European Value Stocks That Could Be Trading Below Their Estimated Worth In July 2025

Reviewed by Simply Wall St

As the European markets navigate a mixed landscape, with the pan-European STOXX Europe 600 Index remaining relatively flat amid ongoing trade discussions with the U.S., investors are keenly observing economic indicators such as industrial production and trade surpluses. In this context, identifying stocks that might be trading below their estimated worth can offer valuable opportunities, particularly in sectors where economic sentiment is improving or where companies demonstrate robust fundamentals despite broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Upsales Technology (OM:UPSALE) | SEK38.30 | SEK75.49 | 49.3% |

| Trøndelag Sparebank (OB:TRSB) | NOK113.70 | NOK222.13 | 48.8% |

| Talenom Oyj (HLSE:TNOM) | €3.525 | €6.97 | 49.4% |

| Sparebank 68° Nord (OB:SB68) | NOK180.02 | NOK352.00 | 48.9% |

| RVRC Holding (OM:RVRC) | SEK46.60 | SEK91.04 | 48.8% |

| Medhelp Care Aktiebolag (OM:MEDHLP) | SEK5.00 | SEK9.94 | 49.7% |

| Echo Investment (WSE:ECH) | PLN5.36 | PLN10.70 | 49.9% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.40 | €6.78 | 49.9% |

| Cambi (OB:CAMBI) | NOK21.90 | NOK42.97 | 49% |

| Aquila Part Prod Com (BVB:AQ) | RON1.45 | RON2.87 | 49.5% |

Let's take a closer look at a couple of our picks from the screened companies.

Recordati Industria Chimica e Farmaceutica (BIT:REC)

Overview: Recordati Industria Chimica e Farmaceutica S.p.A. is a pharmaceutical company that engages in the research, development, production, and sale of pharmaceuticals across various international markets including Italy, the United States, and several European countries with a market cap of approximately €10.96 billion.

Operations: Recordati's revenue is primarily derived from two segments: Rare Diseases, generating €891.12 million, and Specialty & Primary Care, contributing €1.52 billion.

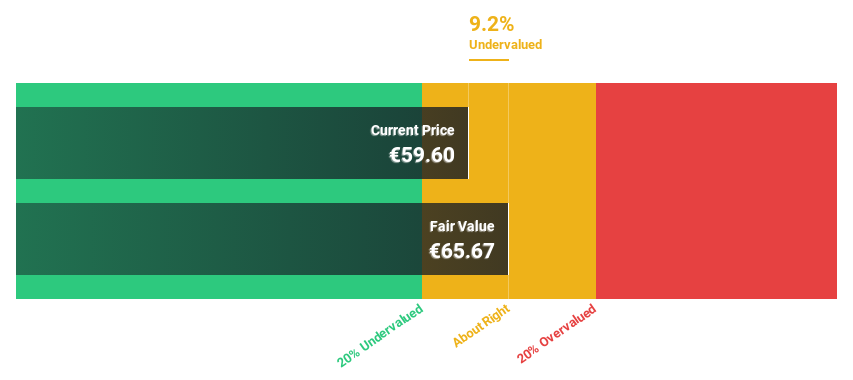

Estimated Discount To Fair Value: 17.5%

Recordati Industria Chimica e Farmaceutica is trading at €53.15, below its estimated fair value of €64.43, suggesting potential undervaluation based on cash flows. Despite a high level of debt and a dividend not well-covered by free cash flows, earnings are forecasted to grow faster than the Italian market at 12.5% annually. Recent earnings guidance projects net revenue between €2.6 billion and €2.67 billion for 2025, with ongoing share buybacks supporting liquidity and strategic initiatives.

- Our expertly prepared growth report on Recordati Industria Chimica e Farmaceutica implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Recordati Industria Chimica e Farmaceutica stock in this financial health report.

Hanza (OM:HANZA)

Overview: Hanza AB (publ) offers manufacturing solutions and has a market cap of SEK5.18 billion.

Operations: Hanza AB's revenue segments in millions of SEK are not specified in the provided text.

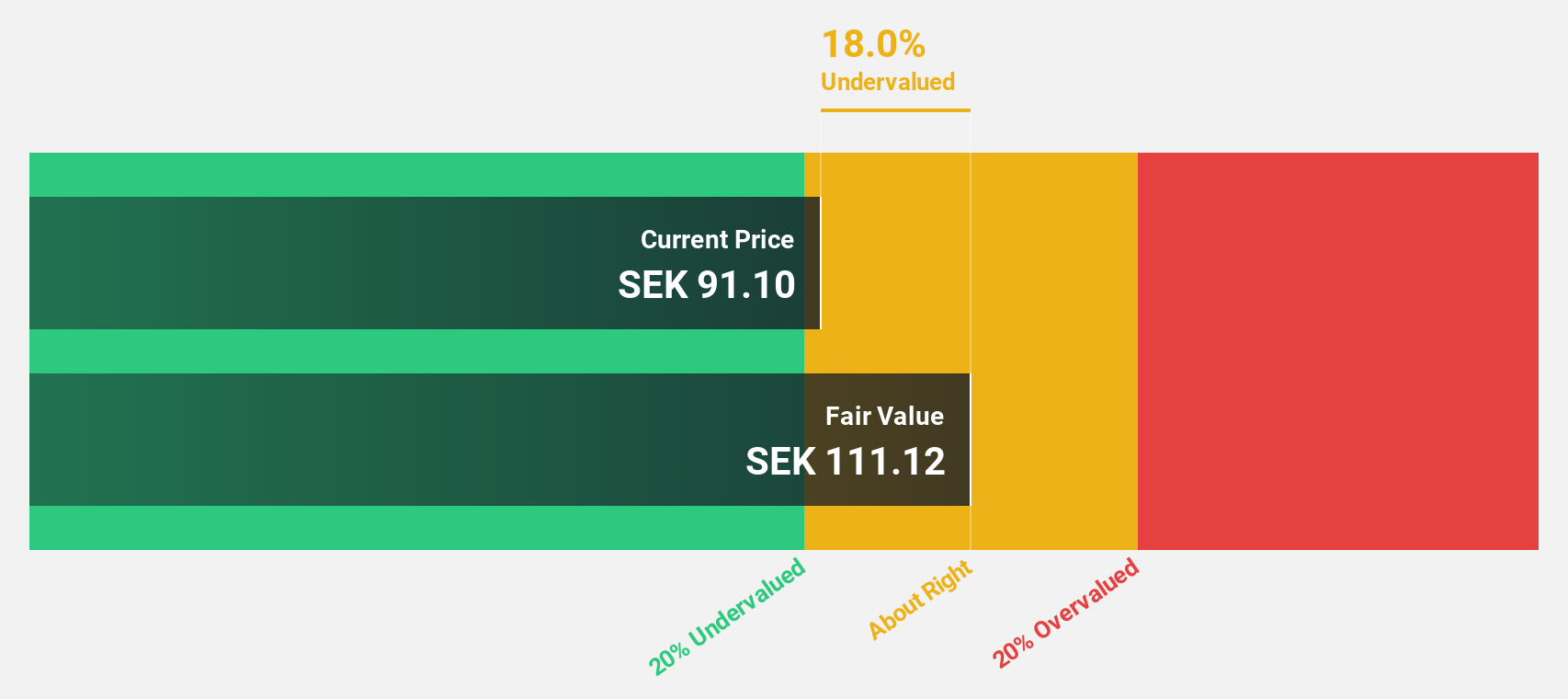

Estimated Discount To Fair Value: 47.8%

Hanza AB, with recent earnings growth and a strong forecast, trades at SEK 112.6, well below its estimated fair value of SEK 215.81. The company reported second-quarter sales of SEK 1,516 million and net income of SEK 52 million, showcasing robust performance compared to the previous year. While profit growth is expected to outpace the Swedish market significantly at over 34% annually, interest coverage remains a concern due to insufficient earnings against interest payments.

- According our earnings growth report, there's an indication that Hanza might be ready to expand.

- Take a closer look at Hanza's balance sheet health here in our report.

Knorr-Bremse (XTRA:KBX)

Overview: Knorr-Bremse AG, along with its subsidiaries, specializes in developing, producing, and marketing brake systems for rail and commercial vehicles as well as other safety-critical systems globally, with a market cap of €14.20 billion.

Operations: The company's revenue is primarily derived from its Rail Vehicle Systems segment, contributing €4.23 billion, and its Commercial Vehicle Systems segment, which accounts for €3.79 billion.

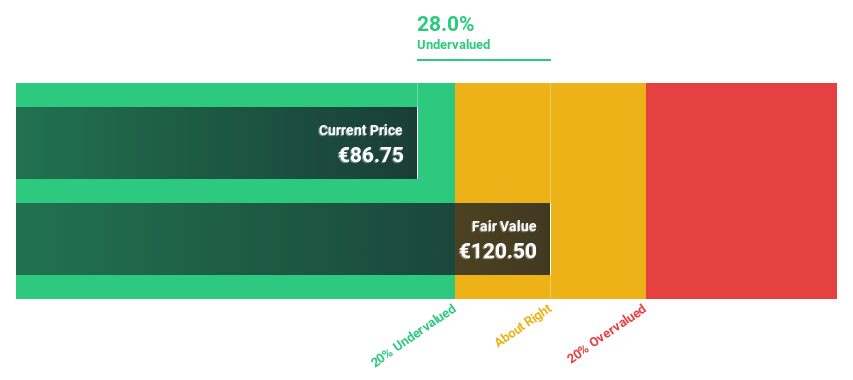

Estimated Discount To Fair Value: 19.7%

Knorr-Bremse AG is trading at €88.1, below its estimated fair value of €109.68, reflecting a potential undervaluation based on cash flows. Despite revenue growth forecasts lagging behind the German market at 4.1% annually, earnings are expected to grow significantly by 22.36% per year, outpacing the broader market's growth rate of 16.6%. Recent guidance confirmed revenues between €8.1 billion and €8.4 billion for fiscal year 2025, supporting its robust profit outlook amidst a challenging revenue environment.

- In light of our recent growth report, it seems possible that Knorr-Bremse's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Knorr-Bremse.

Where To Now?

- Gain an insight into the universe of 178 Undervalued European Stocks Based On Cash Flows by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Knorr-Bremse might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:KBX

Knorr-Bremse

Develops, produces, and markets brake systems for rail and commercial vehicles and other safety-critical systems worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives