As global markets navigate a period of uncertainty marked by inflation fears and political shifts, small-cap stocks have notably underperformed their larger counterparts, with the Russell 2000 Index dipping into correction territory. Amidst this backdrop, identifying high-growth tech stocks that can potentially expand requires careful consideration of their resilience to economic fluctuations and ability to innovate in challenging environments.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| CD Projekt | 23.11% | 32.25% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.43% | 56.40% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Travere Therapeutics | 30.02% | 61.89% | ★★★★★★ |

Click here to see the full list of 1227 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

TXT e-solutions (BIT:TXT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TXT e-solutions S.p.A. offers software and service solutions across Italy and international markets, with a market capitalization of €435.08 million.

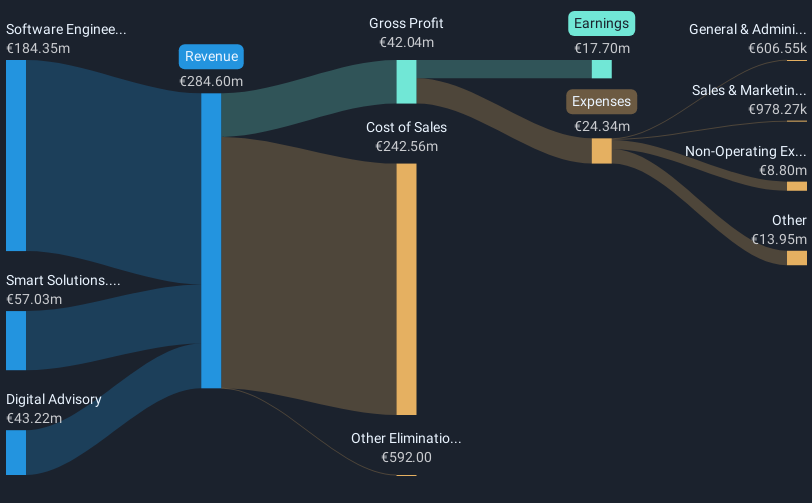

Operations: TXT e-solutions S.p.A. generates revenue from three primary segments: Software Engineering (€184.35 million), Smart Solutions (€57.03 million), and Digital Advisory (€43.22 million). The company's business model focuses on delivering specialized software and consulting services both within Italy and internationally, leveraging its expertise in technology-driven solutions to cater to diverse client needs across these segments.

TXT e-solutions has demonstrated robust financial growth, with a notable increase in sales from EUR 52.06 million to EUR 81.37 million in Q3 2024, and a rise in net income from EUR 3.01 million to EUR 4.02 million over the same period. This performance is underpinned by an impressive annual earnings forecast growth of 22.9%, significantly outpacing the Italian market's average of 6.7%. However, despite these strong figures, TXT's revenue growth at 12.7% annually trails behind the broader industry expectation of 20% per year, suggesting potential areas for strategic enhancement to align with industry leaders. Moreover, while TXT e-solutions enjoys high-quality earnings and is expected to maintain a high return on equity at around 20.3% in three years' time, challenges such as debt not being well covered by operating cash flow need addressing to sustain financial health and support continued expansion in its tech endeavors.

- Take a closer look at TXT e-solutions' potential here in our health report.

Examine TXT e-solutions' past performance report to understand how it has performed in the past.

Dmall (SEHK:2586)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Dmall Inc. is an investment holding company that offers retail digitalization solutions to retailers across various countries, including China and several Southeast Asian nations, with a market capitalization of HK$5.14 billion.

Operations: Dmall Inc. generates revenue primarily from its Retail Core Service Cloud, contributing CN¥1.63 billion, and its E-Commerce Service Cloud, adding CN¥143.82 million.

Dmall Inc., recently completing a significant IPO that raised HKD 778.63 million, is navigating its early stages in the competitive tech landscape. This capital infusion is pivotal as it underscores a strategic push to scale operations and innovate within its sector. With an impressive annual revenue growth forecast at 29.5%, Dmall is positioned to outpace the Hong Kong market's average growth rate of 7.6%. However, challenges such as achieving profitability and managing shareholder equity negatively impact its financial stability. The company's focus on expanding its technological capabilities could be crucial for future success, especially given the industry's rapid evolution and increasing demand for innovative solutions.

- Dive into the specifics of Dmall here with our thorough health report.

Explore historical data to track Dmall's performance over time in our Past section.

Docebo (TSX:DCBO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Docebo Inc. is a learning management software company that offers an AI-powered learning platform across North America and internationally, with a market cap of CA$1.85 billion.

Operations: The company generates revenue primarily from its educational software segment, amounting to $209.17 million. It operates in the learning management software industry, leveraging AI technology to enhance its platform offerings.

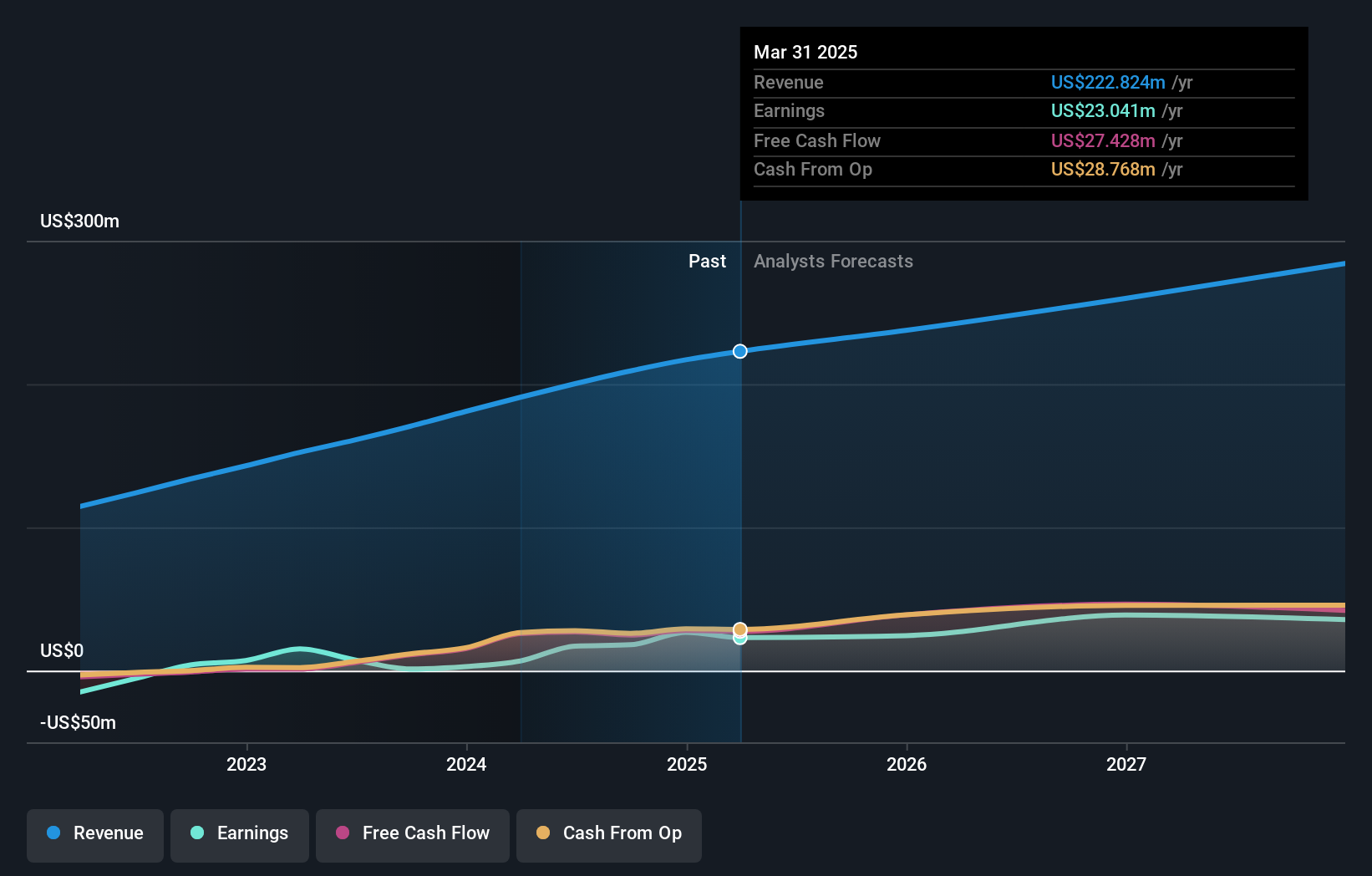

Docebo's recent strategic alliances and robust earnings growth underscore its potential in the high-growth tech sector. With a staggering 1381.8% earnings increase over the past year, vastly outpacing the software industry's average of 23.9%, and an expected annual earnings growth of 38.7%, Docebo is setting benchmarks in educational technology innovation. The company's partnership with Class Technologies introduces AI-driven analytics to enhance virtual training, reflecting a commitment to evolving learning environments that align with future workforce needs. Moreover, Docebo has raised its fiscal year revenue guidance to approximately 19.5%, indicating strong performance and market confidence amidst CFO transitions and expansive industry collaborations like that with Deloitte, aimed at transforming organizational learning ecosystems.

- Get an in-depth perspective on Docebo's performance by reading our health report here.

Understand Docebo's track record by examining our Past report.

Summing It All Up

- Get an in-depth perspective on all 1227 High Growth Tech and AI Stocks by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DCBO

Docebo

Develops and provides a learning management platform for training in North America and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives