Is Reply (BIT:REY) Undervalued? Assessing Its Valuation After Recent Share Price Reversal

Reviewed by Simply Wall St

Price-to-Earnings of 19x: Is it justified?

Reply’s current valuation looks attractive when measured against peers. Its price-to-earnings (P/E) ratio is 19x, which is significantly lower than the sector average of 51.6x. This suggests the stock may offer relatively better value than similar companies in the software industry.

The price-to-earnings ratio compares a company’s market price to its earnings per share, offering insight into how much investors are willing to pay for each euro of earnings. For technology and software firms, this metric is especially telling as it often signals the market’s future growth expectations.

This lower P/E multiple could indicate that the market is underestimating Reply’s ability to grow profits in the future or is cautious about its growth durability. It leaves the door open for upside if the company continues to outperform on its fundamentals.

Result: Fair Value of €120 (ABOUT RIGHT)

See our latest analysis for Reply.However, slower revenue growth or continued investor skepticism could prevent shares from rebounding quickly, particularly if industry sentiment remains fragile.

Find out about the key risks to this Reply narrative.Another View: Discounted Cash Flow Paints a Different Picture

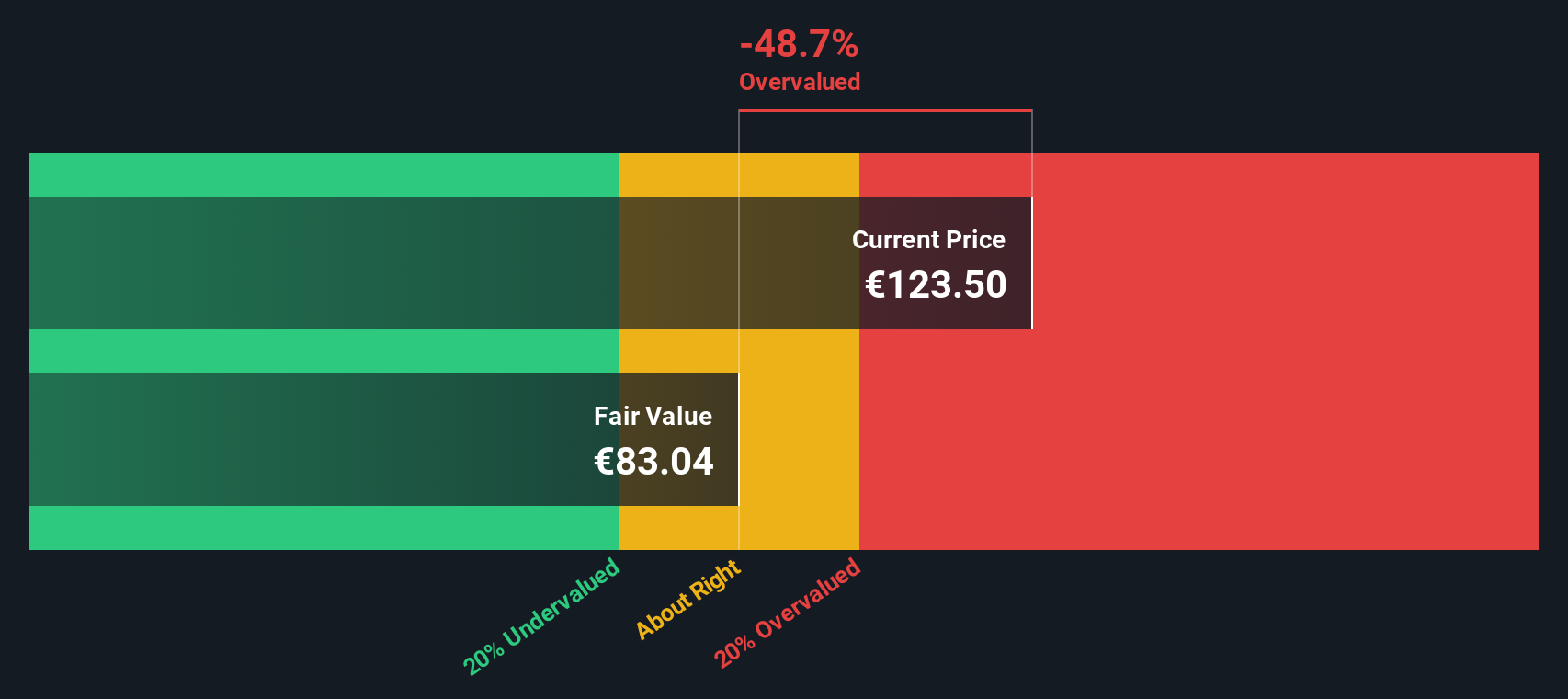

Taking a step back, our DCF model arrives at a very different conclusion. By focusing on cash flows rather than earnings, this approach suggests Reply could actually be overvalued at current prices. Does this signal caution? Or is the market seeing something the models miss?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Reply Narrative

If you want to dig into the numbers yourself or see things from a different angle, you can shape your own reply in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Reply.

Looking for more investment ideas?

Expand your horizons and catch the next winning trend. Don’t let opportunity pass by while others get ahead. Let Simply Wall Street’s expert screeners help you zero in on new opportunities:

- Capitalize on market mispricings by targeting companies trading well below their real value with undervalued stocks based on cash flows.

- Identify tomorrow’s growth leaders and ride the AI innovation wave with top picks uncovered by AI penny stocks.

- Boost your income potential by selecting companies with attractive yields via dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About BIT:REY

Reply

Provides consulting, system integration, and digital services based on communication channels and digital media in Italy and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Micron Technology will experience a robust 16.5% revenue growth

Amazon will rebound as AI investments start paying off by late 2026

Inside Harvey Norman: Asset-Heavy Retail in an Online World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion