- Sweden

- /

- Tech Hardware

- /

- OM:TOBII

European Penny Stocks With Market Caps Under €40M: 3 Picks To Watch

Reviewed by Simply Wall St

The European market has shown resilience with the pan-European STOXX Europe 600 Index closing 2.35% higher, and major indices in Germany, Italy, France, and the UK also posting gains. For investors willing to explore beyond well-known stocks, penny stocks—typically representing smaller or newer companies—can offer intriguing opportunities. While the term "penny stock" may seem outdated, these investments remain relevant by potentially providing growth at lower price points when backed by strong financial health.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Orthex Oyj (HLSE:ORTHEX) | €4.65 | €82.58M | ✅ 4 ⚠️ 1 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.02 | €15.15M | ✅ 4 ⚠️ 5 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €232.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Enervit (BIT:ENV) | €3.78 | €67.28M | ✅ 2 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.08 | €65.33M | ✅ 3 ⚠️ 3 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.435 | €391.99M | ✅ 4 ⚠️ 1 View Analysis > |

| High (ENXTPA:HCO) | €3.88 | €75.67M | ✅ 1 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.265 | €313.07M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.848 | €28.4M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 278 stocks from our European Penny Stocks screener.

We'll examine a selection from our screener results.

Cellularline (BIT:CELL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cellularline S.p.A. is a company that produces and distributes smartphone and tablet accessories across various regions including Europe, the Middle East, North America, and internationally, with a market cap of €53.58 million.

Operations: The company generates revenue of €162.15 million from its Electronic Components & Parts segment.

Market Cap: €53.58M

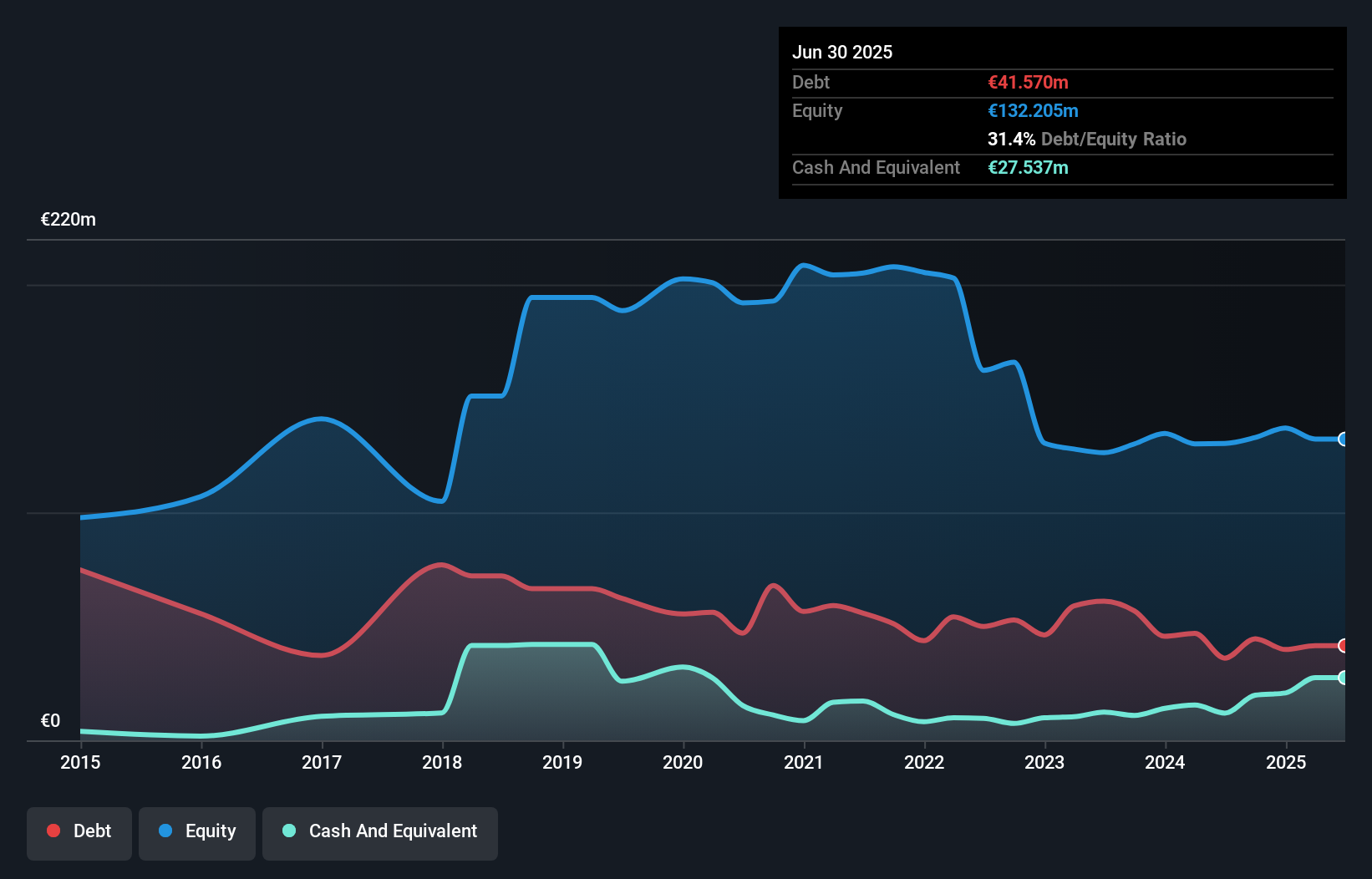

Cellularline S.p.A., with a market cap of €53.58 million, presents a mixed picture for investors in penny stocks. Despite trading at a good value with a price-to-earnings ratio of 9.6x, below the Italian market average, its earnings have declined by 9.3% per year over the past five years and are forecast to continue declining by an average of 3.8% annually over the next three years. The company has recently completed a share buyback program, repurchasing shares worth €0.9 million which might indicate confidence in its valuation despite reporting a net loss for the recent half-year period ended June 2025.

- Get an in-depth perspective on Cellularline's performance by reading our balance sheet health report here.

- Learn about Cellularline's future growth trajectory here.

Siili Solutions Oyj (HLSE:SIILI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Siili Solutions Oyj offers information system development services both in Finland and internationally, with a market cap of €38.35 million.

Operations: The company's revenue segment comprises Information Systems Development Services, generating €110.02 million.

