- Italy

- /

- Entertainment

- /

- BIT:JUVE

Further weakness as Juventus Football Club (BIT:JUVE) drops 4.2% this week, taking three-year losses to 67%

If you love investing in stocks you're bound to buy some losers. But the last three years have been particularly tough on longer term Juventus Football Club S.p.A. (BIT:JUVE) shareholders. Unfortunately, they have held through a 76% decline in the share price in that time. And over the last year the share price fell 56%, so we doubt many shareholders are delighted. Shareholders have had an even rougher run lately, with the share price down 52% in the last 90 days.

With the stock having lost 4.2% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for Juventus Football Club

Juventus Football Club wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last three years, Juventus Football Club's revenue dropped 5.5% per year. That is not a good result. Having said that the 21% annualized share price decline highlights the risk of investing in unprofitable companies. We're generally averse to companies with declining revenues, but we're not alone in that. Don't let a share price decline ruin your calm. You make better decisions when you're calm.

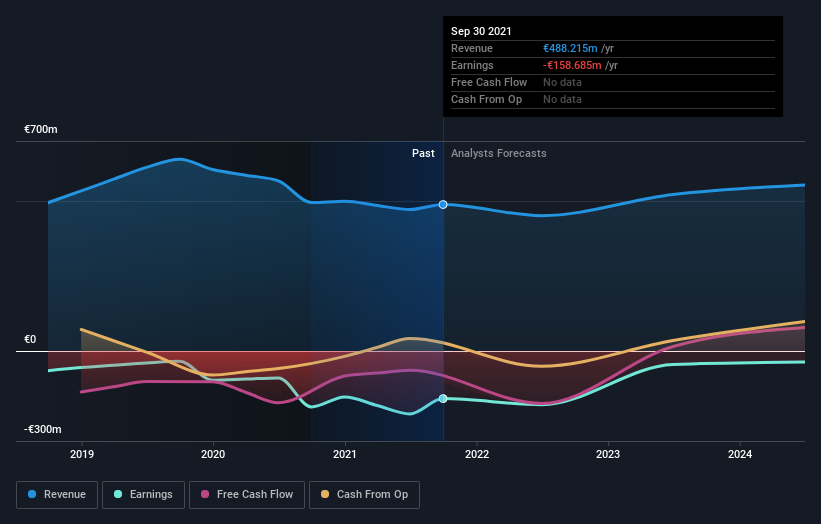

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. You can see what analysts are predicting for Juventus Football Club in this interactive graph of future profit estimates.

What about the Total Shareholder Return (TSR)?

We've already covered Juventus Football Club's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Juventus Football Club hasn't been paying dividends, but its TSR of -67% exceeds its share price return of -76%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Juventus Football Club shareholders are down 46% for the year, but the market itself is up 24%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 8%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Juventus Football Club (of which 1 is significant!) you should know about.

But note: Juventus Football Club may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IT exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:JUVE

Juventus Football Club

Operates as a professional football club in Italy.

Imperfect balance sheet very low.

Similar Companies

Market Insights

Community Narratives