The analyst covering Maps S.p.A. (BIT:MAPS) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. Both revenue and earnings per share (EPS) estimates were cut sharply as the analyst factored in the latest outlook for the business, concluding that they were too optimistic previously.

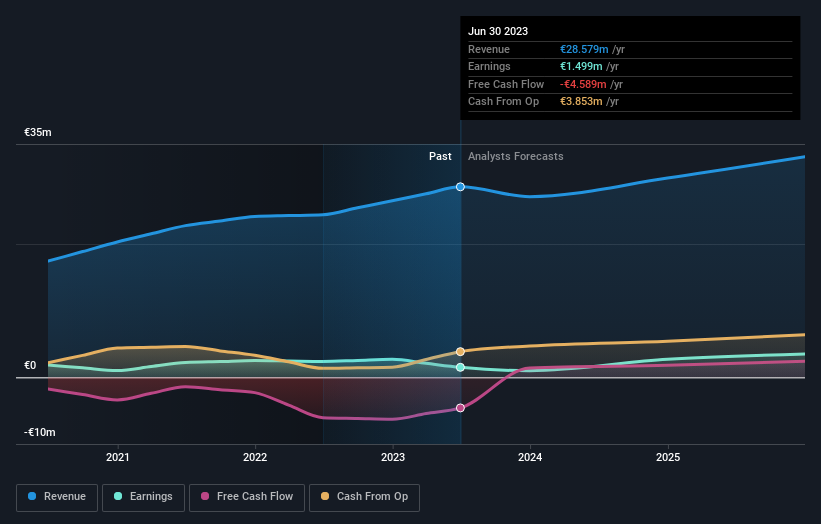

Following the latest downgrade, the lone analyst covering Maps provided consensus estimates of €27m revenue in 2023, which would reflect a discernible 5.2% decline on its sales over the past 12 months. Statutory earnings per share are supposed to crater 34% to €0.08 in the same period. Before this latest update, the analyst had been forecasting revenues of €31m and earnings per share (EPS) of €0.22 in 2023. Indeed, we can see that the analyst is a lot more bearish about Maps' prospects, administering a substantial drop in revenue estimates and slashing their EPS estimates to boot.

See our latest analysis for Maps

It'll come as no surprise then, to learn that the analyst has cut their price target 7.4% to €5.00.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 5.2% by the end of 2023. This indicates a significant reduction from annual growth of 14% over the last three years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 11% per year. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Maps is expected to lag the wider industry.

The Bottom Line

The most important thing to take away is that the analyst cut their earnings per share estimates, expecting a clear decline in business conditions. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. With a serious cut to this year's expectations and a falling price target, we wouldn't be surprised if investors were becoming wary of Maps.

So things certainly aren't looking great, and you should also know that we've spotted some potential warning signs with Maps, including concerns around earnings quality. Learn more, and discover the 3 other risks we've identified, for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:MAPS

Maps

A software solution provider, designs and develops technological solutions to support decision-making processes in public and private businesses and organizations.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

High Quality Business and a true compounding machine

Roche Holding AG To Benefit From Strong Drug Pipeline In 2027 And Beyond

Otokar is the first choice for tactical armored land vehicles to meet Europe's defense industry needs.

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

AMZN: Acceleration In Cloud And AI Will Drive Margin Expansion Ahead

Trending Discussion