Market Cap: €38.35M

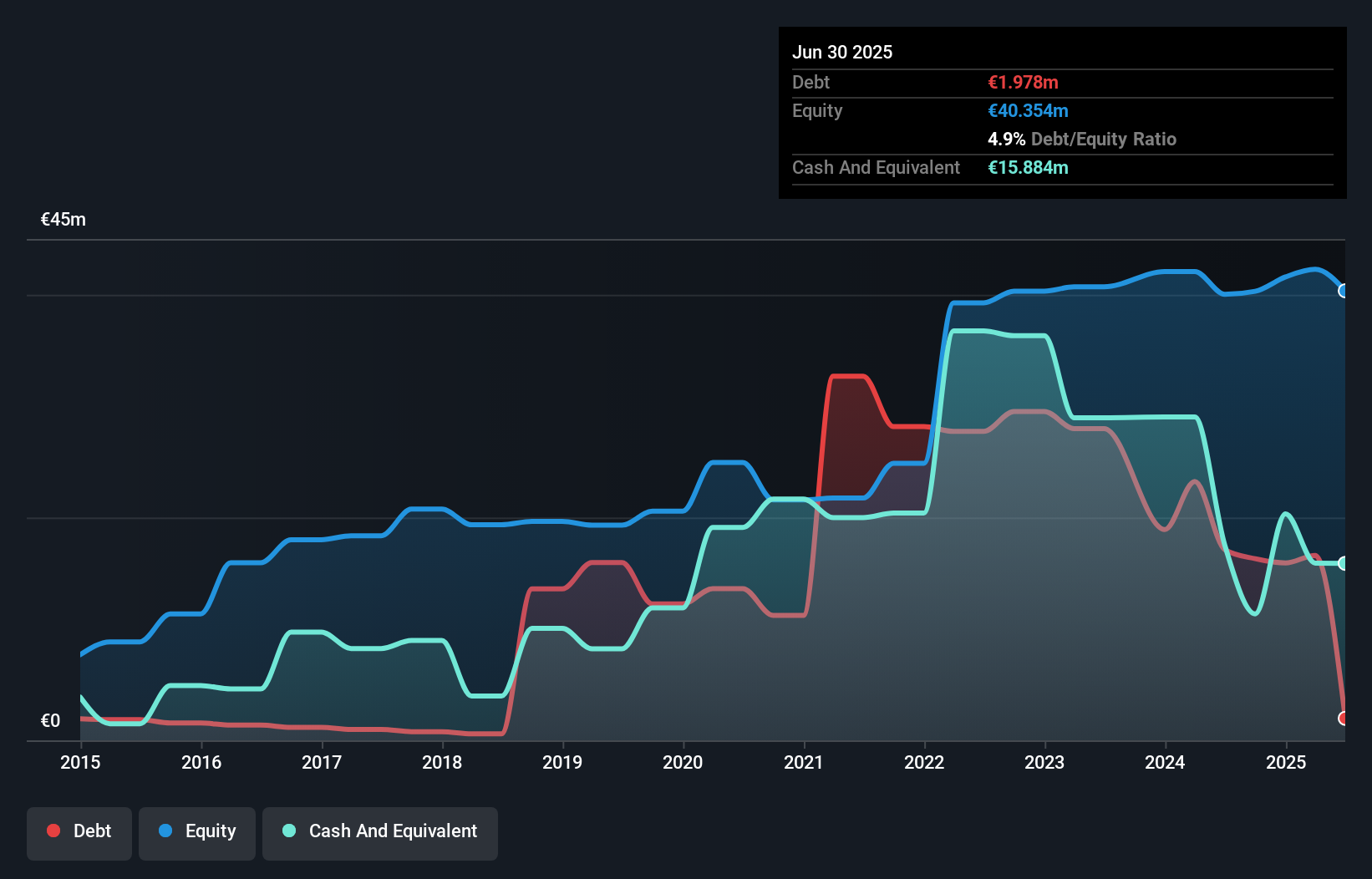

Siili Solutions Oyj, with a market cap of €38.35 million, offers a nuanced opportunity in the penny stock arena. Despite trading at 56.1% below its estimated fair value, recent financial performance reveals challenges; the company reported a net loss of €1.71 million for Q3 2025 and declining profit margins from last year. Its debt situation is stable with cash exceeding total debt and operating cash flow covering 77.4% of its obligations, yet interest payments remain inadequately covered by EBIT at 0.6x coverage. Organizational changes aim to align with strategic goals amid an AI transformation focus but profitability concerns persist.

- Unlock comprehensive insights into our analysis of Siili Solutions Oyj stock in this financial health report.

- Gain insights into Siili Solutions Oyj's future direction by reviewing our growth report.

Tobii (OM:TOBII)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tobii AB (publ) develops and sells eye-tracking technology and solutions across Sweden, Europe, the Middle East, Africa, the United States, and internationally with a market cap of SEK367.12 million.

Operations: Tobii's revenue is primarily derived from three segments: Autosense (SEK55 million), Integrations (SEK446 million), and Products and Solutions (SEK423 million).

Market Cap: SEK367.12M

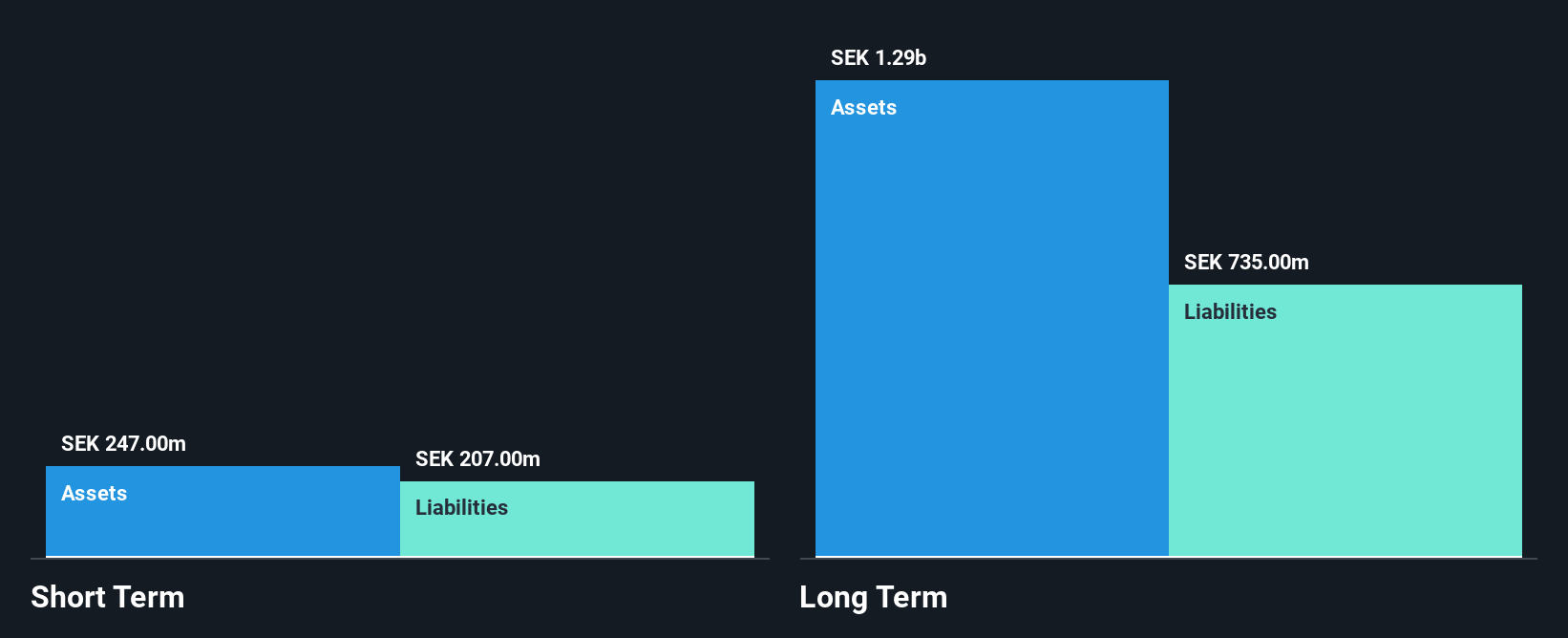

Tobii AB, with a market cap of SEK367.12 million, presents a mixed picture in the penny stock landscape. While its eye-tracking technology underpins strategic partnerships like the recent spin-out of ATTEX Data, Tobii remains unprofitable with a negative return on equity and high net debt to equity ratio at 75.8%. Despite this, Tobii has sufficient cash runway for over three years and continues to innovate in automotive interior sensing through collaborations with major tech firms. Its volatile share price and new board suggest potential instability, yet revenue growth forecasts remain optimistic at 213.88% annually.

- Click to explore a detailed breakdown of our findings in Tobii's financial health report.

- Review our growth performance report to gain insights into Tobii's future.

Summing It All Up

- Embark on your investment journey to our 278 European Penny Stocks selection here.

- Ready To Venture Into Other Investment Styles? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tobii might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TOBII

Tobii

Develops and sells eye-tracking technology and solutions in Sweden, Europe, Middle East, Africa, the United States, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026