If you love investing in stocks you're bound to buy some losers. But the last three years have been particularly tough on longer term Softec S.p.A. (BIT:YSFT) shareholders. Unfortunately, they have held through a 67% decline in the share price in that time. And more recent buyers are having a tough time too, with a drop of 52% in the last year. The falls have accelerated recently, with the share price down 29% in the last three months. Of course, this share price action may well have been influenced by the 26% decline in the broader market, throughout the period.

Check out our latest analysis for Softec

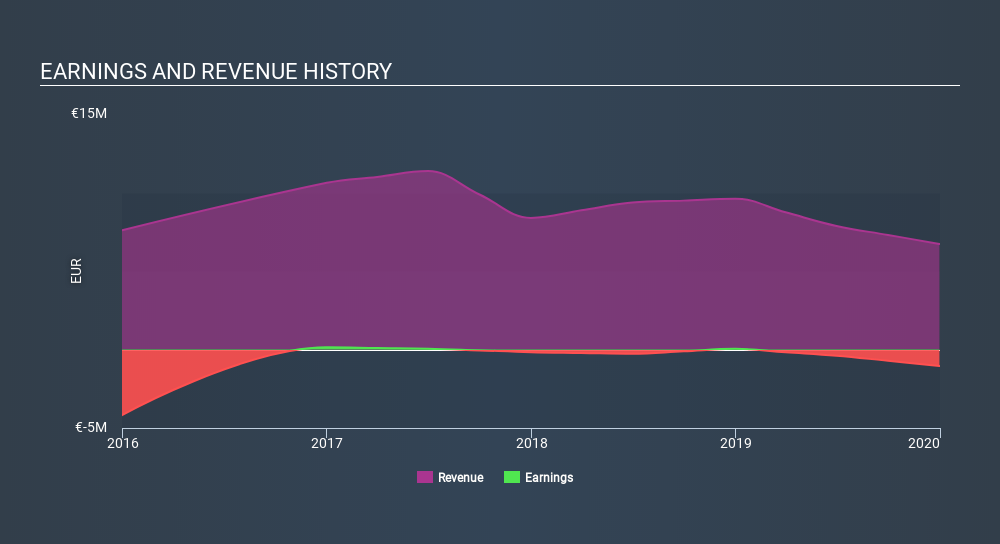

Because Softec made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years, Softec's revenue dropped 13% per year. That's not what investors generally want to see. With revenue in decline, and profit but a dream, we can understand why the share price has been declining at 31% per year. Of course, it's the future that will determine whether today's price is a good one. We don't generally like to own companies that lose money and can't grow revenues. But any company is worth looking at when it makes a maiden profit.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Softec stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Softec shareholders are down 52% for the year, falling short of the market return. The market shed around 18%, no doubt weighing on the stock price. Shareholders have lost 31% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand Softec better, we need to consider many other factors. Take risks, for example - Softec has 3 warning signs (and 1 which is concerning) we think you should know about.

We will like Softec better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About BIT:YSFT

Softec

Softec S.p.A. operates in the digital innovation services sector in Italy and internationally.

Slightly overvalued with weak fundamentals.

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Realty Income - A Fundamental and Historical Valuation

Tesla, Inc. (TSLA): The Autonomy Transition – From "Car Maker" to "AI Utility" in 2026.

Comfort Systems USA Inc. (FIX): The Data Center Vanguard – Powering the AI Physical Layer in 2026.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks