- Italy

- /

- Food and Staples Retail

- /

- BIT:IVS

Would Shareholders Who Purchased IVS Group's (BIT:IVS) Stock Three Years Be Happy With The Share price Today?

While not a mind-blowing move, it is good to see that the IVS Group S.A. (BIT:IVS) share price has gained 27% in the last three months. Meanwhile over the last three years the stock has dropped hard. Regrettably, the share price slid 60% in that period. So the improvement may be a real relief to some. The rise has some hopeful, but turnarounds are often precarious.

Check out our latest analysis for IVS Group

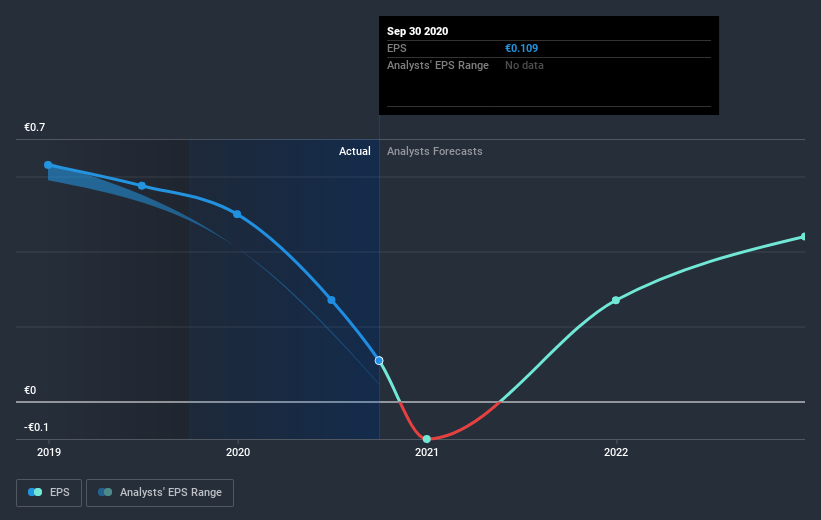

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between IVS Group's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that IVS Group's TSR, which was a 58% drop over the last 3 years, was not as bad as the share price return.

A Different Perspective

We regret to report that IVS Group shareholders are down 44% for the year. Unfortunately, that's worse than the broader market decline of 8.5%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 5% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand IVS Group better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with IVS Group (including 1 which is a bit unpleasant) .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

When trading IVS Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BIT:IVS

Proven track record with limited growth.

Market Insights

Community Narratives