- Italy

- /

- Semiconductors

- /

- BIT:OSA

Little Excitement Around OSAI Automation System S.p.A.'s (BIT:OSA) Revenues As Shares Take 30% Pounding

OSAI Automation System S.p.A. (BIT:OSA) shareholders that were waiting for something to happen have been dealt a blow with a 30% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 76% loss during that time.

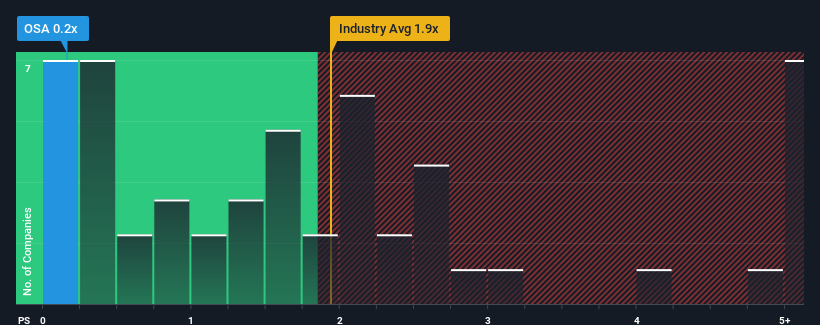

After such a large drop in price, given about half the companies operating in Italy's Semiconductor industry have price-to-sales ratios (or "P/S") above 1.9x, you may consider OSAI Automation System as an attractive investment with its 0.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for OSAI Automation System

How OSAI Automation System Has Been Performing

Recent times have been pleasing for OSAI Automation System as its revenue has risen in spite of the industry's average revenue going into reverse. One possibility is that the P/S ratio is low because investors think the company's revenue is going to fall away like everyone else's soon. Those who are bullish on OSAI Automation System will be hoping that this isn't the case and the company continues to beat out the industry.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on OSAI Automation System.How Is OSAI Automation System's Revenue Growth Trending?

OSAI Automation System's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 21% last year. As a result, it also grew revenue by 8.7% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 6.9% per year during the coming three years according to the three analysts following the company. With the industry predicted to deliver 15% growth per annum, the company is positioned for a weaker revenue result.

In light of this, it's understandable that OSAI Automation System's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

The southerly movements of OSAI Automation System's shares means its P/S is now sitting at a pretty low level. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of OSAI Automation System's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

Before you take the next step, you should know about the 3 warning signs for OSAI Automation System (2 are concerning!) that we have uncovered.

If you're unsure about the strength of OSAI Automation System's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:OSA

OSAI Automation System

Engages in the automation, electronics and applied laser, semiconductor, and service businesses in Italy, Asia, Africa, the Americas, and rest of Europe.

Slightly overvalued with very low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion