- Italy

- /

- Semiconductors

- /

- BIT:TPRO

Investors Still Waiting For A Pull Back In Technoprobe S.p.A. (BIT:TPRO)

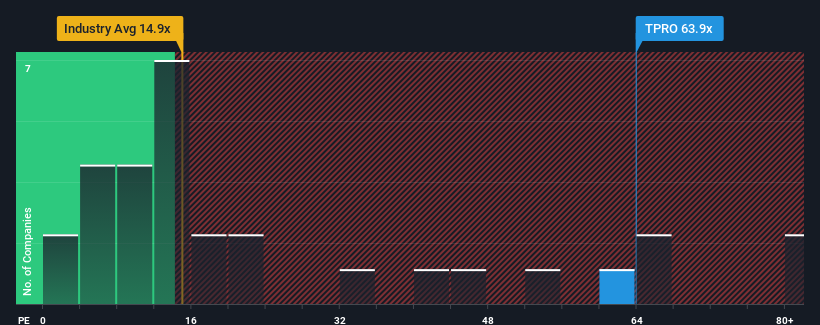

When close to half the companies in Italy have price-to-earnings ratios (or "P/E's") below 14x, you may consider Technoprobe S.p.A. (BIT:TPRO) as a stock to avoid entirely with its 63.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Technoprobe hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Technoprobe

What Are Growth Metrics Telling Us About The High P/E?

Technoprobe's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered a frustrating 35% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 23% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 24% each year as estimated by the six analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 18% each year, which is noticeably less attractive.

With this information, we can see why Technoprobe is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Technoprobe maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Technoprobe (at least 1 which can't be ignored), and understanding these should be part of your investment process.

Of course, you might also be able to find a better stock than Technoprobe. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Technoprobe might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:TPRO

Technoprobe

Produces and sells electronic circuits in Italy, Asia, the United States, and rest of Europe.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives