- Italy

- /

- Specialty Stores

- /

- BIT:BAN

BasicNet's (BIT:BAN) Returns Have Hit A Wall

If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an eye out for. Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. However, after briefly looking over the numbers, we don't think BasicNet (BIT:BAN) has the makings of a multi-bagger going forward, but let's have a look at why that may be.

Return On Capital Employed (ROCE): What is it?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for BasicNet:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.097 = €20m ÷ (€328m - €122m) (Based on the trailing twelve months to December 2021).

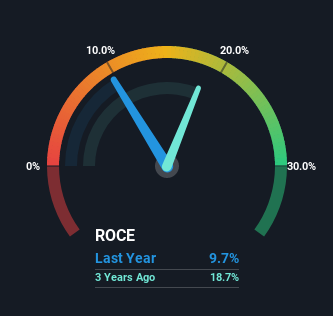

Thus, BasicNet has an ROCE of 9.7%. On its own, that's a low figure but it's around the 12% average generated by the Specialty Retail industry.

Check out our latest analysis for BasicNet

Historical performance is a great place to start when researching a stock so above you can see the gauge for BasicNet's ROCE against it's prior returns. If you'd like to look at how BasicNet has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

The Trend Of ROCE

The returns on capital haven't changed much for BasicNet in recent years. The company has consistently earned 9.7% for the last five years, and the capital employed within the business has risen 70% in that time. Given the company has increased the amount of capital employed, it appears the investments that have been made simply don't provide a high return on capital.

What We Can Learn From BasicNet's ROCE

Long story short, while BasicNet has been reinvesting its capital, the returns that it's generating haven't increased. Although the market must be expecting these trends to improve because the stock has gained 82% over the last five years. However, unless these underlying trends turn more positive, we wouldn't get our hopes up too high.

Like most companies, BasicNet does come with some risks, and we've found 2 warning signs that you should be aware of.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

Valuation is complex, but we're here to simplify it.

Discover if BasicNet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:BAN

BasicNet

Operates in the sports and casual clothing, footwear, and accessories sectors in Europe, the Americas, Asia, Oceania, the Middle East, and Africa.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Novo Nordisk - A Fundamental and Historical Valuation

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion