As global markets continue to navigate a landscape marked by accelerating U.S. inflation and stock indexes nearing record highs, investors are exploring diverse opportunities across various sectors. Penny stocks, often associated with smaller or newer companies, remain a compelling area of interest due to their potential for growth and affordability. Despite being considered an outdated term by some, penny stocks still offer unique opportunities for those looking beyond the mainstream market giants; in this article, we'll explore three such stocks that stand out for their financial resilience and growth potential.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.05 | £327.19M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.94 | HK$45.23B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.855 | MYR283.81M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.95 | £448.86M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.942 | £150.13M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.33 | MYR918.11M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.07 | £305.33M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £4.28 | £81.63M | ★★★★☆☆ |

Click here to see the full list of 5,678 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Cyberoo (BIT:CYB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cyberoo S.p.A. offers managed and cyber security services in Italy with a market cap of €70.08 million.

Operations: The company's revenue is primarily derived from Cyber Security & Device Security (€16.60 million), followed by Managed Services (€4.53 million) and Digital Transformation (€0.15 million).

Market Cap: €70.08M

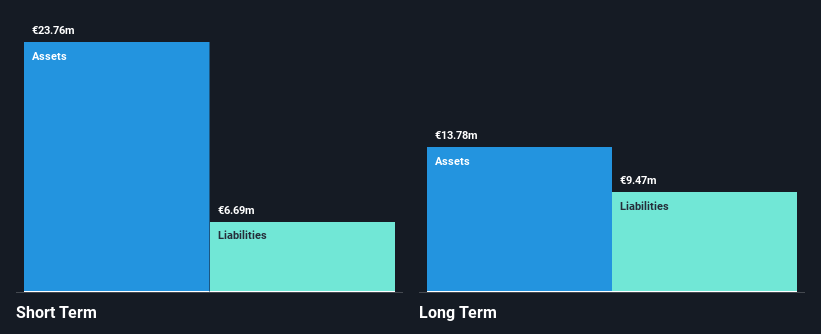

Cyberoo S.p.A., with a market cap of €70.08 million, derives substantial revenue from its Cyber Security & Device Security services (€16.60 million). The company maintains strong financial health, with short-term assets (€23.8M) exceeding both short-term (€6.7M) and long-term liabilities (€9.5M), and interest payments well-covered by EBIT (16.3x). Despite an increase in debt to equity ratio over five years, the net debt to equity remains satisfactory at 0.06%. Earnings have grown significantly by 58% annually over the past five years but have recently slowed, with a forecasted growth of 27.51% per year moving forward.

- Navigate through the intricacies of Cyberoo with our comprehensive balance sheet health report here.

- Understand Cyberoo's earnings outlook by examining our growth report.

China Ruifeng Renewable Energy Holdings (SEHK:527)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: China Ruifeng Renewable Energy Holdings Limited is an investment holding company that generates wind power in the People’s Republic of China, with a market cap of HK$908.80 million.

Operations: The company generates revenue from its wind turbine blades to generate electricity power segment, totaling CN¥327.25 million.

Market Cap: HK$908.8M

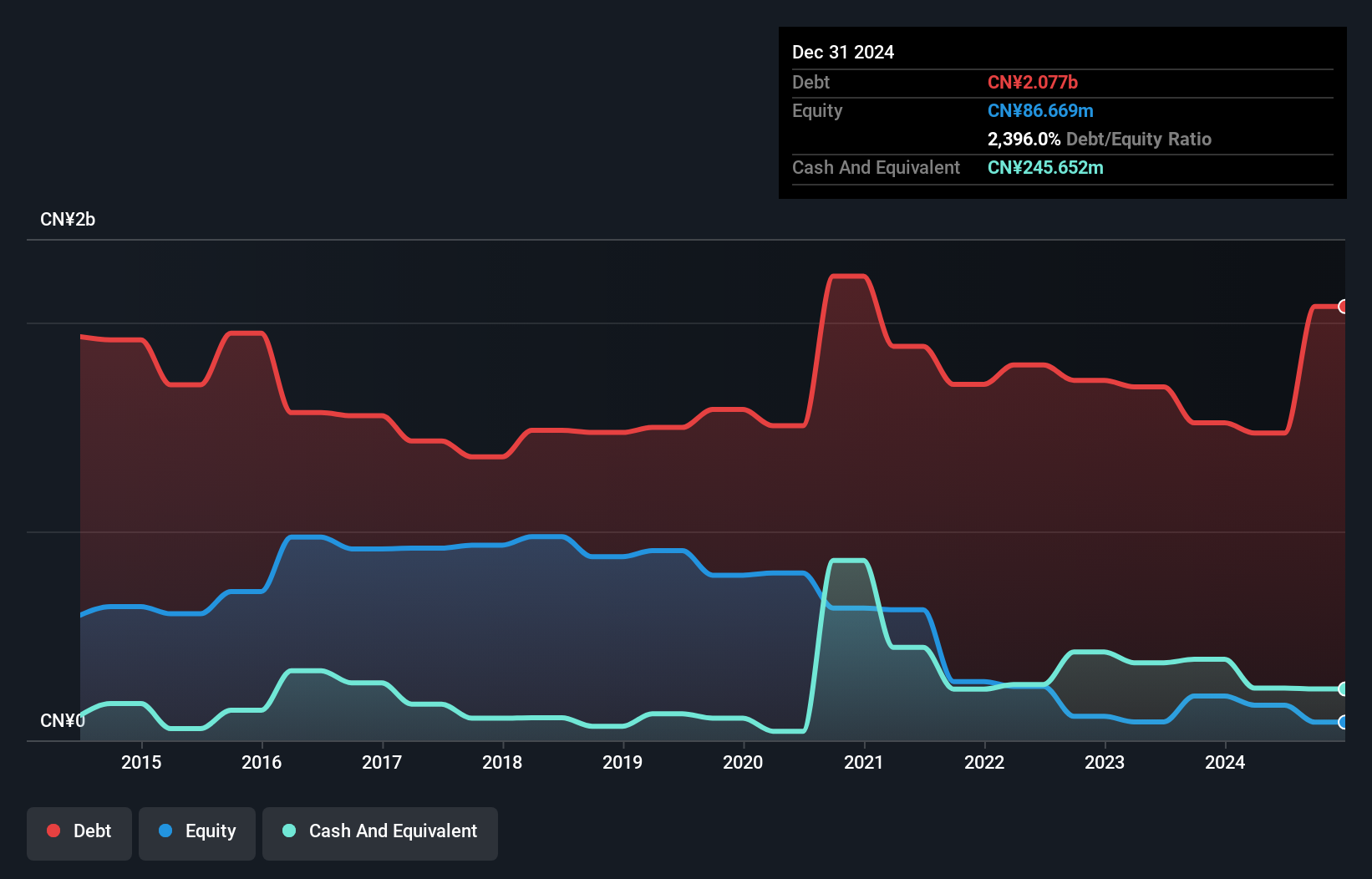

China Ruifeng Renewable Energy Holdings, with a market cap of HK$908.80 million, operates within the renewable energy sector but remains unprofitable. Despite this, it has a positive free cash flow and sufficient cash runway exceeding three years. The company’s short-term assets (CN¥832.0M) cover both short-term (CN¥774.5M) and long-term liabilities (CN¥813.1M), indicating solid liquidity management despite high net debt to equity ratio at 725.5%. The seasoned board and management team provide stability; however, profitability challenges persist with earnings declining by 2.3% annually over five years amidst increased losses in that period.

- Click here to discover the nuances of China Ruifeng Renewable Energy Holdings with our detailed analytical financial health report.

- Gain insights into China Ruifeng Renewable Energy Holdings' past trends and performance with our report on the company's historical track record.

Oshidori International Holdings (SEHK:622)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Oshidori International Holdings Limited is an investment holding company that offers financial services in Hong Kong, with a market cap of HK$1.17 billion.

Operations: The company's revenue segments include Financial Services generating HK$9.61 million and Tactical and/or Strategical Investments contributing -HK$40 million.

Market Cap: HK$1.17B

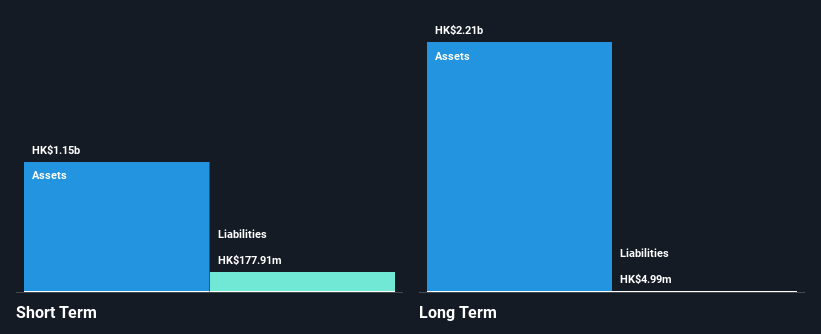

Oshidori International Holdings, with a market cap of HK$1.17 billion, is experiencing financial challenges as it remains pre-revenue and unprofitable. Despite negative earnings growth over the past five years at 21.7% annually, the company benefits from strong liquidity with short-term assets of HK$1.2 billion exceeding both short-term liabilities (HK$177.9 million) and long-term liabilities (HK$5 million). The board's average tenure of 7.8 years adds stability, while a reduced debt-to-equity ratio from 10.2% to 2.2% over five years reflects improved financial management amidst high share price volatility and negative return on equity (-6.55%).

- Click to explore a detailed breakdown of our findings in Oshidori International Holdings' financial health report.

- Review our historical performance report to gain insights into Oshidori International Holdings' track record.

Turning Ideas Into Actions

- Unlock our comprehensive list of 5,678 Penny Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:CYB

Excellent balance sheet and fair value.

Market Insights

Community Narratives