- Germany

- /

- Entertainment

- /

- DB:8WP

European Penny Stocks To Watch In May 2025

Reviewed by Simply Wall St

The European market has recently faced downward pressure, with the pan-European STOXX Europe 600 Index snapping a five-week winning streak amid geopolitical tensions and tariff threats from the U.S. Despite these challenges, investors are still on the lookout for opportunities within smaller or less-established companies, often referred to as penny stocks. While the term "penny stocks" may seem outdated, it continues to signify potential value in emerging firms that exhibit strong financial health and growth prospects.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.315 | SEK2.22B | ✅ 4 ⚠️ 1 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.00 | SEK196.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.71 | SEK278.19M | ✅ 4 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.66 | SEK222.67M | ✅ 2 ⚠️ 2 View Analysis > |

| Abak (WSE:ABK) | PLN4.40 | PLN11.86M | ✅ 2 ⚠️ 4 View Analysis > |

| Cellularline (BIT:CELL) | €2.90 | €61.17M | ✅ 3 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.958 | €32.08M | ✅ 3 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.69 | €17.54M | ✅ 2 ⚠️ 3 View Analysis > |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.01 | €22M | ✅ 2 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.20 | €303.74M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 445 stocks from our European Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Cellularline (BIT:CELL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cellularline S.p.A. manufactures and sells smartphone and tablet accessories across various regions including Europe, the Middle East, North America, and internationally, with a market cap of €61.17 million.

Operations: The company generates revenue from its Electronic Components & Parts segment, amounting to €164.26 million.

Market Cap: €61.17M

Cellularline S.p.A., with a market cap of €61.17 million, has seen its earnings grow by 57.1% over the past year, outpacing the tech industry average. Despite this growth, its return on equity remains low at 4.1%. The company's debt is well-covered by operating cash flow and short-term assets exceed both short and long-term liabilities, indicating financial stability. Recent announcements include a share buyback program aimed at enhancing liquidity and shareholder value, alongside an annual dividend of €0.093 per share. However, Cellularline's dividend history is unstable and management tenure averages two years, suggesting recent leadership changes.

- Click here and access our complete financial health analysis report to understand the dynamics of Cellularline.

- Explore Cellularline's analyst forecasts in our growth report.

Beyond Frames Entertainment (DB:8WP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Beyond Frames Entertainment AB (publ) is a Swedish video game company focused on game creation and publishing, with a market cap of €23.55 million.

Operations: The company generates revenue primarily from its Computer Graphics segment, which accounted for SEK 190.14 million.

Market Cap: €23.55M

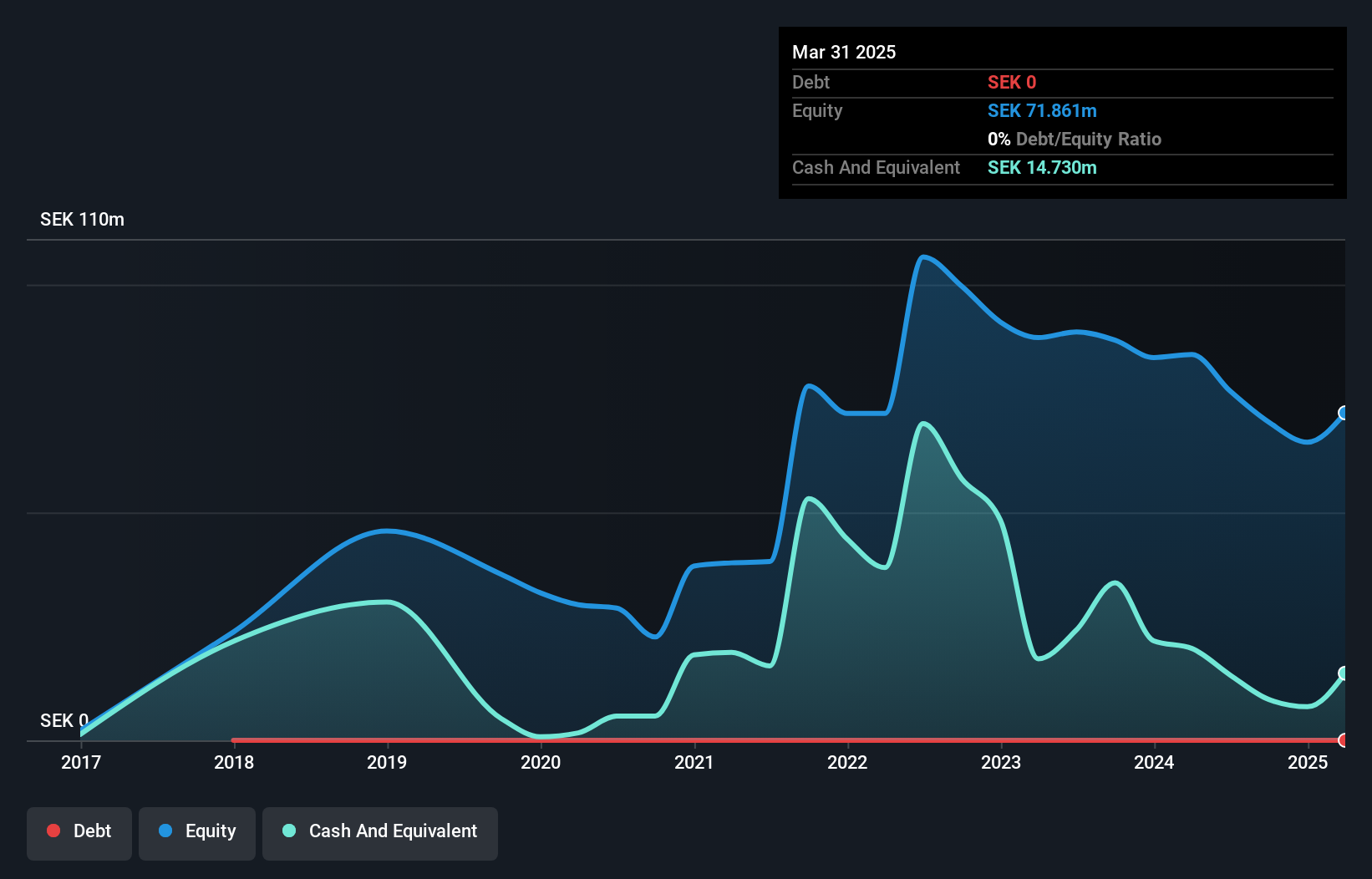

Beyond Frames Entertainment AB, with a market cap of €23.55 million, recently reported a Q1 2025 net loss of SEK 3.73 million on revenue of SEK 49.88 million, down from the previous year. The company has secured SEK 25 million in financing to support its TMNT project development and enhance liquidity flexibility. Its game "ghosts of Tabor" achieved over $30 million in revenue and one million players across platforms, now including PlayStation VR2. While unprofitable and volatile, Beyond Frames is expanding through strategic partnerships like Alpha Nordic AB for project funding diversification and risk management.

- Unlock comprehensive insights into our analysis of Beyond Frames Entertainment stock in this financial health report.

- Learn about Beyond Frames Entertainment's future growth trajectory here.

Scana (OB:SCANA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Scana ASA offers technology and services for the offshore and energy sectors across Norway, other European countries, the United States, Asia, and Africa, with a market cap of NOK730.70 million.

Operations: The company's revenue is primarily derived from its Offshore (Including Maritime) segment at NOK1.11 billion and the Energy segment at NOK734.1 million.

Market Cap: NOK730.7M

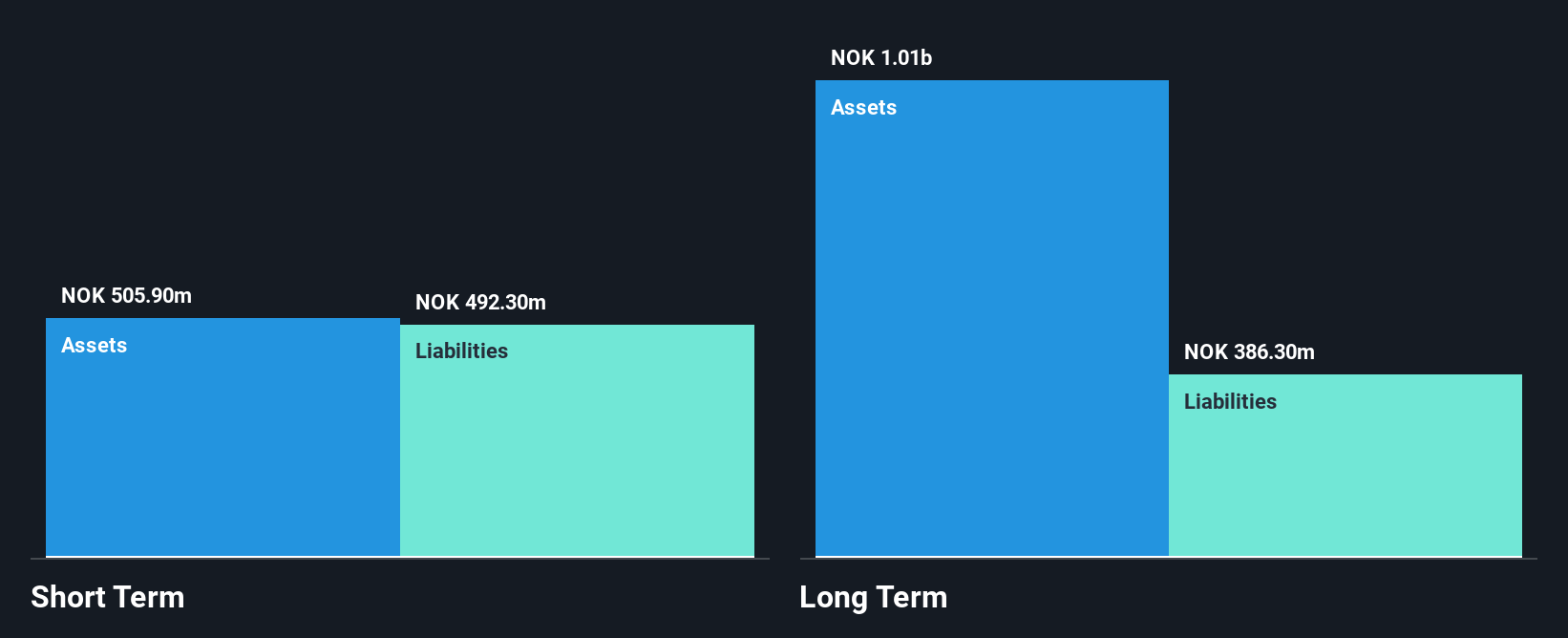

Scana ASA, with a market cap of NOK730.70 million, is navigating challenges in the offshore and energy sectors. Recent earnings reports show a decline in sales to NOK367.9 million for Q1 2025 and a net loss of NOK28.7 million, highlighting volatility concerns despite previous profitability trends. The company's debt management has improved significantly, reducing its debt to equity ratio from over 500% to 20.5% over five years, while operating cash flow adequately covers its debt obligations at 114.3%. However, recent executive changes and low return on equity at 1.6% may impact strategic direction and investor confidence moving forward.

- Jump into the full analysis health report here for a deeper understanding of Scana.

- Examine Scana's earnings growth report to understand how analysts expect it to perform.

Seize The Opportunity

- Reveal the 445 hidden gems among our European Penny Stocks screener with a single click here.

- Contemplating Other Strategies? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beyond Frames Entertainment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:8WP

Beyond Frames Entertainment

A video game company, engages in the game creation and publishing business in Sweden.

Good value with reasonable growth potential.

Market Insights

Community Narratives