Reply (BIT:REY) Valuation Check After New Biological Computing Partnership With University Of Milan

Why the biological computing partnership matters for Reply (BIT:REY)

Reply (BIT:REY) is teaming up with the University of Milan and the Centro Dino Ferrari on a biological computing project built around Cortical Labs’ CL1 platform, using human neuron based systems to explore new computing approaches.

See our latest analysis for Reply.

Despite a busy January that includes AI driven logistics projects with Otto Group and the new biological computing collaboration, Reply’s 1 year total shareholder return of 28.94% decline contrasts with a 5 year total shareholder return of 9.60%. Meanwhile, recent 90 day share price returns of 8.33% decline suggest momentum has been fading.

If this kind of AI focused work catches your eye, it might be a good time to broaden your search with high growth tech and AI stocks.

Reply’s shares have fallen over the past year even as it pushes deeper into AI projects and experimental biological computing. This raises a key question for investors: is this weakness a potential entry point, or is the market already pricing in future growth?

Price-to-Earnings of 15.7x: Is it justified?

Reply trades on a P/E of 15.7x, which sits below several reference points and may suggest the current €111.2 share price is not demanding relative to earnings.

The P/E ratio compares the current share price to the company’s earnings per share, so you are effectively seeing how many euros the market is paying for each euro of Reply’s earnings. For a consulting and digital services group with established profitability, this is one way to judge how the market is valuing its earnings stream.

Here, Reply stands out because that 15.7x P/E is below its estimated fair P/E of 24.9x. It is also below the Italian market P/E of 17.4x, the European IT industry average of 19.8x, and the peer average of 33.3x. That is a wide gap for a business where earnings grew 13.3% over the past year and 14.4% per year over the past 5 years, and where analysts are in good agreement on future earnings growth.

Against the sector, this is a firm discount. Compared with peers, it is even steeper, which suggests the market is assigning Reply a lower earnings multiple than both its direct competitors and the broader IT space, despite high quality earnings, higher profit margins than last year, and forecasts that show earnings still growing.

Explore the SWS fair ratio for Reply

Result: Price-to-Earnings of 15.7x (UNDERVALUED)

However, you still need to balance weaker recent share returns with the shift into AI and biological computing, along with the risk that these projects take longer to pay off.

Find out about the key risks to this Reply narrative.

Another view using our DCF model

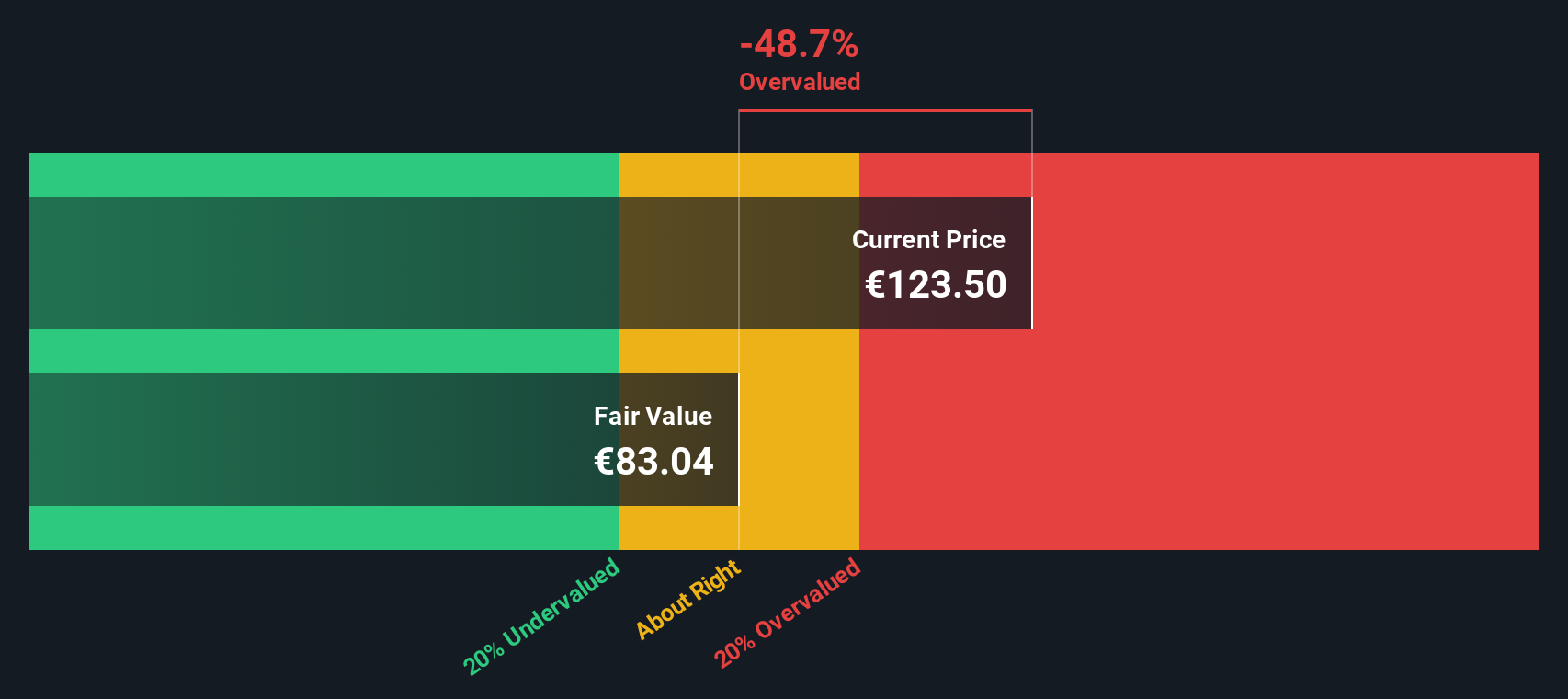

The SWS DCF model presents a different perspective. On this view, Reply at €111.2 is trading above an estimated future cash flow value of €85.74, which screens as overvalued. If earnings appear inexpensive but cash flows do not, which signal should be treated as more important?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Reply for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 881 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Reply Narrative

If you see the numbers differently or simply prefer to rely on your own work, you can pull the data, test your view, and build a full Reply story yourself in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Reply.

Looking for more investment ideas?

If you are serious about sharpening your portfolio, do not stop at one company. Put a few focused screens to work and see what else stands out.

- Spot early stage opportunities with real balance sheet strength by checking out these 3523 penny stocks with strong financials that already show solid financial foundations.

- Zero in on potential growth stories in artificial intelligence through these 24 AI penny stocks that are building real businesses around AI technology and data.

- Search for possible value ideas by scanning these 881 undervalued stocks based on cash flows that trade below what their cash flows might justify.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:REY

Reply

Provides consulting, system integration, and digital services based on communication channels and digital media in Italy and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Hotel101 Global: A Scalable Hospitality Platform Built to Compound

Tesla’s Nvidia Moment – The AI & Robotics Inflection Point

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Trending Discussion