- Italy

- /

- Specialty Stores

- /

- BIT:BAN

This Is The Reason Why We Think BasicNet S.p.A.'s (BIT:BAN) CEO Might Be Underpaid

Key Insights

- BasicNet to hold its Annual General Meeting on 17th of April

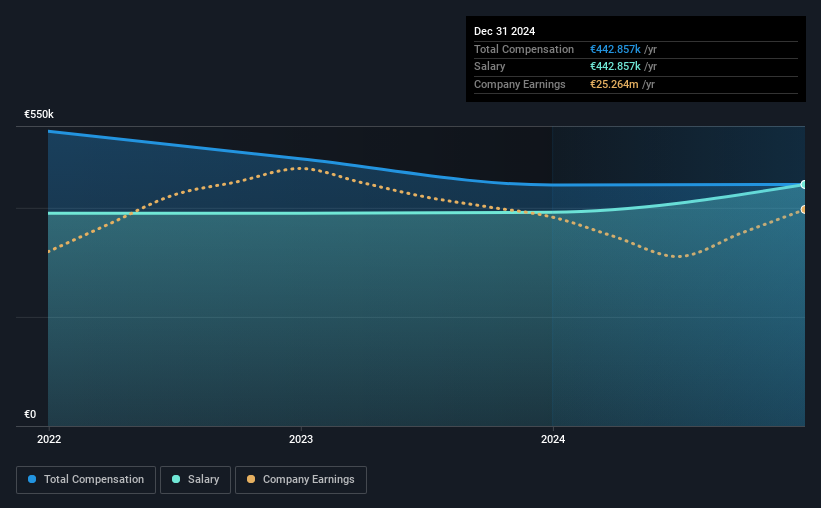

- CEO Federico Trono's total compensation includes salary of €442.9k

- The overall pay is 50% below the industry average

- BasicNet's EPS grew by 11% over the past three years while total shareholder return over the past three years was 37%

The solid performance at BasicNet S.p.A. (BIT:BAN) has been impressive and shareholders will probably be pleased to know that CEO Federico Trono has delivered. At the upcoming AGM on 17th of April, they will get a chance to hear the board review the company results, discuss future strategy and cast their vote on any resolutions such as executive remuneration. Here we will show why we think CEO compensation is appropriate and discuss the case for a pay rise.

See our latest analysis for BasicNet

Comparing BasicNet S.p.A.'s CEO Compensation With The Industry

At the time of writing, our data shows that BasicNet S.p.A. has a market capitalization of €366m, and reported total annual CEO compensation of €443k for the year to December 2024. That is, the compensation was roughly the same as last year. It is worth noting that the CEO compensation consists entirely of the salary, worth €443k.

For comparison, other companies in the Italian Specialty Retail industry with market capitalizations ranging between €179m and €715m had a median total CEO compensation of €887k. That is to say, Federico Trono is paid under the industry median.

Speaking on an industry level, nearly 61% of total compensation represents salary, while the remainder of 39% is other remuneration. Speaking on a company level, BasicNet prefers to tread along a traditional path, disbursing all compensation through a salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

BasicNet S.p.A.'s Growth

BasicNet S.p.A.'s earnings per share (EPS) grew 11% per year over the last three years. Its revenue is up 4.2% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has BasicNet S.p.A. Been A Good Investment?

Most shareholders would probably be pleased with BasicNet S.p.A. for providing a total return of 37% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

BasicNet pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for BasicNet that you should be aware of before investing.

Important note: BasicNet is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if BasicNet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:BAN

BasicNet

Operates in the sports and casual clothing, footwear, and accessories sectors in Europe, the Americas, Asia, Oceania, the Middle East, and Africa.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Novo Nordisk - A Fundamental and Historical Valuation

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion