall St Growth Rating: ★★★★☆☆

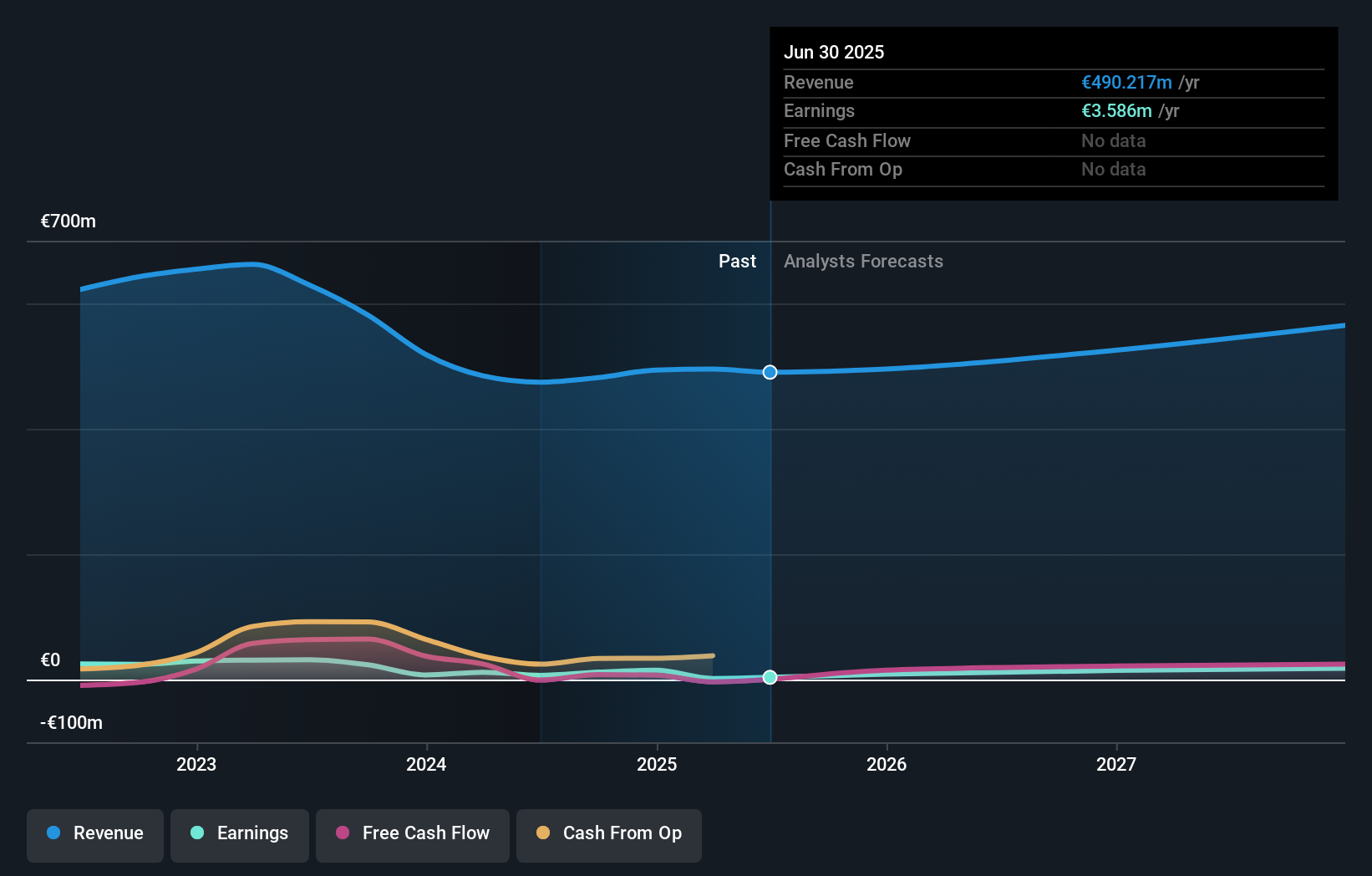

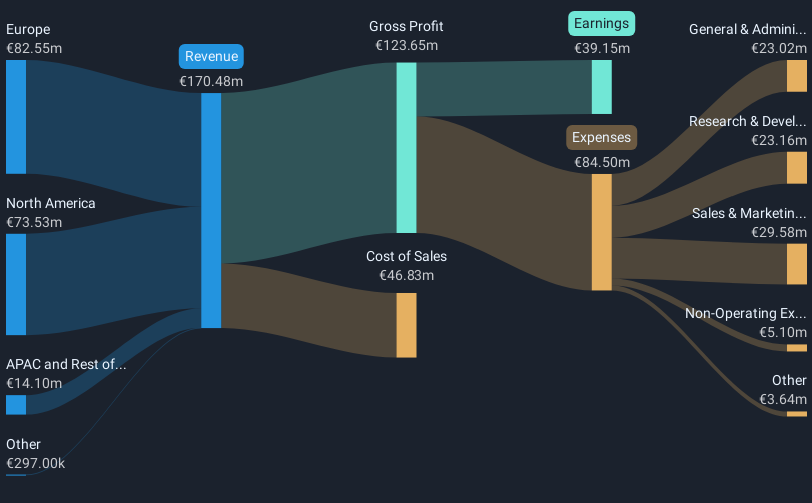

Overview: Datalogic S.p.A. is a company that specializes in the manufacturing and sale of automatic data capture and process automation products across various regions including Italy, the Americas, Asia Pacific, Europe, the Middle East, and Africa with a market cap of €247.31 million.

Operations: Datalogic generates revenue through the production and distribution of automatic data capture and process automation solutions across diverse global markets. The company's operations are geographically diversified, contributing to its market presence in Italy, the Americas, Asia Pacific, Europe, the Middle East, and Africa.

Despite a challenging environment marked by a 87.7% dip in earnings over the past year, Datalogic's strategic focus on innovation in logistics and material handling sectors positions it for potential recovery. The company's R&D commitment is evident as it launched the AV7000 12K camera, enhancing its offerings in high-speed sortation solutions—a critical area as e-commerce demands escalate. With revenue growth outpacing the Italian market at 5.8% annually and an impressive earnings forecast of 56.71% growth per year, Datalogic is aligning its technological advancements with market needs to potentially enhance its competitive edge in the rapidly evolving tech landscape.

- Click here and access our complete health analysis report to understand the dynamics of Datalogic.

Evaluate Datalogic's historical performance by accessing our past performance report.

Planisware SAS (ENXTPA:PLNW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Planisware SAS is a business-to-business software-as-a-service provider with operations in Europe, North America, the Asia-Pacific, and other international markets, and has a market cap of €1.87 billion.

Operations: Planisware SAS generates revenue primarily through its software-as-a-service offerings across various global markets. The company focuses on providing project and portfolio management solutions to businesses, leveraging its expertise in software services.

Planisware SAS demonstrates resilience with a robust annual revenue increase to EUR 183.45 million, up from EUR 156.44 million, underpinned by a consistent net income growth to EUR 42.73 million. This performance is bolstered by strategic R&D investments, aligning with industry trends towards enhanced software solutions and services. The company's commitment to shareholder returns is evident in its recent dividend affirmation of EUR 0.30 per share and an announcement of a substantial dividend payout representing 50% of its annual profit, totaling €21.4 million or €0.31 per share, reflecting confidence in its financial health and future prospects.

- Get an in-depth perspective on Planisware SAS' performance by reading our health report here.

Understand Planisware SAS' track record by examining our Past report.

BioArctic (OM:BIOA B)

Simply Wall St Growth Rating: ★★★★★★

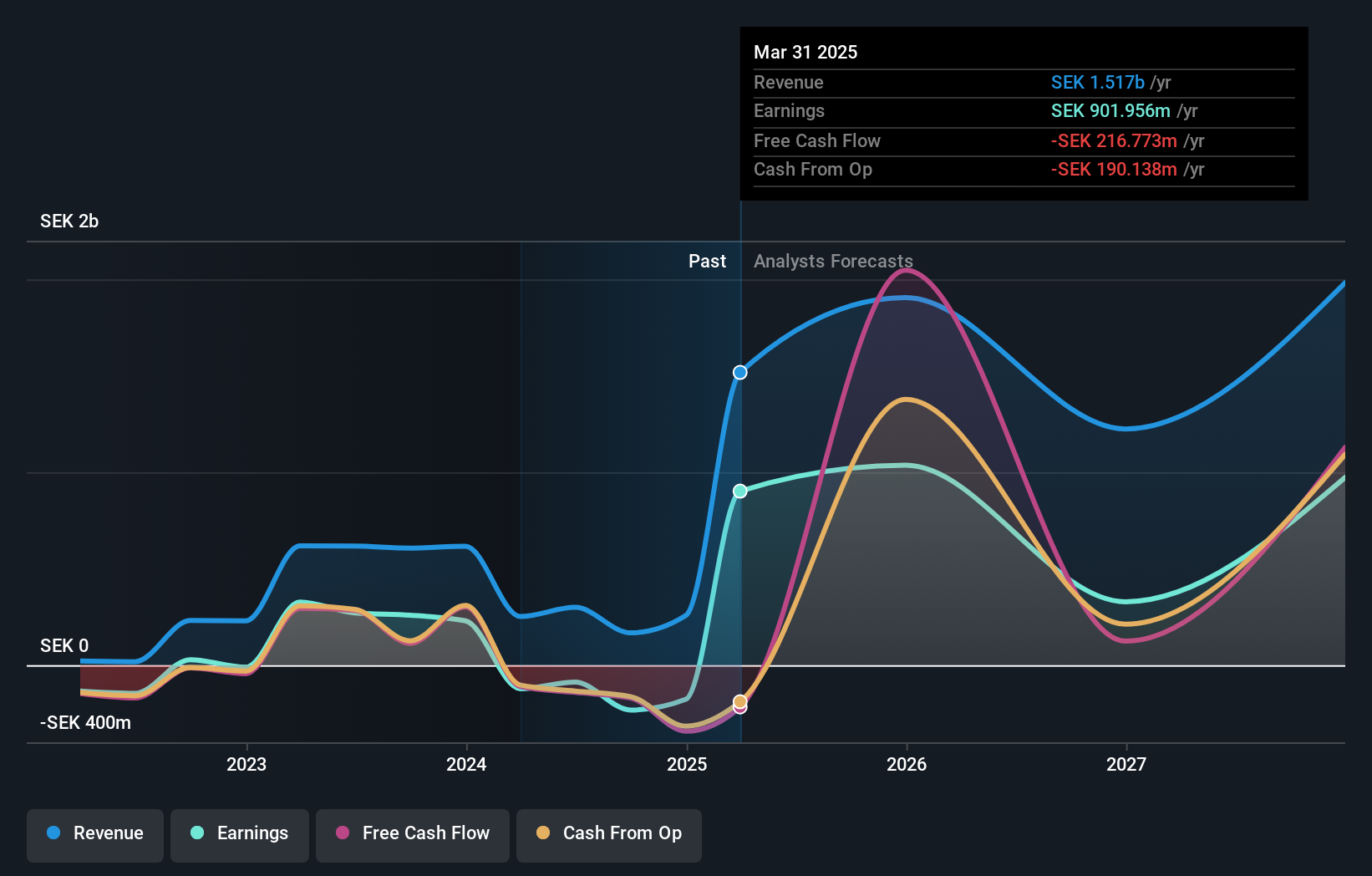

Overview: BioArctic AB (publ) is a Swedish company focused on developing biological drugs for central nervous system disorders, with a market cap of SEK15.52 billion.

Operations: BioArctic AB (publ) generates revenue primarily from its biotechnology segment, amounting to SEK257.35 million. The company is engaged in the development of biological drugs targeting central nervous system disorders in Sweden.

BioArctic AB, a European biotech firm, is making significant strides in the high-growth tech sector with its innovative approach to treating neurodegenerative diseases. The company's revenue is projected to grow at an impressive rate of 37.4% annually, outpacing the Swedish market's growth of 4.2%. This growth is underpinned by BioArctic's robust R&D focus, which has led to promising developments such as the EXIST Phase 2a study for its alpha-synuclein antibody in Parkinson’s disease and Multiple System Atrophy patients. Recent regulatory approvals in Spain and Poland for expanding this study highlight BioArctic’s potential in pioneering treatments for these challenging conditions. With an expected profitability within three years and a forecasted high return on equity of 34.2%, BioArctic exemplifies how targeted R&D investments can propel growth and innovation in biotechnology.

- Take a closer look at BioArctic's potential here in our health report.

Explore historical data to track BioArctic's performance over time in our Past section.

Make It Happen

- Dive into all 229 of the European High Growth Tech and AI Stocks we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:DAL

Datalogic

Manufactures and sells automatic data capture and process automation products in Italy, the Americas, the Asia Pacific, rest of Europe, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion