The European market has shown resilience with the pan-European STOXX Europe 600 Index rising by 3.93% over a recent week, buoyed by the European Central Bank's rate cuts and a delay in tariff hikes, which have collectively bolstered investor sentiment despite ongoing trade uncertainties. In this environment, identifying high-growth tech stocks involves looking for companies that can navigate economic shifts and leverage technological advancements to sustain growth and innovation amidst fluctuating market conditions.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Archos | 21.07% | 36.58% | ★★★★★★ |

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| Bonesupport Holding | 29.45% | 47.76% | ★★★★★★ |

| Yubico | 20.08% | 25.52% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Devyser Diagnostics | 26.28% | 96.54% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| CD Projekt | 33.78% | 37.39% | ★★★★★★ |

| XTPL | 97.45% | 117.95% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

TXT e-solutions (BIT:TXT)

Simply Wall St Growth Rating: ★★★★☆☆

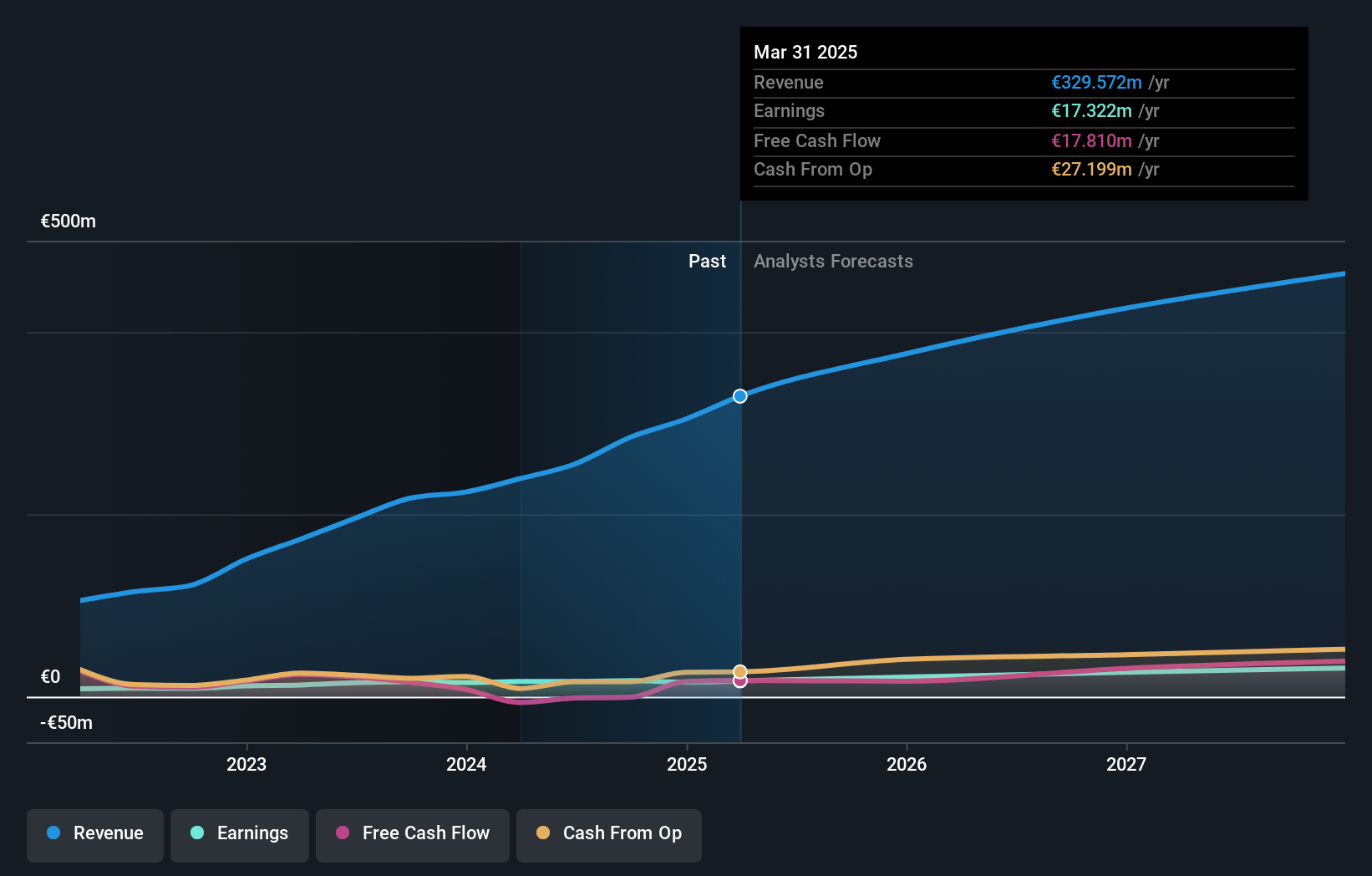

Overview: TXT e-solutions S.p.A. is a company that offers software and service solutions both in Italy and internationally, with a market capitalization of €395.35 million.

Operations: The company operates through three main revenue segments: Smart Solutions (€63.96 million), Digital Advisory (€48.92 million), and Software Engineering (€191.66 million).

TXT e-solutions, a dynamic player in the European tech landscape, is steering towards robust growth with a strategic focus on mergers and acquisitions to bolster its software engineering and smart solutions segments. With an impressive annual revenue growth of 12.6% and earnings expansion at 20.8%, the company outpaces the general Italian market trends significantly. Recent collaborations, like the MoU with Zen Technologies for advanced pilot training solutions, underscore TXT's commitment to innovation and market expansion in high-tech industries. This approach not only broadens its operational horizon but also enhances shareholder value through consistent dividend payouts (€0.25 per share announced for May 2025). As it continues to navigate through competitive waters with a keen eye on R&D (spending figures not specified), TXT is well-positioned to leverage emerging technological trends effectively.

- Unlock comprehensive insights into our analysis of TXT e-solutions stock in this health report.

Review our historical performance report to gain insights into TXT e-solutions''s past performance.

Storytel (OM:STORY B)

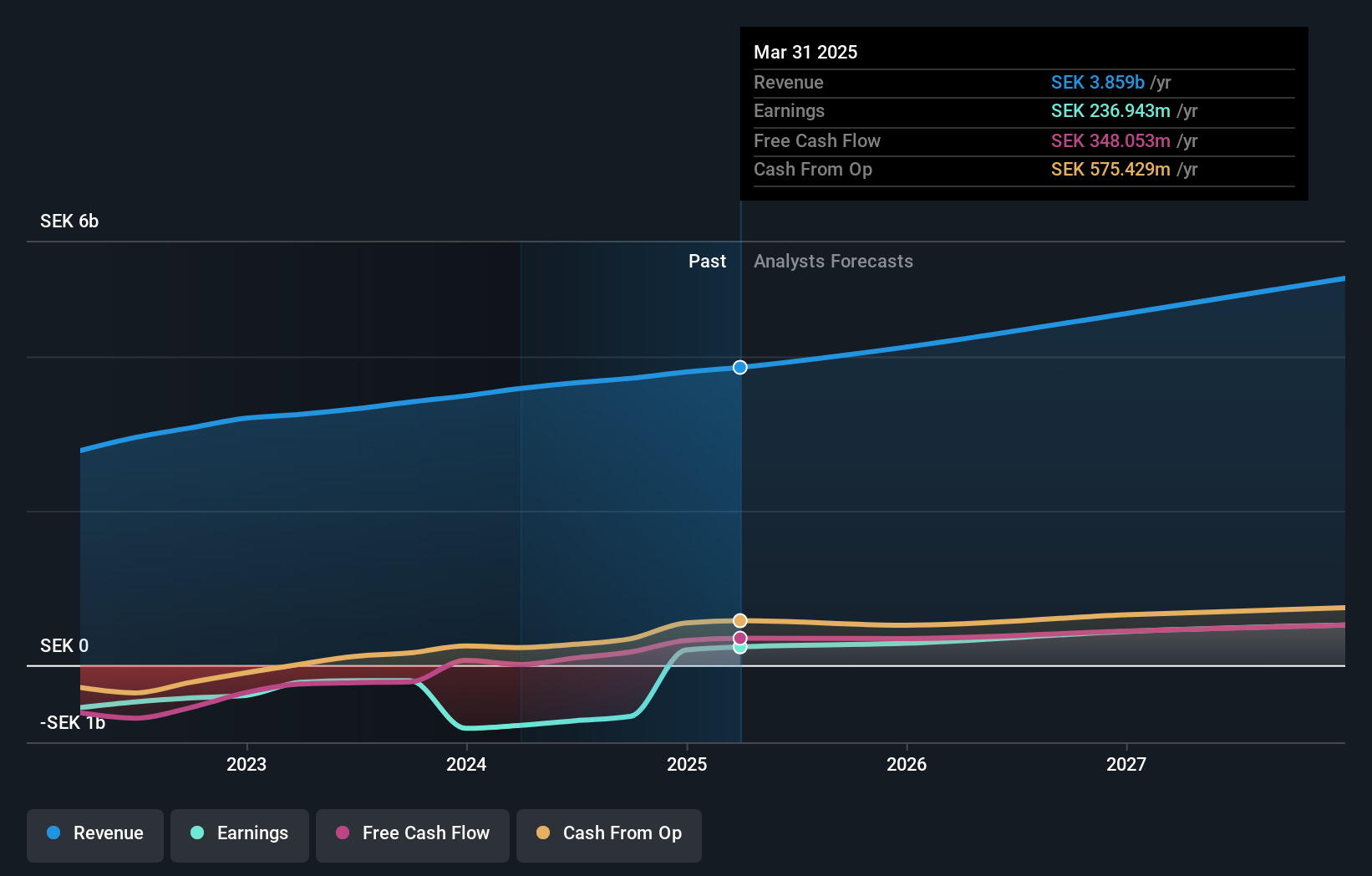

Simply Wall St Growth Rating: ★★★★★☆

Overview: Storytel AB (publ) offers streaming services for audiobooks and e-books, with a market capitalization of approximately SEK7.45 billion.

Operations: The company generates revenue primarily from its streaming services, which account for SEK3.38 billion, and publishing segment, contributing SEK1.13 billion. The focus on digital content delivery supports its business model in the audiobook and e-book markets.

Storytel, a burgeoning force in the European tech sector, has recently pivoted towards profitability with an impressive earnings growth forecast of 32.9% per year. This turnaround is underscored by its latest annual figures, showing a jump in sales from SEK 3.49 billion to SEK 3.8 billion and transforming a substantial net loss into a profit of SEK 196.71 million. The company's commitment to innovation is evident from its R&D investments, aligning with industry trends toward digital content consumption and personalized media experiences. Moreover, Storytel's strategic dividend proposal on its 20th anniversary reflects not only a robust financial standing but also an optimistic outlook for sustaining growth and shareholder value in the dynamic media landscape.

- Click to explore a detailed breakdown of our findings in Storytel's health report.

Gain insights into Storytel's historical performance by reviewing our past performance report.

Sensirion Holding (SWX:SENS)

Simply Wall St Growth Rating: ★★★★☆☆

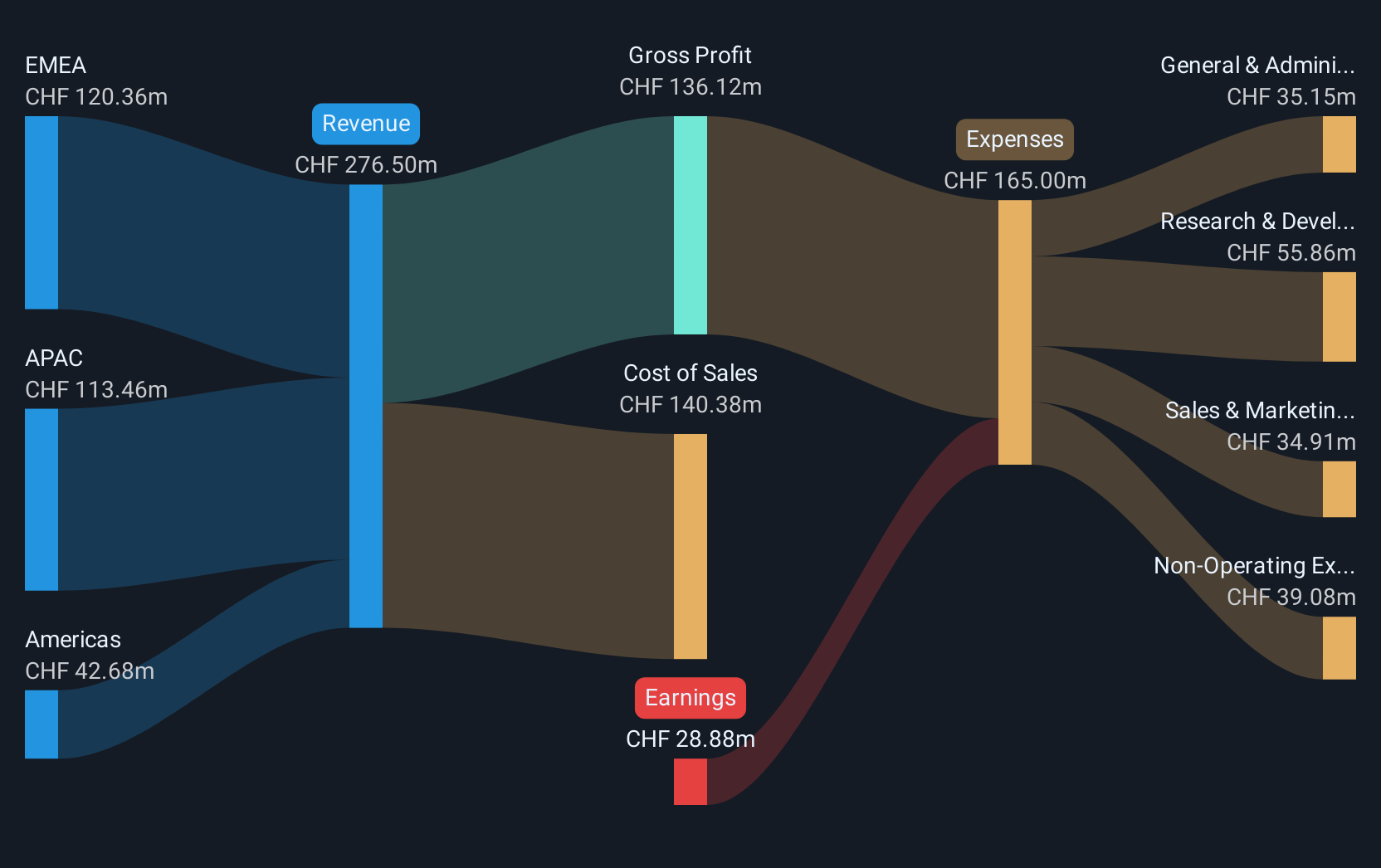

Overview: Sensirion Holding AG is a company that develops, produces, sells, and services sensor systems, modules, and components across various regions including the Asia Pacific, Europe, the Middle East, Africa, and the Americas with a market cap of CHF934.78 million.

Operations: Sensirion generates revenue primarily from its sensor systems, modules, and components segment, which accounts for CHF276.50 million. The company operates across multiple regions including the Asia Pacific, Europe, the Middle East, Africa, and the Americas.

Sensirion Holding AG, a Swiss tech firm, is navigating through unprofitability with strategic initiatives aimed at harnessing high-growth sectors like space technology and environmental sensing. Despite a current net loss of CHF 28.88 million, the company projects robust sales growth to CHF 310-350 million by next year, reflecting an annual revenue increase of 10.2%. Their commitment to R&D is pivotal, notably supporting the WOBBLE2 project with advanced sensors for space experiments. This focus on innovative applications in critical industries positions Sensirion to capitalize on emerging technological trends and improve its financial trajectory in the foreseeable future.

- Get an in-depth perspective on Sensirion Holding's performance by reading our health report here.

Assess Sensirion Holding's past performance with our detailed historical performance reports.

Seize The Opportunity

- Navigate through the entire inventory of 231 European High Growth Tech and AI Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TXT e-solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:TXT

TXT e-solutions

Provides software and service solutions in Italy and internationally.

Good value with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion