Positive Sentiment Still Eludes Almawave S.p.A. (BIT:AIW) Following 25% Share Price Slump

Almawave S.p.A. (BIT:AIW) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 28% in that time.

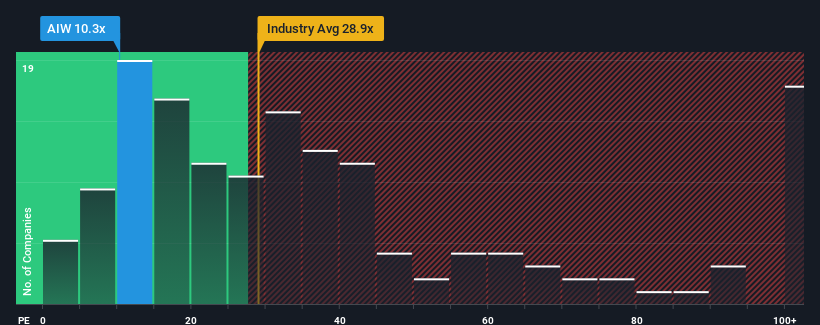

Even after such a large drop in price, given about half the companies in Italy have price-to-earnings ratios (or "P/E's") above 14x, you may still consider Almawave as an attractive investment with its 10.3x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Almawave as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Almawave

How Is Almawave's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Almawave's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 31% last year. The latest three year period has also seen an excellent 130% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 14% per year during the coming three years according to the dual analysts following the company. That's shaping up to be similar to the 13% per annum growth forecast for the broader market.

With this information, we find it odd that Almawave is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From Almawave's P/E?

Almawave's P/E has taken a tumble along with its share price. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Almawave's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Almawave that you should be aware of.

If you're unsure about the strength of Almawave's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:AIW

Almawave

Provides artificial intelligence (AI), natural language processing, and big data solutions in Italy.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion